LYNNWOOD—Lynnwood Finance Director Michelle Meyer and Committee Chair George Hurst reviewed the City’s 2nd Quarter 2025 Financial and Sales Tax reports on Wednesday, July 23. The City is now projecting a $5.1 million shortfall in the General Fund through second quarter in addition to an already projected $4.2 million deficit.

In a memo, Mayor Christine Frizzell chalked the shortfall up to Lynnwood’s rapidly expanding growth (and by extension an increased demand for city services), inflation, unexpected operating costs of the new Community Justice Center (CJC), increased costs for prosecutorial and indigent defense services, lower than projected sales tax collection (which makes up about 44% of the city’s general fund revenue), and a far less-than-anticipated revenue stream generated by the new photo enforcement program.

On Monday, Mayor Frizzell updated her Budget Management Plan calling on City Departments to reduce their General Fund operating costs by a target of 10%, while requesting Finance Director Meyers to re-forecast Lynnwood’s 2025-2026 to reflect zero percent growth in the city’s State Sales Tax, Development Service Charges, and Photo Enforcement revenues.

During Wednesday’s Finance Committee Meeting, all options to generate revenue were discussed including raising the City’s sales tax, reprioritizing capital projects, and creative uses of awarded grants to offset city-funded expenditures. The City’s “bank capacity” was also discussed.

In Washington state, there is a 1% limit on annual increases to property tax levies, but local governments can use “banked capacity,” in layman’s terms, unused property tax levies that is “banked” over the years to exceed the 1% annual threshold. According to Director Meyer, Lynnwood has 33.46% bank capacity (or $3.6 million) the council can levy against residents without a public vote by residents.

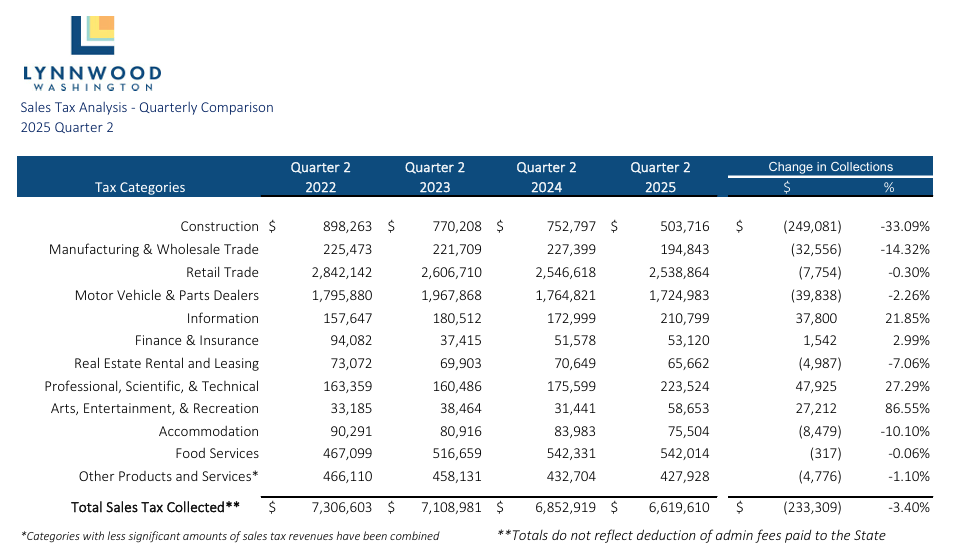

When it comes to sales tax, Lynnwood has taken in $13.94 million Year-to-Date to a 2025 projection of $15.47 million, down 9.87% ($1.53 million) or 3.1% down from 2024’s YTD actual revenues. The impact of tariffs was discussed as well as the possible drop in Canadian tourists visiting the area as significant factors.

During the 2025 PNWER Annual Summit in Bellevue earlier this week, Rep. Rick Larsen (WA-02) shared that as of June 2025, Canadian travelers from British Columbia into Washington state through Whatcom County decreased 43% when compared to June of 2024.

Much anticipated multi-family construction is delayed (or halted), revealed during Wednesday’s meeting, which is also contributing to a quarter-of-a-million-dollar drop in sales tax revenue from the construction sector.

According to financial data reviewed in Wednesday’s meeting, Total Operating Revenues Year-to-Date in the General Fund are $31.2 million, approximately 5.5% more than during the same period in 2024. However, Total Operating Expenditures are $33.2 million or approximately $6 million more than during the same period in 2024.

The significant expenditure drivers when comparing 2024 to 2025 were: “Salaries, Wages, & Benefits” with an increase of $3.57 million (59.49% of the $6 million 2025 expenditure increase) and line item titled “Services & Charges” with an increase of $2.3 million (38.24% of the $6 million 2025 expenditure increase).

Meyer’s shared with the Lynnwood Times that the increase in expenditures were a result of the City negotiating and accepting two Collective Bargaining Agreements, an increase in IT Security Services, and a 26% increase in Liability & Property insurance.

The Lynnwood Times, in future articles, will be deep diving into the numbers so readers can better understand Lynnwood’s Budget Crisis and what city leaders are doing to address it.

Author: Mario Lotmore