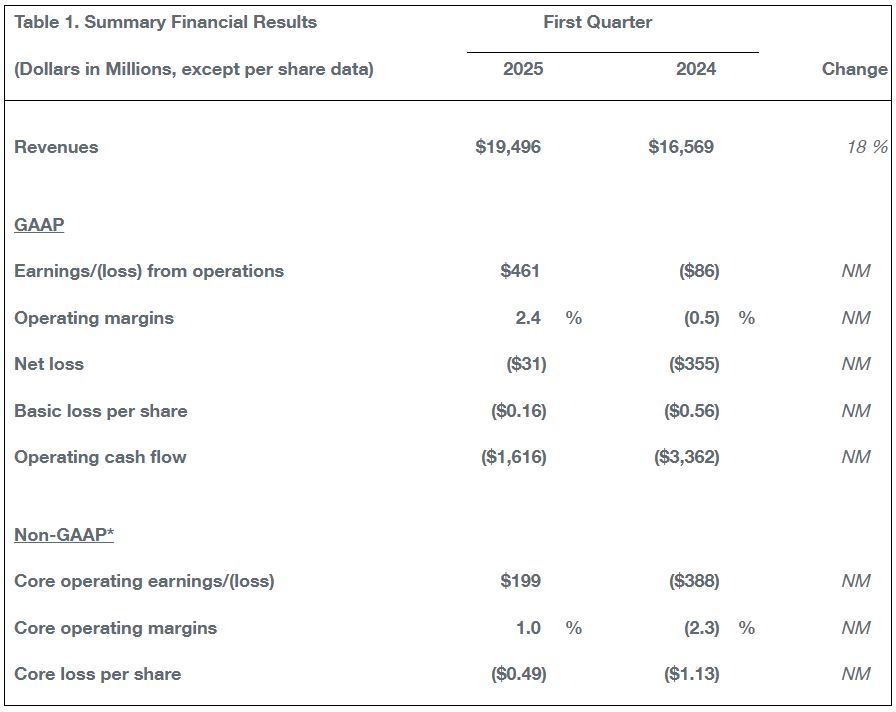

ARLINGTON, Va.—The Boeing Company recorded first quarter revenue of $19.5 billion, GAAP loss per share of ($0.16) and core loss per share (non-GAAP) of ($0.49) (Table 1). The company reported operating cash flow of ($1.6) billion and free cash flow of ($2.3) billion (non-GAAP). Results primarily reflect improved operational performance and commercial delivery volume. Results also reflect only tariffs enacted as of March 31.

“Our company is moving in the right direction as we start to see improved operational performance across our businesses from our ongoing focus on safety and quality,” said Kelly Ortberg, Boeing president and chief executive officer. “We continue to execute our plan, are seeing early positive results and remain committed to making the fundamental changes needed to fully recover the company’s performance while navigating the current environment.”

Cash and investments in marketable securities totaled $23.7 billion, compared to $26.3 billion at the beginning of the quarter, primarily driven by the free cash flow usage in the quarter. Debt was $53.6 billion, down from $53.9 billion at the beginning of the quarter due to the pay down of maturing debt. The company maintains access to credit facilities of $10.0 billion, which remain undrawn.

Total company backlog at quarter end was $545 billion.

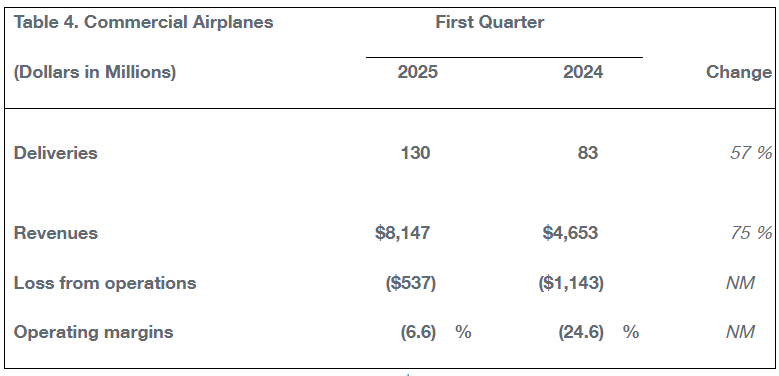

Commercial Airplanes

Commercial Airplanes first quarter revenue of $8.1 billion and operating margin of (6.6) percent primarily reflect higher deliveries (Table 4).

