LYNNWOOD—The council voted 5-1, at its Monday business meeting, to impose a councilmanic 0.1% public safety sales tax increase without voter approval, to fund criminal justice and safety priorities—Council Vice President Derica Escamilla was the lone dissent. Starting April 1, on April Fool’s Day, Lynnwood’s combined sales tax rate will increase to 10.7%—the highest in Washington state.

“We are facing a financial cliff and there will be some difficult or tough discussions we need to have as a group to figure this out…. We continue to operate at unsustainable level right now,” said Lynnwood Police Chief Cole Langdon.

The Lynnwood Police Department currently has 23 vacancies, and for 2027, Chief Langdon shared, a financial challenge is projected.

The expected revenue, according to Finance Director Michelle Meyer for the public safety sales tax is $250,000 to $275,000 per month assuming an April 1 implementation date for 7 months of revenue received during calendar year 2026—9 months of the sales tax in place, less the 2-month delayed remittance period—totaling between $1,750,000 to $1,925,000 for FY 2026.

The City of Lynnwood is still facing a 2025-26 Budget deficit of $3.75 million even after actions (budget cuts and revenue increases) taken by the council towards the end of 2025 which included cuts in LPD through 2026. Meyer clariid with the council that a majority of a General Fund for municipal services will always be public safety related—police, fire (not applicable to Lynnwood), and courts.

Introduced by Council President Nick Coelho and supported by Councilman Robert Luetwyler in December 2025, the ordinance would impose a councilmanic—no voter approval required—0.1% sales and use tax dedicated to public safety and criminal justice purposes. If pre-conditions are approved by the Criminal Justice Training Commission (CJTC), the tax would raise Lynnwood’s sales tax rate from 10.6% to 10.7%—the highest in Washington state.

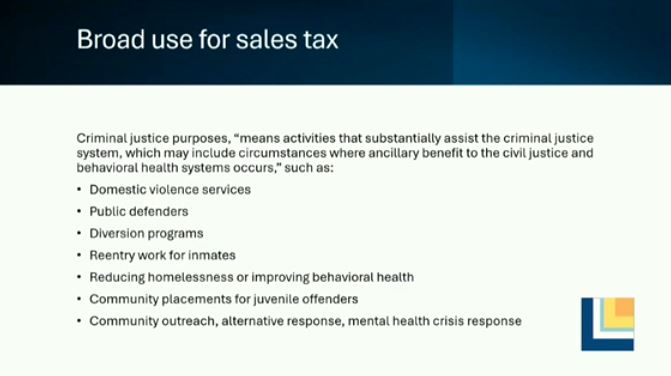

The authority stems from House Bill 2015 (RCW 82.14.345), that took effective July 27, 2025, allowing cities to impose a 0.1% public safety sales tax without a public vote only if the municipality met the same stringent eligibility requirements required for a separate $100 million state grant program administered by CJTC. Compliance with these requirements is mandatory to collect the sales tax, even if the city never applies for the grant funds.

Key eligibility requirements (showing a subset, see link above for full list) for both the public safety sales tax and grant include:

- Adoption of policies aligned with Attorney General guidance on citizenship status, duty to intervene, de-escalation, use of force, and police dogs

- Full participation in specified CJTC trainings (behavioral health, first aid, crisis intervention—at least 25% of officers—and gender-based violence—100% completion by required officers)

- Policies for court-ordered firearm relinquishment and volunteer supervision restrictions

- A CJTC-certified police chief with no disqualifying convictions

- Future compliance with statewide use-of-force data reporting

The $100 million grant program which expires June 30, 2028, is restricted to:

- Hiring and retaining new (non-lateral) officers and co-responders

- Training and certain broader public safety initiatives

- Maximum state contribution of 75% of salary + benefits, capped at $125,000 per position over three years (not annually).

The Department of Revenue (DOR) has a 75-day notification lead time to implement a new sales tax. CJTC has 45 days to review the documents and notify a city of any outstanding deficiencies. The city will then have 180 days to respond and correct any deficiencies.

Taking these timeframes into account, the earliest (best case scenario) the new sales tax of 10.7% would take effect in Lynnwood would be by April 1, 2026, as the council will now meet the DOR’s deadline of January 16, after Monday’s vote.

The motion to approve the 0.1% public safety tax was made by Council President Nick Coelho and seconded by Councilman Leutwyler.

City Council Vacancy

The Lynnwood City Council selected the following eight finalists to interview to fill the Position 6 vacancy after voters elected Councilman George Hurst as mayor in November 2025: Noel Baca, Richard Wright, Jacob “Jake” Berger, Paula Ferreira-Smith, Hannah “Han” McDonald, Quinn Marcus Van Order, Chelsea Wright, and Catherine “Cathy” Louise Baylor.

Propose Resolution in response to ICE

Freshman Lynnwood Councilwoman Isabel Mata introduced a draft resolution at Monday’s meeting in response to perceived overreaches by ICE nationally motivated by the death of Renee Good.

In her resolution, she is requesting the following:

- Declare Lynnwood’s commitment to constitutional rights, nonviolent civic engagement, and the safety/dignity of all community members. It would express deep concern over federal immigration practices that undermine public trust and civil liberties.

- The mayor to instruct the Chief of Police to train and prepare Lynnwood officers to intervene in cases of excessive force or unlawful conduct by external agencies (e.g., ICE) operating within Lynnwood.

- The mayor to direct staff to research and propose an ordinance for council consideration, focusing on law enforcement identification and accountability. This would be modeled after similar measures in other Washington cities like Seattle.

The resolution will be added to a future work session for discussion after Council members Escamilla and Leutwyler agreed with Mata to add as an agenda item.

Author: Mario Lotmore

2 Responses

Yay Lynnwood we did it!

We’re number one!!!

Wait…

Now She has been with out artwork for five months however final month her charge emerge as $12747 really on foot on the internet for some hours. study greater on this net internet site…..

checking this page…