There’s a school of thought that says people don’t start paying close attention to election campaigns until after Labor Day, when summer family activities are brought to an end by the start of a new academic year.

Whether that’s accurate or not, we also are approximately five weeks away from the beginning of Washington’s general-election period. So, for those who may not already be following the four voter-driven measures on the upcoming ballot, let’s start with Initiative 2117.

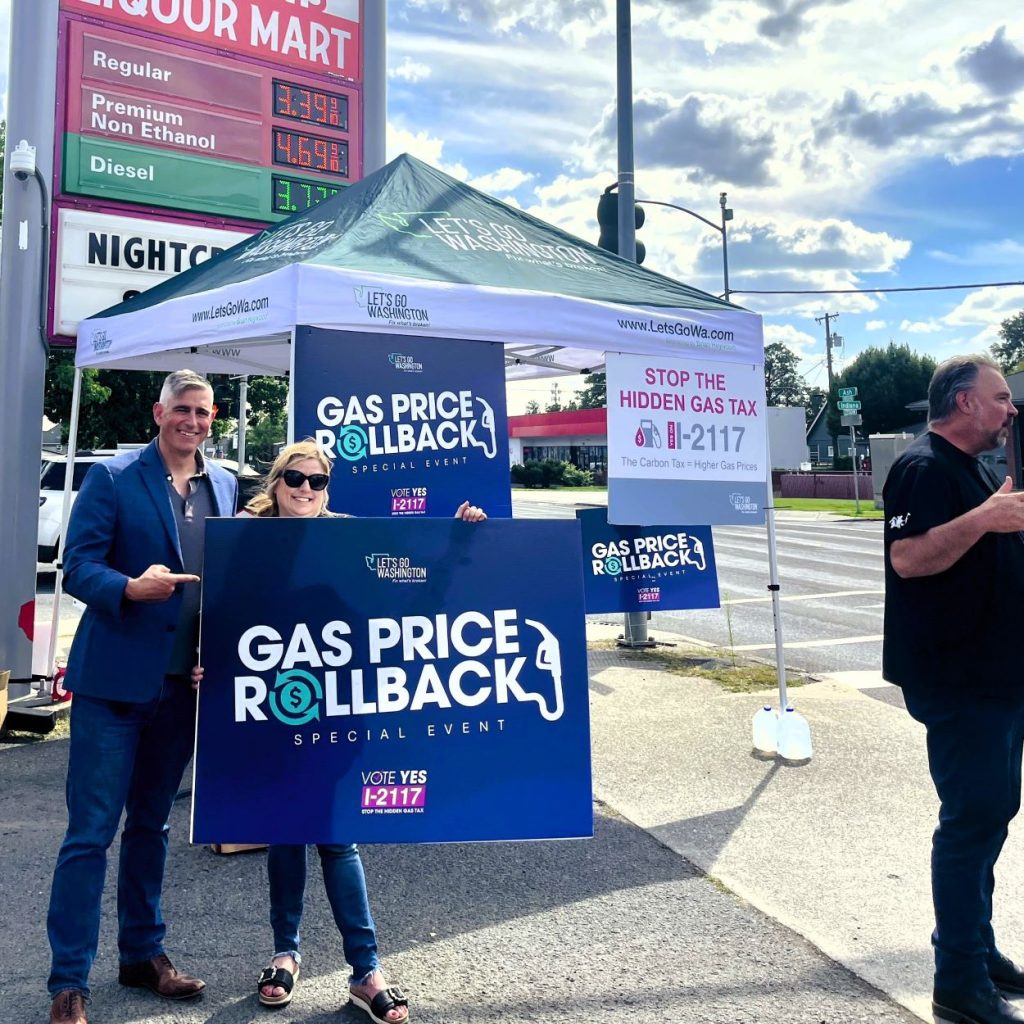

I-2117 will repeal what is formally known as the Climate Commitment Act — the CCA — which is more accurately known as Gov. Jay Inslee’s “cap-and-tax” law. Supporters of the measure correctly call it a hidden gas tax.

The cap is about carbon emissions. The tax part has to do with how the state government has driven up the price of gasoline for drivers and natural gas for cooking and heating, through its sale of carbon “allowances.”

Gov. Inslee had pushed a cap-and-tax plan for years, and finally got it in 2021. After using the pandemic to bar the people of Washington from the Capitol grounds, effectively silencing them not only on cap-and-tax but several other consequential bills, Democrats used their majority in both houses of the Legislature to push the CCA through.

Fast forward to mid-2022, when Inslee was asked how his new climate law would affect gas prices — which in turn influence the cost of everything involving an internal-combustion engine, especially freight hauling.

The governor’s now-infamous reply was that the law would cost no more than pennies, and might even lower gas prices.

As soon as 2023 arrived, and the CCA took full effect, fuel prices immediately began to rise in our state. By that summer, Washington had the highest gasoline prices in the nation. They topped even California, the other cap-and-tax state in the nation, and Hawaii, which has to have all its fuel shipped in at additional cost.

At the time, I said Inslee was either ignorant or had deliberately misled the people about the cost of his scheme. If asked today — with our state still ranking second or third for gas prices nationally — I would lean heavily toward the latter.

Also, the CCA has driven up natural gas prices, just not as transparently. Through his office, Attorney General Bob Ferguson, who wants to succeed Inslee as governor, prohibited Puget Sound Energy from disclosing to its 900,000 natural-gas customers how cap-and-tax is driving up their cost of natural gas for heating and cooking.

