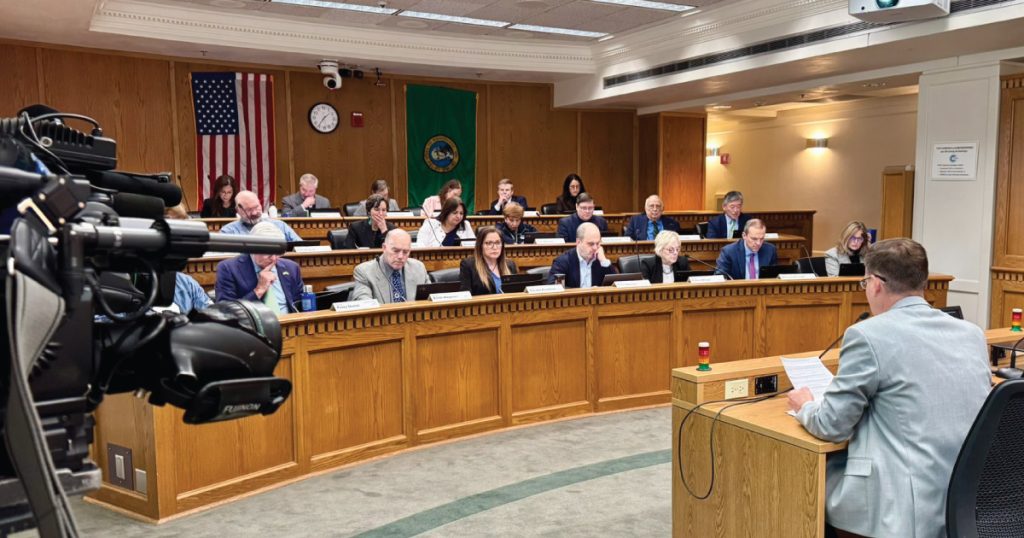

OLYMPIA—Washington lawmakers heard impassioned pleas from both sides during a packed Senate Ways and Means Committee hearing on Friday, February 6, 2026, over Senate Bill 6346, a proposal to impose a 9.9% tax on individuals earning more than $1 million annually. Supporters cast the measure as a vital step toward fixing what they call a regressive tax system and funding essential services like education and health care, while critics warned it would hammer small businesses, drive away jobs, and set the stage for broader income taxes despite voters’ repeated rejections.

The hearing drew massive public interest, with more than 80,000 people signing in to register positions—roughly 61,000 opposing the bill, 19,000 supporting it. Dozens testified in person and remotely, splitting roughly evenly between pro and con voices, with a handful expressing other concerns like calls for amendments. The committee waived its five-day notice rule in a 15-9 party-line vote to allow the hearing, drawing objections from Republicans who argued the public needed more time to digest the complex 62-page bill.

Committee Chair June Robinson (D-Everett) opened the session by suspending the rule over protests from Ranking Member Chris Gildon (R) and others, who called the rush premature given the bill’s introduction just days earlier and a fiscal note released only an hour before the meeting.

Senate Bill 6346—also known as the “Millionaires’ Tax”— introduced by Senate Majority Leader Jaime Pedersen (D-Capitol Hill), would start with federal adjusted gross income and make adjustments to arrive at “Washington taxable income.” It excludes long-term capital gains unless already subject to the state’s capital gains tax, adds back certain state and local taxes deducted federally, and provides a $1 million standard deduction per household—adjusted for inflation from 2030—and a $50,000 charitable deduction. Non-residents of Washington state pay only on Washington-sourced income, apportioned based on activity within the state.

The Millionaires’ Tax would take effect January 1, 2028, with first returns due in 2029. It exempts real estate sales, qualified family-owned small businesses, and retirement income from public pensions. Estimated to affect about 30,000 taxpayers—roughly 0.5% of households—it is expected to generate approximately $3.5 billion annually, with 5% ($175 million) dedicated to county public defense and the remainder to the general fund for education, health care, and other services. However, these monies are not earmarked for education nor health care and can be used as the legislature sees fit when it is allocated to the state’s general fund.

During the hearing, Senator Pedersen revealed that although SB-6346 targets only individuals with at least $1 million in annual income, no current law can permanently bind future legislatures should a future legislature expand the tax to other income brackets.

“We don’t have the ability to bind future legislatures, and I suspect that in the future,” Senator Pedersen (D) replied to Senator Chris Gildon (R) regarding possible expansion of the income tax. “We all want to make sure that our successors will have the flexibility to respond to the challenges that they see in front of them.”

