There are many reasons to repeal Washington’s tax on income from capital gains by approving Initiative 2109.

One is that Washington voters, when asked about an income tax, have already said “no” 11 times. The vote folks may remember best was from 2010.That ballot measure would have taxed the top 3% of incomes in Washington. It also would have reduced property taxes, and exempted most businesses from our state’s unique business-and-occupation tax.

Even with that trade-off, the 2010 initiative was trounced at the polls. The “no” vote was more than 64%.

Voters likely realized that if they went along with any sort of income tax, it would open the door to a tax that eventually applied to everyone.

Also, the income-tax rates would be ratcheted up over time, the same way we all have seen other taxes climb — like the sales tax and gas tax.

Besides, voters had no reason to trust that any reduction in property and business taxes would be more than temporary.

Another reason is that the capital-gains income tax is not about fairness, even though the opponents of I-2109 desperately want you to believe it is. Here’s how you can tell.

The Democrats who pushed the capital-gains tax through in 2021 could have borrowed a page from the failed 2010 initiative and coupled their new income tax with meaningful tax relief in other areas.

That would have put more of the tax burden on those who are theoretically more able to afford it. But it didn’t happen. No one had their taxes lowered, even temporarily.

In the state voters’ guide, those opposing I-2109 trot out the tired old argument about Washington’s tax code being “upside down,” or regressive, meaning it is harder on lower-income residents. Again, let’s cut through to the truth.

Democrats have complained for many years Washington’s tax code is regressive — then voted for policies that are regressive.

A prime example is the massive transportation-funding package Democrats passed in 2022. It dramatically increased fees for things like driver’s licenses and license plates, which cost a low-income resident just as much as anyone else.

If the Democrats had offset their new tax on personal income with something like a reduction of the state sales tax, they would have a different argument to make when opposing I-2109.

Instead, there is no disputing that the capital-gains tax is all about generating even more money for government to spend. Tax fairness has nothing to do with it.

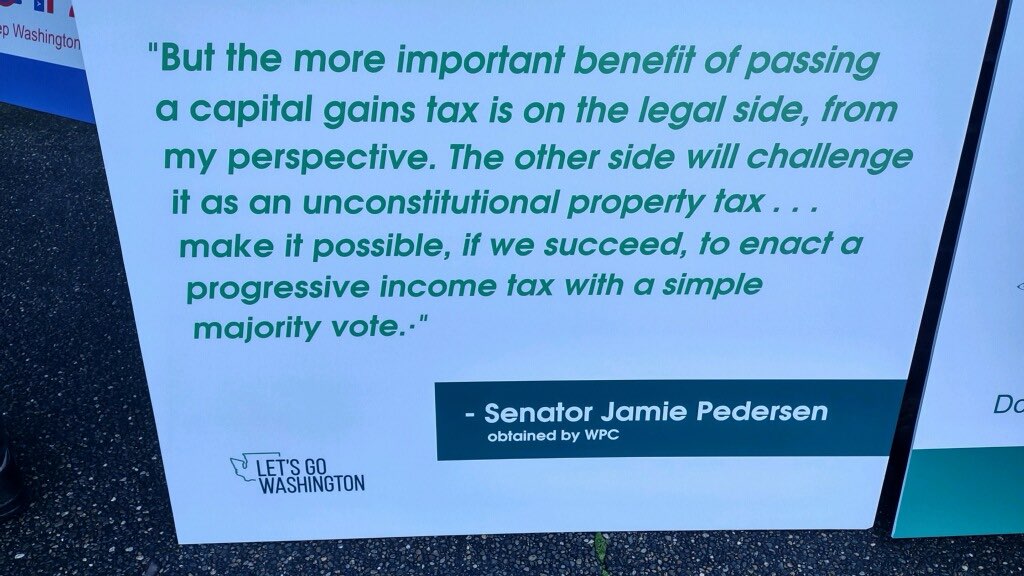

Here’s a third reason: Supporters of the capital-gains income tax want the majority of voters to think they will never be subject to the tax — that it will always be paid by someone else.

An ad opposing I-2109 declares “99.8% of us will never pay this tax.” Never? Here’s why no one should fall for that claim.

The collection of the capital-gains tax began in mid-2023, after the state Supreme Court inexplicably ruled the tax is constitutional. The first year of collections made state government about $800 million richer.

