All major indexes – Dow Jones Industrial Average, S&P 500, and the Nasdaq Composite – tumbled today, raising concerns of a looming recession following last week’s reports from the U.S. Bureau of Labor Statistics of a 40-year high 8.6% consumer inflation rate and a 3.0% decline in real earnings for the month of May. According to the Wall Street Journal, investors and traders now speculate that the Federal Reserve will raise interest rates “higher and faster than already expected.”

“The inflation reading has also boosted expectations of how high the Fed’s benchmark rate would eventually rise,” according to Matt Grossman of the Wall Street Journal. “Investors are now expecting the officials to raise rates to nearly 4% by next spring, up from last month’s expected peak around 3%.”

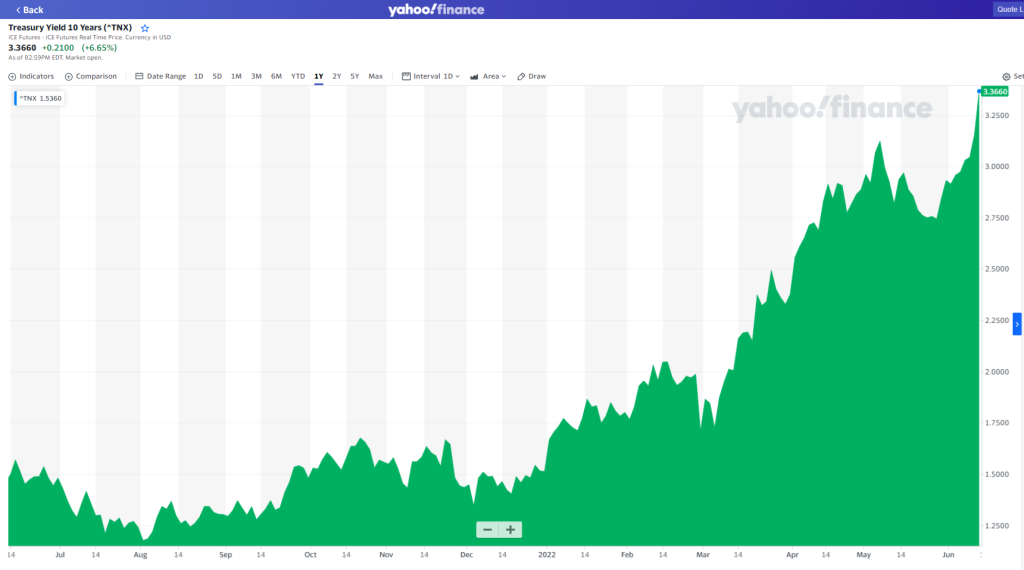

The yield on the 10-year Treasury note closed today at 3.371%, a 10-year high. The two-year Treasury note yield settled at a new 15-year high of 3.279%. Higher rates equate to higher borrowing costs for businesses impacting their profit margins and can lead to asset deflation as mortgage rates increase for borrowers.

Overall, the S&P 500 fell 151.23 points, or 3.9%, to 3,749.63, falling into a bear market for the first time in more than two years. Stocks enter a bear market when their index sink 20% from their high points.

The Nasdaq Composite fell 530.80 points, or 4.7%, to 10,809.23. The Nasdaq Composite, which is a reflection of the technology sector, has been in a bear market since March of 2022.

The Dow Jones Industrial Average, which reflects industrial and banking stocks, dropped 876.05 points, or 2.8%, to 30,516.74. While the Dow Jones Industrial Average has yet to reach a bear market, it has suffered a correction – a drop of at least 10% in the price from the most recent peak.

Typically, a bear market – a decline in the value of stocks – precedes a recession. A recession, on the other hand, is a general decline in a country’s production of goods and services, measured usually as two consecutive quarters of shrinking growth as determined by the National Bureau of Economic Research.

