LYNNWOOD—New single-family home construction will jump at least $9,652 (minimum of $72,114 for multi-family dwellings) for one-time water and sewer connection fees for a homeowner or developer in Lynnwood, along with a 15% property tax rate increase and a 67% utility tax increase for existing residents following approvals by the Lynnwood City Council at its Monday, November 24th Business meeting.

Finance Director Michelle Meyer told the council that even with the approved levy increase and previously adopted utility-tax and fee adjustments, the city remains roughly $5 million short of closing the 2026 gap under current revenue forecasts. Additional cuts or new revenue sources may be required next year if sales tax and development-related revenues do not rebound, she added.

The Council is considering increasing the city’s sales tax—currently the state’s highest. If approved, the increased tax burden overwhelmingly will be from non-Lynnwood residents who shop in the city—Snohomish County’s retail Mecca.

2026 Property Tax Levy

In a contentious meeting Monday night, the Lynnwood City Council voted 4-3 to raise the city’s 2026 property tax levy by 14.9254%, setting the rate at $0.77 per $1,000 of assessed value, up from the current $0.67. The increase is projected to generate an additional $1.7 million, bringing the total levy to approximately $8.9 million — a 23.4% revenue increase over 2025. The council’s decision adds roughly $85 per year (or $7 per month) to the tax bill of the average single-family home.

Voting in favor of the final motion were Councilmembers Robert Leutwyler, Derica Escamilla, Patrick Decker, and George Hurst. Opposed were Councilmembers Josh Binda, David Parshall, and Nick Coelho.

Councilman Hurst, who proposed the $8.9 million compromise that ultimately passed, expressed significant reservations about maximizing the levy.

“If we take all the banked capacity this year, we’re left with only 1% annual increases going forward — exactly what happened in Edmonds, where voters recently rejected a levy lid lift,” Hurst said.

An amendment by Councilmembers Binda and Coelho to push for the maximum banked capacity rate of $0.95 per $1,000—raising the levy to $11.05 million (a 53% property tax increase) and $209/year for the average home—failed 2-5.

The 2026 property tax levy increase is part of a broader councilmanic effort to close an estimated $8 million shortfall in the 2025-2026 biennial budget, driven by a $70 million Community Justice Center bond debt, loss of one-time federal funds (ARPA and COPS grants), and slowed development/economic activity according to Finance Director Michelle Meyer.

“This is not a panic knee-jerk reaction,” said Councilman Leutwyler. “We have a $70 million bond obligation for the Community Justice Center that a prior council approved without corresponding revenue. It is now our job to figure out how to pay for it.”

Councilmember Escamilla floated the idea of pausing jail operations and then immediately clarified she was not calling for permanent closure.

“But you know what they don’t use every day? It’s a necessity. It’s… It’s the police,” Councilwoman Escamilla said. “We need the police. We will always need the police. We don’t need a jail. We don’t. And I’m not… It was a wild, like, oh, let’s just get rid of it. I mean, thinking about it from the community’s perspective of only if you do bad things and you break the law, will you end up in that jail?”

Councilwoman Escamilla is no stranger to law enforcement; her home was raided in May 2024 and her brother spent a night in the Lynnwood Jail in August 2025 for third-degree theft following an alleged incident involving stolen packages and mail from a residential porch.

After pushback from Councilman Decker and others, Escamilla back-pedaled and clarified that she does not want to permanently close or get rid of the jail.

“What I simply suggested was a pause, maybe while we recalibrate just the jail…. I’m not trying to close our jail or anything like that,” she said.

General Facility Charges for Water and Sewer Utility

In a 5-2 vote, the Lynnwood City Council approved Ordinance 3498, establishing the city’s first-ever General Facility Charge (GFC) for the Water Utility. The one-time connection fee, which applies only to new development and not to existing customers, ranges from $1,932 to $64,394 per water meter depending on meter size (based on a rate of $1,932 per meter capacity equivalent, or MCE).

Meter Size MCE FACTOR 3/4″ 1 1″ 1.67 1.5″ 3.33 2″ 5.33 3″ 10 4″ 16.67 6″ 33.33

Voting in favor of the final measure were Council members Coelho, Leutwyler, Parshall, Binda, and Decker; opposed were Council members Hurst and Escamilla.

An amendment to implement the water utility connection fee in a phased approach over a 4-year period, introduced by Councilwoman Escamilla, failed 3-4 with Council members Coelho, Leutwyler, Binda, and Decker dissenting.

