By Mario Lotmore | Lynnwood Times Staff

Olympia, Wash., March 6, 2021 – Today the Washington state Senate narrowly passed SB 5096 to impose a 7% capital tax on the sale of stocks, bonds, and other high-end assets in excess of $250,000 for both individuals and couples. Those persons who profit more than $250,000 in the sale of their business and if that business makes more than $10 million per year, it is also subject to capital gains tax.

The final vote was 25-24 in the Democrat majority chamber with all twenty Republican Senators and four Democrat Senators voting against, but it was not enough to defeat the measure.

The Democrat Senators who broke ranks with their party were: Sen. Annette Cleveland (LD49 – Vancouver), Sen. Steve Hobbs, (44LD – Lake Stevens), Sen. Mark Mullet (5LD – Issaquah), and Sen. Tim Sheldon (35LD – Potlatch).

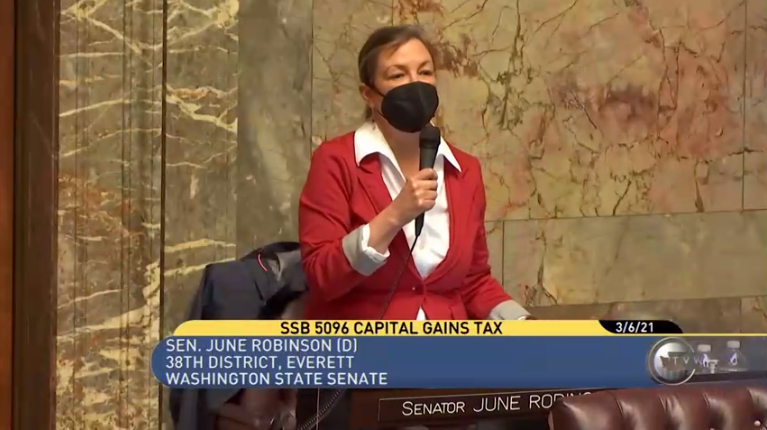

“Our hardworking Washington families are ready for us to reform and rebuild our tax code,” said Democratic Sen. June Robinson (LD38 – Everett), the bill’s primary sponsor.

Key leaders in the Senate Republican Caucus reacted strongly after the Senate’s Democratic majority approved legislation to create what they call a state income tax, despite knowing an income tax has been unconstitutional in Washington since 1932.

Since 1934, Washington voters have rejected 10 attempts to enact an income tax, either through amending the state constitution or a citizen initiative. If Senate Bill 5096 becomes law as passed today, on a 25-24 vote, voters will have to mount a challenge by qualifying a referendum themselves. A proposal to send the bill directly to the November ballot as a referendum was among all 15 Republican amendments rejected by the Democratic majority.

“There is absolutely no budgetary justification for any new taxes this year – especially not after billions and billions of federal dollars have been injected into our state over the past year, with the prospect of at least $4 billion more coming this month,” said Sen. Lynda Wilson, R-Vancouver, Republican Leader, Senate Ways and Means Committee.”

She continued, “We’ve seen the emails revealing that the strategy behind this bill is to get a state income tax in front of the current Supreme Court, with the hope that it will be found constitutional. Should that happen, it’s a foot in the door toward imposing a full-blown income tax that would hit countless more people down the line.”

Retirement accounts, real estate, farms and forestry would be exempt from the proposed tax. The measure now heads to the Democratic majority House for vote. If approved it would take effect Jan. 1, 2022 and is expected to bring in about $500 million a year.

Author: Mario Lotmore