EVERETT—South County Fire Board of Commissioners voted unanimously Tuesday, November 19, to adopt a balanced budget that funds emergency services operations for 2025. Residents of the Regional Fire Authority (RFA) are expected to see little or no change to current tax rates.

The $116 million operating budget funds current levels of emergency services and includes a modest 2.6% increase in property tax collections, lower than the current rate of inflation. The overall property tax levy rate for residents is expected to be unchanged.

The 2025 Budget includes the following:

- $776,000 for Deputy Fire Marshals to answer community fire prevention needs

- $225,000 for a Safety Captain

Other additions focus on building organizational efficiencies and securing vital assets:

- $150,000 for HR and Finance process and technology optimization

- $100,000 for records management assistance

- $60,000 for IT security services

Commissioners also approved a 2% increase in the benefit charge. Due to updates in benefit charge distribution for commercial properties, residential properties are expected to see no measurable increase.

“We work for our residents and businesses,” said Fire Chief Bob Eastman. “We answer to you and our budget is responsible to you. We are very thankful to be able to deliver a budget that keeps the impact to our taxpayers below inflation and also ensures you continue receiving excellent fire and emergency medical services.”

How have my taxes for fire and emergency medical services (EMS) changed over the years?

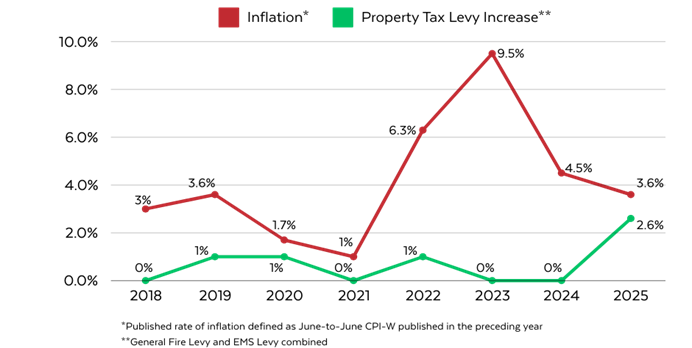

South County Fire’s long-term planning and conservative approach to funding has allowed property tax increases to remain below the rate of inflation since the RFA formed. The average yearly property tax increase since 2018 is below one percent.

Why am I charged fire taxes based on my land value, when my house is the only thing that needs to be protected?

Washington State law establishes property taxes as one of the primary ways public fire services can be funded. As a Regional Fire Authority, South County Fire is only allowed to levy property taxes based on assessed property value: an EMS Levy up to $0.50 per $1,000 of assessed property value and a Fire Levy up to $1.50 per $1,000 or assessed property value.

The maximum fire levy is reduced by a third – down to $1.00 per $1,000 or assessed property value – with the addition of a voter-approved benefit charge. State law limits yearly property tax increases to 1% per year plus new construction collections. In years where the 1% increase is not used, that taxing capacity can be “banked” for possible use in the future.

Property values can be appealed and homeowners can also request a property tax exemption through the Snohomish County Assessor’s Office.

What is a benefit charge?

The benefit charge, renewed by voters in 2024, provides a fair and balanced way to distribute emergency service costs. Unlike traditional levies based on a property’s value, this fee is based on building size, use and hazards. That means residential homeowners typically pay less than higher risk industrial or commercial buildings. With the benefit charge, the maximum fire levy is reduced by a third.

Who is impacted by the levy rates and benefit charge?

The levy rates and benefit charge apply to properties within the RFA, which includes the cities of Brier, Lynnwood, Mill Creek and Mountlake Terrace along with communities in unincorporated southwest Snohomish County. The City of Edmonds contracts with the RFA to provide emergency services and collects its own taxes and fees to pay for the services provided by the RFA.

Why does the 2025 budget refer to a deficit?

South County Fire does not have an operational deficit. This language in the 2025 budget refers to planned deficit spending.

Operational deficit: suggests ongoing revenues are insufficient to fund current-year operating costs.

Planned deficit spending: one-time spending using one-time funding that may not be reflected in revenues from the current year.

The planned deficit spending for 2025 is largely offset by underspending and includes a one-time transfer of funding for future maintenance of apparatus, equipment and fire stations. It also includes establishment of a “rainy day” fund (revenue stabilization reserve) to help ensure residents continue receiving emergency services in the event of a disaster, economic downturn or fiscal emergency.

South County Fire’s financial policy prohibits one-time funding resources from being used for ongoing expenditures (costs that reoccur each year).

Have other questions about the budget? Visit our website to view the complete 2025 budget www.southsnofire.org/budget.

SOURCE: South County Fire

Author: Lynnwood Times Staff