The Washington Employment Security Department (ESD) is reporting that for June the unemployment rate in Washington is 4.9%. That sounds great, until you compare Washington’s performance with the other 49 states where it ranks 7th worst in the nation.

South Dakota, which during the pandemic did not implement any significant economic restrictions, has the lowest rate at 2%

It gets worse when you consider that compared to a year ago, Washington had an unemployment rate of 3.8% and as a percentage, has a higher rate of jobs loss over the last 24 months than every other state except Rhode Island.

While Washington has robust tech, internet retail and aerospace sectors, significant layoffs from some of the region’s largest employers have had an impact on the job market. Continued high interest rates, implemented to counter inflationary pressures, are slowing business growth as borrowing for expansion is expensive.

Highest unemployment rates for US States June 2024

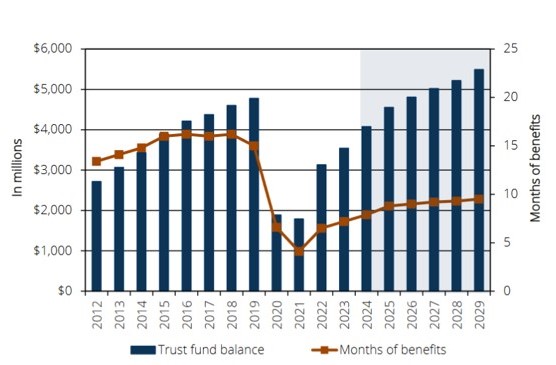

The Unemployment Trust Fund balance, which took a significant hit during the pandemic, due to government mandated shutdowns, has recovered but not to its pre-pandemic levels. ESD has increased unemployment tax rates on employers, driving up the cost of products and services, to replenish the loss of the fund balance. Over the next few years, ESD is predicting a drop in employer unemployment contributions, but reverses this trend in 2028. Unemployment benefit payouts are expected to reach $1.753MM by 2029, up from 1.576MM in 2024 with unemployment rates not changing significantly for the next 3 years.

Washington Unemployment Trust Fund Balance June 2024

Washington is particularly difficult to build and run a business due to its punitive tax structure which includes the Business and Occupation tax (B&O) on gross receipts and the recently implemented capital gains income tax on the sale of a business. Both taxes are baked into in the cost of a producing product or providing a service. This B&O tax represents 19.1% of the taxes a business pays to Washington and is calculated on gross revenue, allowing no deductions for costs. Even a business that loses money has to pay B&O tax on any revenue generated.

While most employees invest in a 401K pension for retirement, many small business owners rely on the sale of a business, built over many years, to fund the retirement years. Most business owners have mobility and will move out of state before paying an effective income tax on their retirement income.

Washington has the opportunity to supercharge the economy by reducing regulations on small businesses and enacting reforms that will encourage job growth and investment in the state.

For Washington Policy Centers recommendations, read the whitepaper that describes the simple changes that would have an immediate impact on the business climate and job growth in Washington.

By Mark Harmsworth, Director, Center for Small Business, Washington Policy Center

About Mark Harmsworth

Mark Harmsworth was elected in 2014 to the Washington State House of Representatives where he served two terms. His focus was on transportation and technology, including serving as the ranking member on the House Transportation Committee.

Prior to the legislature, Mark served two terms on the Mill Creek City Council and was elected Mayor Pro-Tem in his last year.

He recently finish serving as a Director on the Everett Community College Foundation Board and currently serves as a Director on the Boys and Girls Club of Snohomish County.

Mark works in the technology industry and is an owner of a small business after completing a long career at Microsoft and Amazon.

Mark and his family live in Mill Creek, Washington.

COMMENTARY DISCLAIMER: The views and comments expressed are those of the writer and not necessarily those of the Lynnwood Times nor any of its affiliate

Author: Lynnwood Times Contributor