Senate Committee Staffer Jeff Mitchell clarified with lawmakers during the hearing that pass-through entities like partnerships and S-corporations flow income to owners’ personal returns, potentially subjecting them to the tax, though credits may offset Business & Occupation (B&O) taxes paid.

Senator Perry Dozier (R) pressed on any potential clause that would shield the bill from public referendums. Currently, the bill does not explicitly mention “referendum” in its text, but it provides for a delayed effective date of January 1, 2028, with first tax returns and payments due in 2029. This effective future date would allow time for a referendum under Washington law, as referendums apply to non-emergency legislation and can suspend laws until a voter approval or rejection.

However, Senator Keith Wagoner (R), in his response to the Lynnwood Times, suggested removing or preventing any emergency clause language to ensure the referendum process remains available for Washington state residents.

Senator John Braun (R-Centralia) asked if real estate gains exempted under capital gains rules would remain, which Mitchell confirmed it would.

The bill starts with federal adjusted gross income, excludes all long-term capital gains and losses initially, then adds back only net long-term capital gains subject to Washington’s capital gains tax (plus the standard and charitable deductions that reduced the taxable amount). Thus, real estate sales that qualify for exemption under the capital gains rules—such as qualified family-owned small businesses or residential property—remain untaxed, avoiding any undoing of exemptions.

Senator Matt Boehnke (R) had a question about how this tax bill deals with college athletes, especially when it comes to money made from “name-image-likeness” (NIL) deals. He wanted to know if there are any exemptions or rules for splitting up that income if the athlete doesn’t live in Washington full-time.

If a student athlete doesn’t live in Washington, the state won’t tax all of their NIL income—only the part that’s directly tied to activities or work done inside Washington state, Mitchell explained. However, if the athlete is a full-time Washington resident, all of their income (including NIL) could be taxed under the bill’s general rules, but with the $1 million deduction applying first.

Public Testimony on Millionaires’ Tax

Public testimony kicked off with Eli Tayor Goss, Executive Director of Washington State Budget and Policy Center, a coalition urging passage to “shift our upside-down tax code more right-side up” and fund health care and education.

Jed Fowler, president of HD Fowler Company, said he would owe the tax but supported it, arguing it fosters “shared prosperity” and is “fundamentally pro-business.” Fowler dismissed voluntary payments when questioned by Sen. Gildon, saying he wants a “progressive revenue base” for all.

Teacher Kelly Diamond from Spokane described overcrowded classes and urged funding to “bridge the divide between extreme wealth” and underfunded schools. King County Executive Girmay Zahilay backed the bill for lowering taxes on working families while funding affordability needs.

Opposition mounted quickly. Brian Heywood, a hedge fund manager and founder of Let’s Go WA, warned the tax would hit small businesses hard, sharing that he knows over 50 high-earner couples who are already relocating domiciles outside of Washington state, including investor Billionaire Democrat donor Nick Hanauer, allegedly.

Former Attorney General Rob McKenna argued the bill violates the state constitution’s uniformity clause in Article 7, Section 1, that defined income as property taxable at no more than 1% uniformly, and urged a constitutional amendment instead. In other words, the Millionaires’ Tax creates different “classes” of taxpayers as it doesn’t apply to everyone uniformly, and that the tax at 9.9% is far over the 1% cap for property taxes.

Jared Walczak, Vice President of the Tax Foundation, a nonpartisan think tank based in Washington, D.C., that focuses on tax policy research and analysis shared that the Millionaires’ Tax bill structure contained “unusual” elements compared to typical state income taxes specifically around its charitable cap, Marriage penalty, and effective rate when combined with Seattle payroll taxes, and pass-through entity tax credits.

“So, if this bill should pass, Washington’s new 9.9% rate on the highest earners would yield a top rate of more than 18% in Seattle, counting both the employer and the employee side taxes,” Walczak said adding that, “This would happen without any meaningful adjustment to the state’s business taxes.”

Walczak pointed out that the bill’s $50,000 cap on charitable deductions is unusually restrictive. In most states with income taxes, taxpayers can deduct a much larger portion of their charitable giving—often without a hard limit or tied to a percentage of income.

The $1 million standard deduction is capped at $1 million per household, creating a “penalty” where a married couple combined earnings over $1 million but less than $2 million will pay more tax than two unmarried individuals earning over $1 million.

Walczak also shared the risks to Washington of lower economic growth and Washington-based companies choosing to locate their new hires out of state if Washington chooses to go against the trend of 26 states since 2021 who have cut tax rates.

