WASHINGTON, D.C., July 27, 2022 – The Federal Open Market Committee raised the target range for the federal funds rate by 3/4 percentage point, bringing the target range to 2-1/4 to 2-1/2 percent, Federal Reserve Chairman Jerome Powell announced today. As of June 2022, the federal fund effective rate is 1.52 percent. This is the most aggressive hike since 1994, according to CNBC.

During his press conference today, Powell shared that “another unusually large increase could be appropriate at our next meeting” but that decision will depend on the economic indicators in the upcoming weeks.

The explanation for such an aggressive rate hike according to Federal Reserve Chair Powell, is “to take the measures necessary to return inflation to our 2 percent longer-run goal.”

“From the standpoint of our Congressional mandate to promote maximum employment and price stability, the current picture is plain to see: The labor market is extremely tight, and inflation is much too high.,” said Chair Powell. “Against this backdrop, today the FOMC raised its policy interest rate by 3/4 percentage point and anticipates that ongoing increases in the target range for the federal funds rate will be appropriate. In addition, we are continuing the process of significantly reducing the size of our balance sheet, and I will have more to say about today’s monetary policy actions after briefly reviewing economic developments.”

The Federal Reserve’s monetary policy actions are guided by our mandate to promote maximum employment and stable prices for the American people. My colleagues and I are acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation.

Financial Indicators

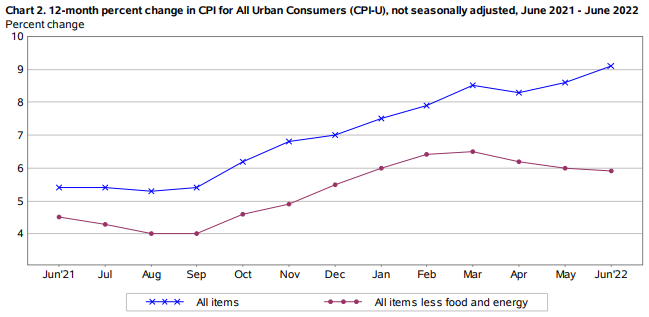

On July 13, the U.S. Bureau of Labor Statistics announced that consumer inflation rose to a 41-year high of 9.1% in June, up from 8.6% in May – the highest inflation since November of 1981. The energy index rose 41.6% over the last year, the highest since April 1980.

The index for food at home rose 1.0% in June from May, the sixth consecutive increase of at least 1.0 percent in that index. Although the overall food index increased 10.4%, the largest 12-month increase since the period ending February 1981, the food at home index rose 12.2%, the largest 12-month increase since the period ending April 1979.

Powell shared that growth in consumer spending has slowed because consumers have less disposable income and are experiencing “tighter financial conditions.” In the second quester of this year according to Powell, the housing sector and business fixed investment are both down.

However, despite the downturn in the financial indicators, Powell stressed that the labor market remains “extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated.”

U.S. Recession on the Horizon

The county braces for tomorrow’s second quarter GDP estimate from the Department of Commerce’s Bureau of Economic Analysis (BEA). First-quarter growth declined at a 1.5% annualized pace, and an updated estimate today from the Atlanta Fed puts the second quarter as -1.2%, officially putting the United States in what most economist in the world consider an official recession.

On July 27, the #GDPNow model nowcast of real GDP growth in Q22022 is -1.2%. https://t.co/T7FoDdgYos #ATLFedResearch Download our EconomyNow app or go to our website for the latest GDPNow nowcast. https://t.co/NOSwMl7Jms pic.twitter.com/oMg171agqi

— Atlanta Fed (@AtlantaFed) July 27, 2022

Author: Mario Lotmore

One Response