WASHINGTON, D.C.—Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2 percent in 2024. More than 66 million Social Security beneficiaries throughout the United States will see the 3.2 percent cost-of-living adjustment (COLA) beginning in January 2024. Increased payments to approximately 7.5 million people receiving Supplemental Security Income (SSI) began on December 29, 2023.

The increase equates to an average increase of slightly more than $50 per month, according to the Social Security Administration. Approximately 1.43 million Washingtonians receive Social Security benefits which are provided to those who are retired, survivors of an eligible person, and/or disabled.

“Social Security and SSI benefits will increase in 2024, and this will help millions of people keep up with expenses,” said Kilolo Kijakazi, Acting Commissioner of Social Security in an October announcement.

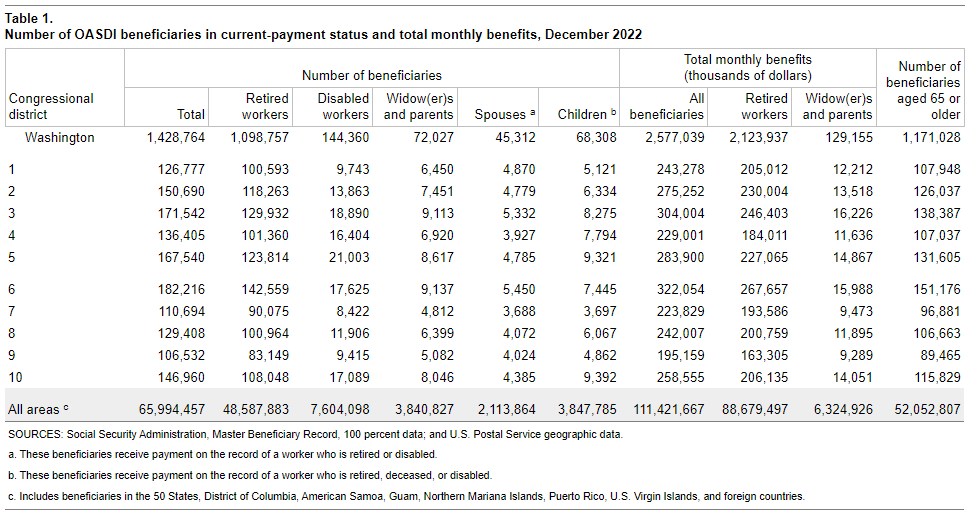

The table below breaks down the number of non-SSI beneficiaries in current-payment status and total monthly benefits as of December 2022 by Congressional District for the state.

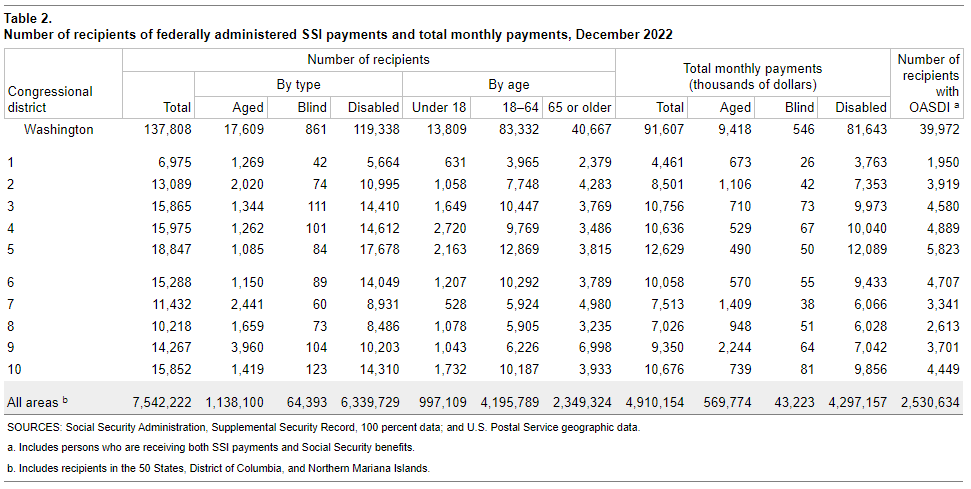

The table below breaks down the number of SSI beneficiaries in current-payment status and total monthly benefits as of December 2022 by Congressional District for the state.

Also beginning January 1, 2024, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $168,600 up from $160,200. The earnings limit for workers who are younger than “full” retirement age (see Full Retirement Age Chart) will increase to $22,320—$1 is deducted from benefits for every $2 earned over $22,320.

The earnings limit for those reaching their “full” retirement age in 2024 will increase to $59,520—$1 s deducted from benefits for each $3 earned over $59,520 until the month the worker turns “full” retirement age.

The Social Security Act provides for how COLA is calculated. The Social Security Act ties the annual COLA to the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as determined by the Department of Labor’s Bureau of Labor Statistics.

The leading driver for the increase was inflation based on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2022 through the third quarter of 2023.

SOURCE: Social Security Administration with additions by the Lynnwood Times.

Author: Lynnwood Times Staff