The 737 program gradually increased production in the quarter and maintains plans to reach 38 per month this year. The 787 program continued to stabilize production at five per month in the quarter and still expects to increase to seven per month this year. The 777X program began expanded FAA certification flight testing in the quarter, and the company still anticipates first delivery of the 777-9 in 2026.

Commercial Airplanes booked 221 net orders in the quarter, including 20 777-9 and 20 787-10 airplanes for Korean Air and 50 737-8 airplanes for BOC Aviation. Commercial Airplanes delivered 130 airplanes during the quarter and backlog included over 5,600 airplanes valued at $460 billion.

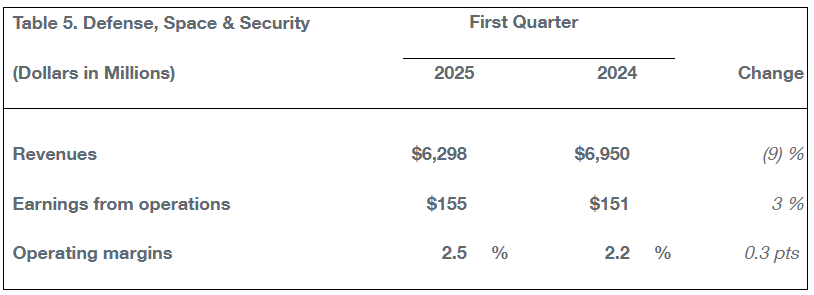

Defense, Space & Security

Defense, Space & Security first quarter revenue was $6.3 billion. First quarter operating margin of 2.5 percent reflects stabilizing operational performance.

During the quarter, Defense, Space & Security was selected by the U.S. Air Force for a contract to design, build and deliver the F-47, its next-generation fighter aircraft. This order is not included in backlog at the end of the quarter pending completion of the source selection and evaluation review process. Backlog at Defense, Space & Security was $62 billion, of which 29 percent represents orders from customers outside the U.S.

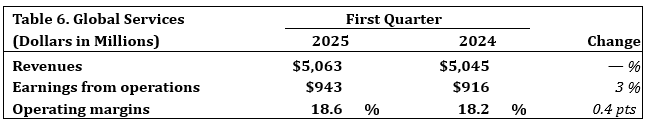

Global Services

Global Services first quarter revenue was $5.1 billion. First quarter operating margin of 18.6 percent reflects favorable performance and mix.

In the quarter, Global Services delivered the 100th 767-300 Boeing Converted Freighter to SF Airlines and received a modification contract from the U.S. Air Force to integrate electronic warfare systems for the F-15 Eagle. In April, the company entered an agreement to sell portions of its Digital Aviation Solutions business, and the transaction is expected to close by the end of 2025 subject to regulatory approval and customary closing conditions.

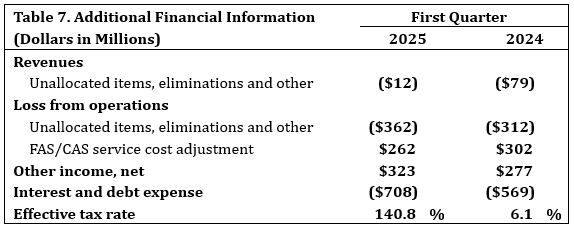

Additional Financial Information

Unallocated items, eliminations and other primarily reflects timing of allocations. The first quarter effective tax rate primarily reflects an increase in the valuation allowance.

Source: The Boeing Company

Author: Lynnwood Times Staff