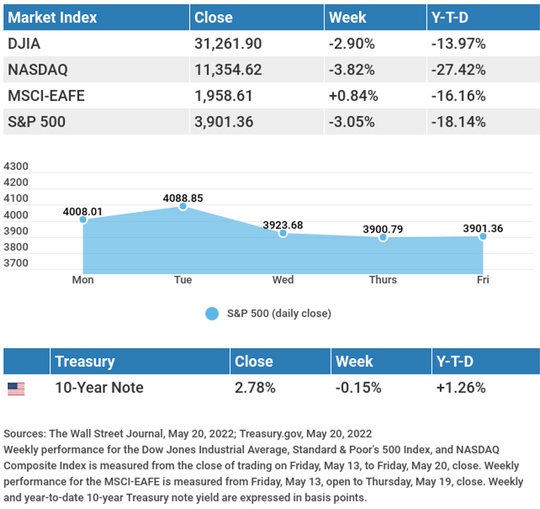

Recession fears grew last week following weak earnings reports from major retailers, sending stocks lower. The Dow Jones Industrial Average fell 2.90%, while the Standard & Poor’s 500 lost 3.05%. The Nasdaq Composite index dropped 3.82% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.84%.1,2,3

Trending Lower

Stock prices remained in a downtrend, capped by a sell-off on Wednesday following a succession of disappointing earnings reports from several major retailers. Despite solid April retail sales and industrial production data, weak economic numbers from China and shrinking profit margins at U.S. retailers fanned recession fears throughout the week.

Rising yields, which have been an overhang to the markets in recent weeks, turned lower as investors appeared to move cash to bonds from stocks. But lower yields did not help stock prices, which closed out the week with a volatile trading session.

Cloudy Picture with Retailers

Investors received a mixed message from the retail sector. April’s retail sales increased 0.9% from March, signifying that consumer spending remained strong. But it was difficult to determine from the retail sales report whether the increase was a function of higher retail prices or a resilient consumer.4

It was also a big week for earnings reports from some of the nation’s largest retailers. Results were disappointing as retailers struggled with supply chain issues, higher costs, and misaligned product mix. Some retailers indicated a drop in the number of transactions, suggesting that shoppers reduce purchases due to higher prices on essential items.

This Week: Key Economic Data

- Tuesday: Purchasing Managers’ Index (PMI) Composite Flash. New Home Sales.

- Wednesday: Federal Open Market Committee (FOMC) Minutes. Durable Goods Orders.

- Thursday: Gross Domestic Product (GDP). Jobless Claims.

- Friday: Consumer Sentiment.

This Week: Companies Reporting Earnings

- Monday: Zoom Video Communications (ZM).

- Tuesday: Best Buy Co., Inc. (BBY), AutoZone, Inc. (AZO), Intuit, Inc. (INTU).

- Wednesday: Nvidia Corporation (NVDA), Snowflake, Inc. (SNOW).

- Thursday: Costco Wholesale Corporation (COST), Marvell Technology, Inc. (MRVL), Workday, Inc. (WDAY), Dollar General Corporation (DG), Dell Technologies, Inc. (DELL), VMware, Inc. (VMW).

Footnotes and Sources

- The Wall Street Journal, May 20, 2022

- The Wall Street Journal, May 20, 2022

- The Wall Street Journal, May 20, 2022

- The Wall Street Journal, May 17, 2022

Paul Ellis, CIMA® may be reached at 425.405.7720 or paul.ellis@elliswealthmanagement.net.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Registered Representative, Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Cambridge and Ellis Wealth Management, LLC are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (425) 405-7720. This email service may not be monitored every day, or after normal business hours. This material distributed via the MarketingPro system.