Public Works Director Jared Bond explained that without the new one-time Water Utility fees, future capital costs would be shifted to monthly utility rates paid by current residents.

When asked why the City did not impose water connection charges back in the 2000s when Sewer GFCs where established, Bond told the Lynnwood Times that there “was an intention to do that during our last evaluation 3 years ago, but we never got back to it.”

Lynnwood’s growth over the last three years have been driven by multi-family dwellings near transit hubs like the Lynnwood City Center Station. Single-family completions have been low due to land constraints and Lynnwood’s Comprehensive Plan favoring zoning for density. New commercial development in Lynnwood is also limited because of space constraints and is tied to mixed-use developments.

Since 2022 seven multi-family structures have been built in Lynnwood—Avalon Alderwood, KINECT @ Lynnwood, Woods at Alderwood Phase 2, Alexan Access, Novo on 52nd, Ember, and Koz Development—and 18 single-family homes providing some 2,300 housing units.

For multi-family developments, water service typically follows Uniform Plumbing Code (UPC) guidelines for sizing based on fixture units—a measure of demand. The Lynnwood Times estimated that each of the seven multi-family structures would have generated approximately $64,394 to $112,000 in water utility GFC revenue (a total of $450,758 to $784,000); and approximately $34,776 for the 18 single-family homes for capital utility projects. This is based on the most likely water meter configurations from typical engineering practice in Washington State for transit-oriented, and mid-rise multifamily projects.

The council also approved Ordinance 3499, by the same 5-2 margin, an increase to the existing sewer GFC from approximately $4,000 to $11,720 per connection—a 193% increase per equivalent residential unit (ERU). According to LMC 14.51.050.C, a residential single unit property shall be assigned one ERU per unit as a sewer connection charge; whereas a residential multi-family unit property shall be assigned 0.75 ERU per unit.

Voting in favor of the measure were Council members Coelho, Leutwyler, Parshall, Binda, and Decker; opposed were Council members Hurst and Escamilla.

Councilman Hurst argued that the sudden increases could discourage middle housing and townhome development, stating, “We do want growth to pay for growth, but at the same time, we want housing to be more attainable in Lynnwood.” His calls for additional stakeholder engagement with builders before implementation went unanswered by fellow council members.

Accessory dwelling units (ADUs) are explicitly exempt from both the new Water Utility and the increased Sewer Utility charges, and Director Bond clarified there is no overlap with fees charged by the Alderwood Water & Wastewater District.

Bond shared with the Lynnwood Times that both Water and Sewer GFCs will “only be spent for capital projects, not operations.”

“In 2024, our sewer utility identified over $200 million of needed projects over the next 6 years, and in 2025 the water utility identified $445 million over the next 20 years,” Bond told the Lynnwood Times. “For our utilities, most projects we undertake are funded exclusively with local funds. That being said, the revenue for these utility projects comes from the monthly bills that our customers pay. These GFCs will help to keep those monthly bills lower, as it will lower the portion of the rate necessary to cover the capital project expenses.”

Both the new water GFC and increased sewer GFC take effect January 1, 2026.

The new Enso mixed-use development with over 300 residential units and 4,200 sq ft retail, is scheduled for completion in the summer of 2026. If the old sewer GFC isn’t grandfathered in, the project could be facing an additional $1.83 million (316 units x $7,720 GFC increase in sewer fees x 0.75 ERU per unit) in sewer fees owed to the City of Lynnwood—this is not including sewer fees for retail space and an estimated $112,000 in water connection fees.

The upcoming Northline Village with its 1,369 residential units and 250,000+ sq ft in retail/office/entertainment adjacent to the Lynnwood City Center light rail station is scheduled to break ground in 2026 which has been delayed for years due to financing constraints—from the COVID-19 pandemic—and lease termination agreements. The new GFC rates added at least $500,000 for residential dwellings plus hundreds of the thousands of dollars for retail spaces in water connection fees; and at least $7.9 million in for residential dwellings plus hundreds of the thousands of dollars for retail spaces in sewer connection fees.