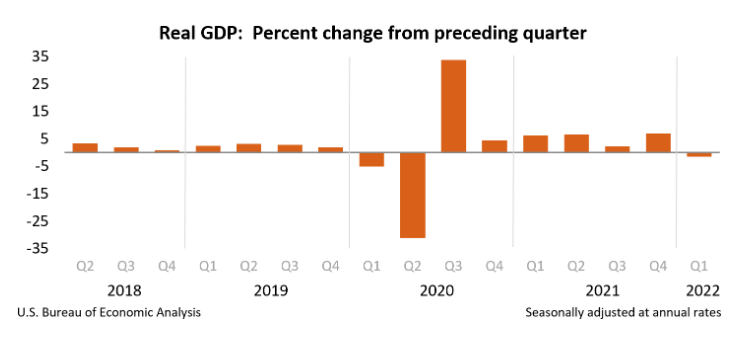

Real gross domestic product (GDP) decreased at an annual rate of 1.5% in the first quarter of 2022, according to the “second” estimate released by the Bureau of Economic Analysis. The original estimate was reported as a 1.4% decrease. In the fourth quarter of 2021, real GDP increased 6.9%. According to the Atlanta Federal Reserve, the GDP estimate for the second quarter of 2022 hovered around 2.0% for the month of May but has since declined to 0.9% as of June 8. Its estimates during the first quarter of 2022 hovered around 1.0% until the days leading up the BEA release of -1.4%.

The cryptocurrency market was not immune to today’s selloff. Bitcoin dropped 17% to below $23,000 on Monday, down 66% from its November high. Binance was forced to halt its exchange due to a backlog issue, while crypto firm BlockFi later announced it was laying off 20% of its workforce due to the challenging market environment.

May’s Consumer Inflation Index

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1% in May to a 12-month rate increase of 8.6% according to the U.S. Bureau of Labor Statistics – the largest 12-month increase since December of 1981.

Inflation on gasoline is at 48.7% compared to a year ago which is directly impacting farms, commuters, and the supply chain. Over the past year, food prices have increased 11.9% in grocery stores – the largest 12-month increase since April of 1979. Meats, poultry, fish, and eggs are up 14.2%. Dairy products are 11.8% more expensive with cereals and bake goods up 11.6%.

Real average hourly earnings for all employees decreased 0.6% from April to May, equating to an earnings decline of 3.0%, seasonally adjusted, over the last 12 months. The average hourly earnings for production and nonsupervisory employees decreased 0.5% from April to May, equating to an annual decrease of 2.5%.

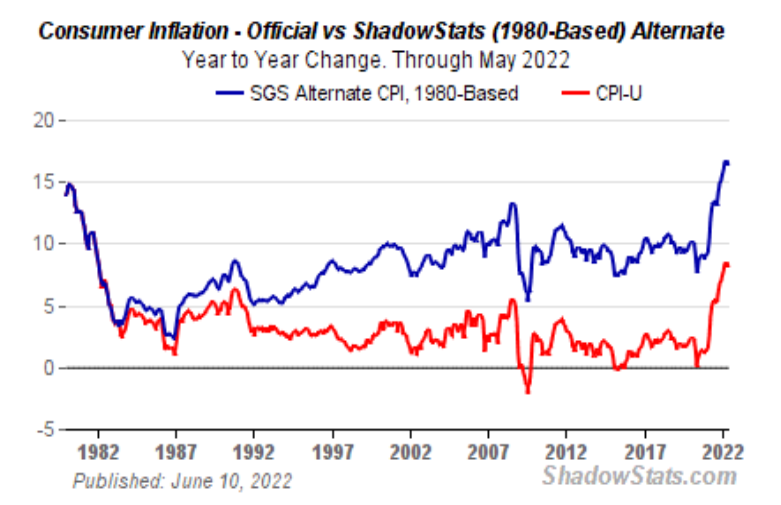

“Correct” Inflation Calculations for May 2022

The CPI-U (consumer price index) is the broadest measure of consumer price inflation for goods and services published by the Bureau of Labor Statistics (BLS). It measures the change in prices paid by consumers for goods and services. The methodologies in calculating inflation have shifted over the years – once in 1980s and the other in 1990s. These changes in calculations have depressed reported core inflation now used by BLS.

According to ShadowStats.com, actual inflation based on the 1980 calculation would be 16.80%, a new 75-year high.

In the chart below, ShadowStats.com, offers alternatives to government economic statistics for the United States, shows SGS-Alternate CPI estimates based on the methodology which was employed prior to 1980. Many economists argue that this provides an apples-to-apples comparison to core inflation currently calculated by BLS.