ARLINGTON, Va.—At its third-quarter 2024 earnings briefing on October 23, Boeing President and CEO Kelly Ortberg shared the grim reality of the company’s financial challenges ahead and his four-point plan to “restore Boeing to the leadership position that we all know and want.”

“It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again,” said Ortberg during Wednesday’s webcast. “Going forward, we will be focused on fundamentally changing the culture, stabilizing the business, and improving program execution, while setting the foundation for the future of Boeing.”

Third quarter results reflect impacts of the International Association of Machinists and Aerospace Workers (IAM) work stoppage and previously announced pre-tax charges on commercial and defense programs due to delays.

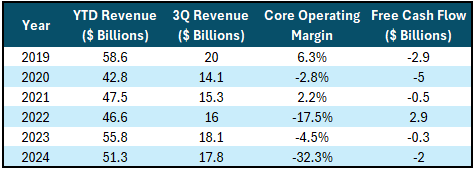

Revenues for the quarter were $17.8 billion, down $300 million from the previous year. So far for the year, Boeing has reported a total of $51.3 billion in revenues, down from $55.8 billion in third quarter 2023. For the year, the company is reporting a Net Loss of $8 billion with $6.174 billion in the third quarter alone.

Boeing reported its worse operating margin of negative 32.3% going back to 2019 representing its challenge to generate a profit through its core operations. Boeing hasn’t reported a full-year profit since 2018, a year before two crashes of the 737 MAX jet that led to the grounding of the plane worldwide.

In addition, its Free Cash Flow is reported at negative $2 billion this quarter conveying a risk to investors for Boeing to repay creditors and/or pay dividends.

The Core Loss per Share is reported at $10.44 for the third quarter and the stock is down $14.52 overall for the year.

Cash and investments in marketable securities totaled $10.5 billion, compared to $12.6 billion at the beginning of the quarter driven by free cash flow usage in the quarter. In October, the company entered into a new $10.0 billion short-term credit facility and now has access to total credit facilities of $20.0 billion, which remain undrawn.

Boeing is reporting total Consolidated Debt at $57.7 billion, relatively unchanged from the previous quarter. Its credit rating is near junk with S&P reporting BBB-, Moody’s at Baa3 and Fitch at BBB-.

On a positive note, the aerospace juggernaut is reporting a total backlog of $511 billion, up $42 billion from the third quarter of 2023.

Turning the big ship in the right direction

Ortberg laid out his framework to restoring Boeing to its “former legacy” that appears akin to Dr. W. Edwards Deming approaches to effective business management:

- Culture change

- Stabilize the business.

- Improve execution discipline on new platform commitments

- Build a new future

“Our leaders, from me on down, need to be closely integrated with our business and the people who are doing the design and production of our products,” Ortberg said.

He also committed to a returned emphasis on core total quality management (TQM) principles to “prevent the festering of issues” and “identify, fix, and understand root cause[s].”

Ortberg shared his commitment to ending the company’s strike with IAM.

“I’m very hopeful that the package we put forward will allow our employees to come back to work so we can immediately focus on restoring the company,” he said.

Employees will be following a detailed “return-to-work plan” following the strike to minimize value chain costs as the factory restarts.

Ortberg shared that Boeing would pause developing and building any new airplanes until the company stabilized its operations, streamlined its portfolio, and restored a healthy balance sheet. He does plan to move forward with workforce reductions to help achieve his goal of “a leaner, more focused organization.”

“This is a big ship that will take some time to turn, but when it does, it has the capacity to be great again,” Ortberg said.

Commercial Airplanes

Commercial Airplanes third quarter revenue of $7.4 billion and operating margin of negative 54 percent reflect previously announced pre-tax charges of $3.0 billion on the 777X and 767 programs as well as the IAM work stoppage and higher period expense, including research and development, Boeing reports.

The 787 program is currently producing at 4 per month and maintains plans to return to 5 per month by year end. In the quarter, Commercial Airplanes booked 49 net orders and delivered 116 airplanes, with a backlog of over 5,400 airplanes valued at $428 billion.

Defense, Space & Security

Defense, Space & Security third quarter revenue of $5.5 billion and operating margin of negative 43.1 percent reflect the previously announced pre-tax charges of $2.0 billion on the T-7A, KC-46A Tanker, Commercial Crew, and MQ-25 programs, Boeing reports.

Results also reflect unfavorable performance on other programs. During the quarter, Defense, Space & Security delivered the first production MH-139A to the U.S. Air Force and definitized a contract for two E-7A Wedgetails from the U.S. Air Force.

The backlog at Defense, Space & Security was $62 billion, of which 28 percent represents orders from customers outside of the United States.

Global Services

Global Services third quarter revenue of $4.9 billion and operating margin of 17 percent reflect higher commercial volume and mix, Boeing reports.

During the quarter, Global Services secured agreements for Landing Gear Exchange Program and Integrated Material Management with All Nippon Airways and a KC-135 spares contract from the U.S. Air Force.

The backlog at Global Services was $20 billion.

Author: Mario Lotmore