LMC Section 3.41.030(E) Update for Utility Tax

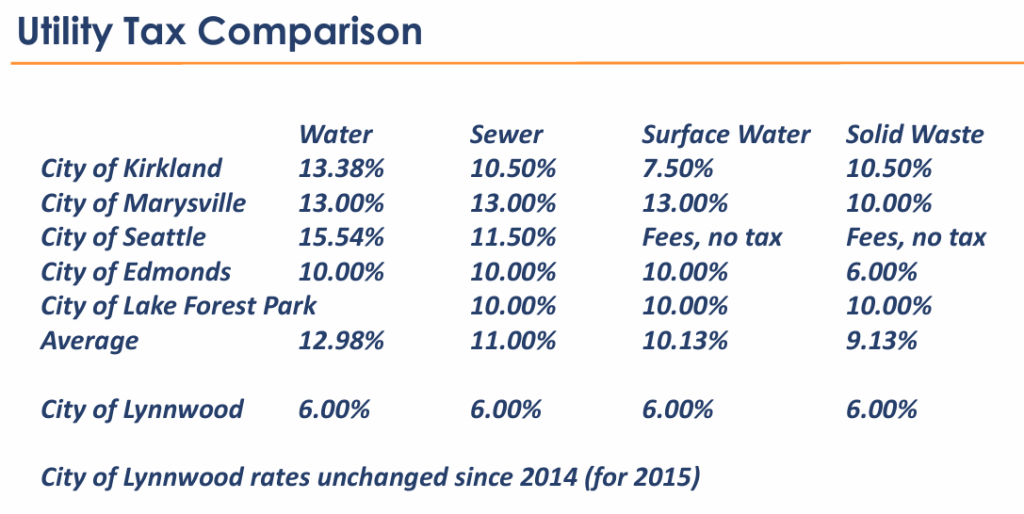

In a 4-3 vote, the Lynnwood City Council approved Ordinance 3501, raising the City’s utility tax rate on water, sewer, surface water, and solid waste collection from 6% to 10% effective February 1, 2026—a 66.67% rate increase. The utility rate increase, the first in ten years, is projected to generate an additional $1.9 million annually for the City’s General Fund, contributing to closing its multi-million-dollar budget shortfall.

Voting in favor of the final measure were Council members Coelho, Leutwyler, Parshall, and Binda; opposed were Council members Hurst, Decker, and Escamilla. An amendment proposed by Councilwoman Escamilla to limit the increase to 8% failed on a 3-4 vote, with Leutwyler, Decker, Coelho, and Parshall dissenting.

Councilman Leutwyler, sponsor the original motion, called the 10% rate “a compromised approach” that remains below many regional benchmarks despite a decade without adjustment.

Councilman Hurst, who voted against the final measure, warned that ongoing base-rate hikes combined with the new taxes would drive significant bill increases. Using his own household as an example, Hurst projected his bimonthly bill rising from approximately $297 to $356.

“This is just a tax on people, and I disagree with it” Hurst said. “Every household is required to have utilities. Every household is required to have actually garbage waste or waste contract. It just, no. We already have rates in place to pay for the waste. the water sewer and stormwater.”

Other key votes

Mid-biennial Budget Amendments

- Council approves adjustments to various fund accounts (General, Capital, Criminal Justice, REET, etc.): +$8.89 million in Revenue and +$9.7 million in Expenditures.

- Passes 7-0

2025 Comprehensive Plan Amendment List

- Council approves updates to the 2025 Comprehensive Plan

- Passes 7-0

Six-Year Transportation Improvement Program (TIP) 2027-2032

- Council approves updates to its six-year plan of anticipated Transportation improvement projects

- Passes 7-0

Six-Year Capital Facilities Plan (CFP) 2027-2032

- Council approves updates to its six-year plan of anticipated Capital projects

- Passes 7-0

LMC Updates for Title 13

- The council approved updates and revisions to procedures for the City’s “Waterworks Utility” which refers to the water, sewer and surface water systems.

- Passes 7-0

Author: Mario Lotmore

2 Responses

We are not the government’s endless piggy bank to cover for their poor fiduciary oversight of our tax money. I guarantee their thought prices is, “Whelp, we can always raise taxes.”

Property tax = you don’t own your home, you are renting it from the inefficient government. Try not paying your property tax and see if you get to keep your home.

We have become a country of pansies and lemmings. When will people become smart and realize we’re being fleeced by our own government???

Although I can afford these extreme tax increases, (which were caused by past & current inept leaders), many households cannot.

Renters may be hit extra hard with some landlords taking advantage with higher percentage charges. Don’t we have a large enough homeless problem?

Pay extra attention while voting in the future.