Brent Frey, founder of Smartsheet and TerraClear, said the tax would “destroy” incentives for hard work, prompting his company to shift operations out of state. Patrick Connor of the National Federation of Independent Business raised alarms over taxing undistributed earnings in pass-through businesses, potentially crippling cash flow.

Sean Graham of the Washington State Medical Association signed “other,” pushing for dedicated health care funds amid $100 million annual B&O hikes on providers. Paul Jewell of the Washington State Association of Counties appreciated the 5% public defense allocation—estimated at $175 million yearly—but sought a fairer distribution formula and more resources.

Candace Bock of the Association of Washington Cities sought city shares of public defense funds, noting they handle half the volume in the state of criminal cases.

Molly Gallagher of the Direct Cash Coalition praised expansions to the Working Families Tax Credit, eliminating age restrictions for childless adults and adding $44 million yearly. Personal stories followed: Alina Swart from Asotin County said the credit covers her phone bill, easing family communication; Giovanni Rosario, a recent graduate, noted it would help young adults like him afford basics.

Gwen Goodfellow, an SEIU caregiver, supported the bill to prevent care cuts for vulnerable clients. Teresa Camarena, a Wenatchee childcare provider, backed the Millionaires’ Tax for what she called equitable contributions. Melissa Dingman, a MomsRising member, shared how state health programs saved her son’s life, urging the tax to counter federal cuts.

Suzanne Southerland of the Washington Education Association called it a “fairness tax.”

Critics, however, continued to express their concerns.

Brent Ludeman of the Building Industry Association of Washington highlighted restrictions on loss carryforwards and income averaging, hurting developers. Michele Willms of the Associated General Contractors said the tax treats business revenue as personal wealth, squeezing contractors’ working capital.

Andrea Ray of the Washington Hospitality Association worried it burdens family-owned restaurants and hotels.

Troy Schmiel, a homebuilder, cited the marriage penalty—capping deductions at $1 million per household—as effectively a “$500,000 tax.” Max Martin of the Association of Washington Business echoed small business harms. Tim Eyman described the Millionaires’ Tax as “the jealousy bill,” violating Initiative 2111, an income tax ban in Washington state.

Jeff Pack of Citizens Against Unfair Taxes called it tyrannical, ignoring 11 voter rejections. Lori Lane worried about “tax creep.” Jessica Z who testified online opposed the tax, referencing France’s failed “solidarity wealth tax” that she alleged resulted in capital flight.

The Greater Everett Chamber of Commerce, in a statement, opposed the bill due to harms on pass-through businesses, urging members to testify against administrative burdens and double taxation risks.

The Ways and Means Committee is scheduled on Monday, February 9, to vote potentially advancing the bill.

Sens. Pedersen and Wagoner answer our questions on Millionaires’ Tax bill

Sen. Pedersen, sponsor of the Millionaires’ Tax bill, addressed with the Lynnwood Times after Friday’s hearing on two pieces of misinformation about the bill—claims that it hits non-millionaires broadly and a lack of support for measure.

“First, the only time in the last 15 years that Washington voters have weighed in on an income tax (I-2109 in 2024), they approved it by an almost 2/3 margin,” Pedersen wrote in a statement to the Lynnwood Times. “The proponents of the initiative to repeal the capital gains tax consistently called it ‘the capital gains income tax.’ The voters strongly approved it.”

Pedersen pushed back against critics who argued the bill would burden small business owners, stressing that the tax is designed to target individuals with Washington taxable income exceeding $1 million after deductions.

“Owners of pass-through businesses are entitled to a dollar-for-dollar tax credit for all B&O taxes paid to the state,” Pedersen wrote. “For most business owners, this will significantly reduce (or even eliminate) their tax liability.”

Washington’s B&O tax is a gross receipts tax—0.47% to 1.75% depending on the industry—and Section 506 of the proposed bill allows full crediting of these payments against the new 9.9% Millionaires tax. However, the credit doesn’t cover losses carried forward from pre-2028 years, which critics see as a gap.

Pedersen added that he supports increasing small business credits and charitable deductions as amendments to his bill.

“This is an opportunity to make our tax system fairer and more sustainable,” Pedersen wrote. “With these resources, we will be able to make investments in K-12 education, health care, human services such as mental health, and higher education.”

Senator Wagoner (R-Sedro Woolley) told the Lynnwood Times that the top 20% of earners already pay 60% of revenues the state collects, which he feels isn’t being reported to residents. Wagoner stressed to the Lynnwood Times that no where in the Millionaires’ tax bill does it earmark monies for “education, food banks, healthcare.”