Then, this past June, the state’s chief economist reported the capital-gains collection was on track to total about half as much in its second year.

The reason, he speculated, was that taxpayers were learning “to operate in the new environment.” In other words, those targeted by the Democrats’ new tax have figured out how to shield themselves from it.

A prime example is the Democrats’ number-one tax target, Amazon founder Jeff Bezos. After nearly 30 years in Seattle, he relocated to Florida a matter of months after our state’s high court overturned a superior-court ruling against the capital-gains income tax. Bezos’ move immediately kept $600 million out of the hands of Democrats, and much, much more going forward.

When a tax fails to generate as much revenue as government expects, Democrats don’t react by reducing their spending accordingly. They look instead to either increase the tax rate, apply the tax to more people, or both. Everyone knows that.

You can bet Democrats are already looking at how to expand the capital-gains tax so it hits a larger percentage of Washingtonians — maybe by applying it to real estate or retirement assets.

They’ve already proposed legislation to increase the rate, to help pay for a move toward universal health care in our state. SB 5335 failed, but expect similar proposals if the capital-gains income tax is not repealed.

There’s one sure way to protect your assets from the capital-gains tax: do away with the tax by approving I-2109.

Still not convinced? Here are more things voters ought to know before the general-election voting period begins Oct. 18.

The first is that K-12 education and child care aren’t as dependent on the capital-gains tax as the opponents of I-2109 want voters to believe.

To amplify the argument in the state voters’ guide in support of I-2109, basic education received full funding before the collection of the capital-gains tax began — and remember, that was little more than a year ago. If the tax is repealed, full funding will continue.

I know this is true because providing for basic education is the number-one duty of state government. If K-12 is first in line for funding, as our state constitution indicates, it should not have to rely on any brand new tax for support — ever.

Also, to drive the point home, the tax on capital-gains income doesn’t fund anything that can’t be supported with other revenue.

While childcare is not a constitutional priority like K-12, the childcare sector in our state would be a whole lot better off if government stepped aside and stopped meddling.

If voters approve I-2109, Republicans will have a stronger case for getting the state out of the childcare business and focusing instead on reforming the regulations that have caused private providers to give up and shut their doors.

I’ll close with one more argument for voters to consider.

Among other things, the passage of Initiative 960 in 2008 allowed for non-binding, advisory votes on each bill passed to change Washington’s tax code.

When passing the capital-gains tax in 2021, Democrats added language to make sure it could not be challenged through a voter referendum. Therefore, the only way the people could be heard was through the advisory vote later that year — and they were definitely unhappy.

Asked whether the capital-gains tax should be repealed or maintained, a whopping 1.11 million voters chose “repeal.” That was more than 61%.

Again, their opinion was only advisory, but it was still the most recent, and 11th, vote against an income tax in our state.

More than 433,000 Washington voters signed petitions to qualify I-2109. That tells me the opposition to the capital-gains tax remains at least as strong today as the 2021 advisory vote indicated.

Washington voters are smart. They know being exempt from a tax today doesn’t mean they will remain exempt from that tax tomorrow.

They can tell when a “fairness” argument is bogus. And they know to be skeptical when told a tax will always apply to only a few.

The opposition to an income tax in our state goes back more than 90 years. I-2109 gives voters their first opportunity to repeal the income tax forced upon them three years ago.

Once the voters weigh the risks and rewards, I believe they will end this unnecessary tax and say no to the government greed that is behind both it and the plan for a universal income tax. Vote yes, pay less!

John Braun, Republican Senate Minority Leader

Senator John Braun was first elected to the Washington State Senate in 2012 to represent Southwest Washington’s 20th Legislative District, which includes most of Cowlitz and Lewis counties along with parts of Clark and Thurston.

John is leader of the Senate Republican Caucus and a member of the Senate Ways & Means Committee, the Labor & Commerce Committee, and the Housing Committee.

Prior to his business career, John served on active duty in the U.S. Navy. He holds a bachelor’s degree in electrical engineering from the University of Washington and master’s degrees in business administration and manufacturing engineering from the University of Michigan.

He and his family reside on a small farm in rural Lewis County, outside Centralia.

COMMENTARY DISCLAIMER: The views and comments expressed are those of the writer and not necessarily those of the Lynnwood Times nor any of its affiliates.

Author: Lynnwood Times Contributor