If the CCA is so beneficial, why not be transparent about the cost? By itself, Ferguson’s muzzling of the truth disqualifies him from becoming our state’s chief executive. But let’s get back to I-2117.

While the Climate Commitment Act functions like a gas tax, it does nothing to help pay for roads and bridges — unlike Washington’s real gas tax, which has been dedicated to “highway purposes” since voters approved a constitutional amendment 80 years ago.

Early this year, when the Legislature was still in a position to pass I-2117 instead of sending it to voters, the Democratic senator who chairs the Senate Transportation Committee tried to falsely link the CCA revenue with highway funding. That failed scare tactic needs to be remembered, in case we hear it again before Nov. 5.

Even though we now know the true costs of cap-and-tax, Washington’s largest newspaper, based in Seattle, recently recommended a “no” vote on I-2117. While I appreciate seeing our First Amendment at work, the newspaper blew it on this one.

To begin with, it will only admit Inslee was “wrong” to claim the CCA would, at worst, add pennies to the cost of gas. The truth is, Inslee was either lying or had no idea what he was talking about when predicting the impact of his cap-and-tax scheme. When lies are used to sell a policy, that alone is reason to repeal the policy.

Meanwhile, a separate column by the newspaper’s editorial cartoonist perpetuated Inslee’s two-year-old disinformation, contending the passage of I-2117 might save a “few cents” on a gallon of gas. Anyone who has been in Oregon and Idaho during the past year knows better, as gas prices in those states continue to be way more than a few cents cheaper. The only credible explanation for the difference in prices is Washington’s cap-and-tax policy.

Also, in opposing I-2117 the newspaper makes no mention of how the increased costs of gasoline and natural gas due to cap-and-tax hit lower-income people harder. The CCA’s effect on the price of a gallon of fuel, which peaked at nearly 50 cents per gallon, takes a proportionately bigger bite from someone making minimum wage than someone who makes well above that level.

Costs that hit lower-income people harder than those with higher incomes are called regressive. Sales tax is another example. A wealthy person may not even notice that 9 or 10 cents tax on each dollar spent, but a poor person does.

Democrats in our state love to complain about what they call Washington’s “upside-down” tax system when pushing for something like the capital-gains tax. Yet they knowingly and hypocritically approved a regressive policy by passing the CCA three years ago.

Republicans want clean air as much as anyone. We simply don’t believe being on the leading edge of climate policy — to quote the Seattle newspaper’s reasoning for opposing I-2117 — should fall on the backs of our lower-income neighbors, who are less able to afford the artificially high cost of energy caused by the CCA.

The auctions of carbon allowances have enriched state government by more than $2 billion in barely a year. Opponents of I-2117, like the Seattle editorial board, claim all those dollars have allowed the Democrat-controlled Legislature to create a “clean energy” budget. There are ample reasons to dispute that.

For instance, the cap-and-tax law requires that projects benefiting “overburdened communities” receive at least 35% of what the law takes in. That explains why just this past month, the state Department of Health announced more than $14 million in CCA-related grants to organizations in our state.

Recipients include Seattle-based ECOSS, which “specializes in bridging knowledge and cultural gaps through equitable community engagement and partnerships, promoting sustainable solutions that work not just for some, but for all.”

Another is For The People, also in Seattle. Its organizers “share their expertise and experience with racial justice, gender justice, climate justice, animal rights, economic justice, and environmental justice with the members of our communities.”

Perhaps someone can explain how this makes our air cleaner. Otherwise it looks more like a way to redistribute public dollars in a way that dodges the Legislature and the questions we might ask about what’s logical and appropriate, and who will actually gain from this spending.

In slamming I-2117, the Seattle newspaper’s editorial made no mention of these questionable grants, but instead criticized the Let’s Go Washington organization for not offering “another solution” to the issue of carbon reduction.

That’s a good one. Why should Let’s Go Washington offer an alternative to something that already won the support of 469,000 Washington voters through the initiative-petition process? Until I-2117 was filed, the people had no real opportunity to organize against this wrong-headed policy, which was adopted behind a cyclone fence built to keep them out.

I don’t see any “alternative solutions” from the huge multinational corporations donating big money to the campaign against I-2117, which means they want to preserve the cap-and-tax law. Like our Democratic colleagues, they seem content to support a carbon policy that unfairly falls hardest on Washington’s working people and those in poverty, forcing them to scrape even harder just to drive their cars and heat or cool their homes.

Senate Republicans passed a responsible carbon-reduction bill in 2015. Democrats in the House and Governor Inslee said no, they wanted a different approach.

The general-election period begins Oct. 18 and runs through Nov. 5. Now that the people know about the lies, pain and economic injustice associated with the cap-and-tax law, I believe a majority will vote to repeal the hidden gas tax by approving I-2117. As the supporters put it: Vote yes, pay less.

John Braun, Republican Senate Minority Leader

Senator John Braun was first elected to the Washington State Senate in 2012 to represent Southwest Washington’s 20th Legislative District, which includes most of Cowlitz and Lewis counties along with parts of Clark and Thurston.

John is leader of the Senate Republican Caucus and a member of the Senate Ways & Means Committee, the Labor & Commerce Committee, and the Housing Committee.

Prior to his business career, John served on active duty in the U.S. Navy. He holds a bachelor’s degree in electrical engineering from the University of Washington and master’s degrees in business administration and manufacturing engineering from the University of Michigan.

He and his family reside on a small farm in rural Lewis County, outside Centralia.

COMMENTARY DISCLAIMER: The views and comments expressed are those of the writer and not necessarily those of the Lynnwood Times nor any of its affiliate

Author: Lynnwood Times Contributor