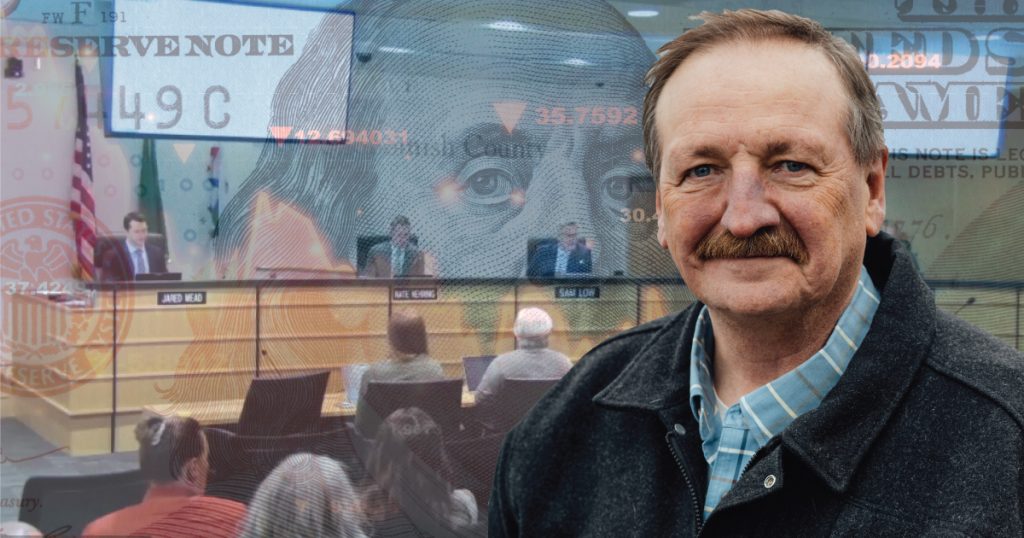

SNOHOMISH COUNTY—A week after a damning audit report by George Skiles, Partner at Sjoberg-Evanshenk Consulting, County Executive Somers stands firm and clears the air on his proposed 2025 Biennial Budget.

Below is a statement by Snohomish County Executive Somers in its entirety:

“As budget deliberations continue, my priority remains sustaining core county services that deliver for our residents. A number of amendments have been brought forward during the County Council’s deliberation and public hearing process, and I need to see what the Council approves before making any decisions about next steps. However, I do believe additional revenue is essential for the 2025-26 biennial budget to sustain the services our community rightfully expects.

“My proposed budget does not add or remove programs. We are striving to hold steady in the coming biennium, despite a systemic budget shortfall as revenues fail to keep pace with rising costs. Snohomish County has a track record of making the most with limited resources, and I am mindful of the impact any increase in the county’s property tax levy could have on people.

“What I’ve proposed in my budget would amount to less than one-half of one percent (<.05%) increase on a taxpayer’s total property tax bill. The 8 percent number that has been frequently quoted misrepresents the proposal. The increase that I have proposed only applies to a small portion of each property tax dollar – the approximately six cents of each dollar that funds county government. The other 94 cents go to the state, your schools, special districts like fire, libraries, sewer, and others. The exact breakdown varies some based on other levies where you live, but they are all listed on your property tax bill. The other approximately 94 cents of your tax dollar are not impacted by the proposed county increase.

“Our Finance department did the math to help us understand the potential impact to taxpayers in dollars: On an average-valued home in Snohomish County, this proposed increase would amount to $2 more per month or $24 more a year in property taxes in 2026 compared to 2024.

“It is important for people with concerns about taxes to have their voices heard. And we do hear them. I believe that $24 more a year by 2026 is a reasonable amount to seek so we can avoid reducing government services, in particular in our law and justice agencies.

“If a budget is passed that does not include additional revenue, we will face staff cuts in the near and long term. And with more than 75% of the proposed budget dedicated to public safety, those cuts will inevitably be felt in this vital area of county responsibility.

“I stand by my proposed budget and by the hard-working employees of Snohomish County. A $2 per month increase in property taxes would preserve jobs and public services.”

5 Responses

Is this so he can pay the double dippers (Fosse and Liias come to mind) their salary? Or maybe it’s for the increase in the Snoco Sheriff’s pay after she got elected? I think everyone in this county that is paying attention sees through this.

Again, no increase in taxes is warranted. The Council is to blame for the shortfall. When will government learn that programs must fall within approved revenue projections and not count upon voters goodwill.

Dave Somers et al.,

Please work within the audit’s spotlighted areas to evaluate and eliminate unnecessary positions and expenses, excess/ over-expenditures, duplication, and areas of waste BEFORE raising property taxes one penny. It is offensive for you to imply (engaging in what is virtually a shaming tactic) that your constituents shouldn’t be concerned with such a small and manageable property tax increase. That is not your judgement to make nor should you assume that the proposed dollar amount is the sole issue under consideration. Perhaps the issue is the County Council’s duty to responsible fiscal management. Perhaps the issue is the County Council’s need to take accountability and recognize their obligation to study and implement the audit’s findings, making budgeting adjustments accordingly. Perhaps the issue is that somewhere along the way, those making the decisions have forgotten that balancing a budget involves working within your means and decreasing the “expenses” column, acknowledging that attempts at increasing the “income” column is not a prudent option. Again, please fulfill your elected responsibilities and follow all avenues (including audit recommendations) to balance the budget prior to increasing taxes, no matter how nominal you choose to paint those increases.

What an out of touch bureaucratic bafoon. We’re in this shortfall due to these elected officials inability to live within their budgetary means. If I can’t afford to go to the movies because I have to buy food, I don’t go to the movies. Cuts are inevitable! Being an adult means you might have to say no to someone or propose funding cuts for some failed social program.

They spend money on things that they don’t even use – two examples: the two hotels – one in Everett and one in Edmonds – where they were going to house the homeless. Both are thoroughly ruined by drugs so they hired a remediation company. I hear that company ripped them off and that both hotels are still uninhabitable. I believe they paid over $3M total for both of them.

Right Mr. Somers … $24 a year is nothing.