“The brunt of the revenue would go straight to the General Fund to be spent or squandered (pick your term) by the majority party in whatever way they deem fit,” Sen. Wagoner wrote to the Lynnwood Times calling the bill “anti-marriage” for its treatment of combined income earners.

He warned of diminishing tax revenue returns as a result if the bill passes and alleged it will negatively impact small business owners “disproportionately.”

Wagoner shared that he supports any removal of an Emergency Clause and would like to add “No Supplant language if the legislature has specific intents for use.”

“Currently, Public Defense and the Working Families Tax Credit are specified uses in the bill,” Wagoner wrote. “Maybe that sounds good to some but nothing prevents the legislature from just changing it.”

California Millionaires’ Tax parallels to Washington State

With all this talk about a Millionaires’ Tax in Washington state, California may provide a crystal ball into what may happen here in the Evergreen State. After passing a “Millionaires’ Tax” in 2004, then a “Very-High Earner” tax on those making over $250,000 passed in 2012, now Californians may be hit with a new “Billionaire Tax.”

The 2026 Billionaire Tax Act proposes a 5% annual tax on California’s billionaires’ net worth exceeding $1 billion, starting January 1, 2027, to raise $20-40 billion yearly for healthcare, but includes residency rules that taxes former residents for five years post-departure. If the proposed ballot initiative garners the 900,000 signatures needed to qualify, it will be on the November 3, 2026, election ballot.

An initiative from SEIU-UHW targets worldwide assets including illiquid tech stocks with rules presuming full control value for voting shares. If passed, the new tax would apply a tax on ALL property owned, not just real estate but stocks, bonds, furniture, autos, cash, gold, silver – everything. In other words, if a person has a positive net worth but very little cash, the state of California would tax the value of the net worth, resulting in a tax bill to be paid by the taxpayer to the state.

Since 2004 California has had and continues to have a “Millionaires’ Tax” which started at 1% and now 14.3%.

In 2004, California voters approved Proposition 63, known as the Mental Health Services Act, which imposed an additional 1% tax on taxable income exceeding $1 million. This was explicitly described as a “millionaire tax” in economic analyses and was designed to fund mental health services. It took effect in 2005 and remains in place today.

In 2012, Proposition 30, introduced by former Gov. Jerry Brown (D), imposed higher marginal income tax rates for high earners, including a top rate of 13.3% on incomes over $1 million (for single filers; brackets are doubled for joint filers).

Proposition 30 added three new personal income tax (PIT) rates for “very-high-income” earners in California through 2018:

- A 10.3 percent tax bracket for single filers’ taxable income between $250,001 and $300,000 and joint filers’ taxable income between $500,001 and $600,000;

- An 11.3 percent tax bracket for single filers’ taxable income between $300,001 and $500,000 and joint filers’ taxable income between $600,001 and $1 million; and

- A 12.3 percent tax bracket for single filers’ taxable income above $500,000 and joint filers’ taxable income above $1 million.

So, the Millionaires’ Tax now expanded to a “Very-High-Income” Tax starting at $250,001.

This were to sunset in 2018, but was extended through 2030 with the passage of Proposition 55 in 2016. Combined with the 1% Millionaires’ Tax passed in 2004; this resulted in an effective top state income tax rate of 14.3% for those earning over $1 million.

Now that California is facing multi-year structural deficits that balloon to over $22 billion in 2027—the same year the proposed Billionaires’ Tax is to take effect—total net worth is now a viable option to tax.

A New York Post article from January 12, reports that California has lost nearly $700 billion in wealth in the past month due to fears over a proposed “Billionaire Tax” ballot initiative. This exodus reduced the estimated $2 trillion taxable base to now $1.3 trillion, with projections that it could fall below $1 trillion by year’s end.

Recent green-flight from California: Google co-founder Larry Page linked to 45+ LLCs going inactive or relocating, including a $71.9 million Miami mansion purchase; Sergey Brin tied to 15 LLCs moving to Reno, Nevada; In-N-Out heiress Lynsi Snyder shifting to Tennessee with a new corporate office.

Chamath Palihapitiya—a venture capitalist, former Facebook executive, and one of California’s wealthiest residents—described the exodus as a “complete and total unforced error” that could lead to budget shortfalls, lawsuits, and potential tax hikes on the middle class if not addressed.

Governor Newsom now opposes the initiative saying it is a “race to the bottom.”

A poll conducted by David Binder Research found that support for the Billionaires’ Tax dropped from 55% to 41%, while those opposing the initiative surged to 53%. The poll surveyed 800 likely California voters from Dec. 6-10. It was conducted in both English and Spanish and had a margin of error of 3.5%.

Author: Mario Lotmore