MUKILTEO—Mukilteo City Council approved a new replacement ambulance chassis for the Fire Department, moved their Public Hearing on Property Tax Levies, and discussed the City’s Preliminary Budget at their Regular Meeting, Monday, November 7.

2023 General Property Tax Levy and EMS Property Tax Levy

Councilwoman Elizabeth Crawford motioned to continue the Public Hearing on the 2023 General Property Tax Levy until November 21, seconded by Councilman Richard Emery.

The 1% increase equates to an average household impact of $4.94 per year per average home,

assessed at $646,300. Washington State taxing jurisdictions with a population of 10,000 or more may increase property tax collections each year by up to 1%.

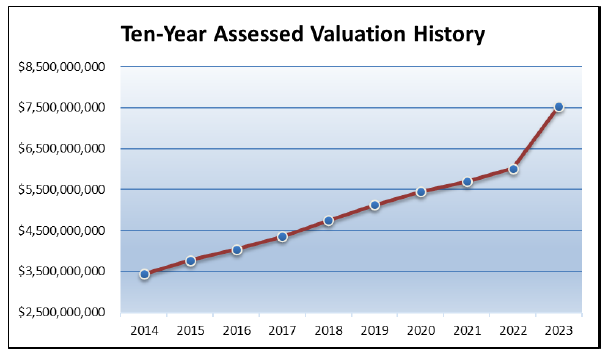

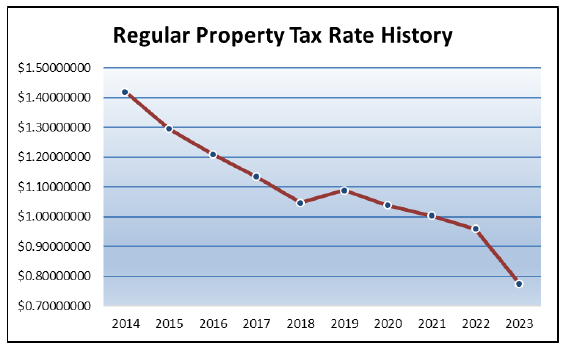

The Snohomish County Assessor’s office has estimated the assessed valuation of all taxable property within the City of Mukilteo to total $7,536,348,183 which includes $5,920,854 for new construction added during 2022. The proposed property tax levy rate per $1,000 of assessed value decreases from $.95903497 for 2022 to $0.77542143 for 2023.

The charts and tables depict the changes in the City’s assessed values for the past ten years and the property tax rate per $1,000 of assessed value for the past ten years.

The City can choose to bank the 1% capacity for possible use in a future year, which would reduce revenues into the General Fund for 2023. Alternatively, the City can choose to add previously 2 banked capacity of $55,881.48 to the 2023 levy, which would bring the 2023 levy to the maximum allowable and increase revenues into the General Fund for 2023.

“I think the optics don’t look very good if we increase taxes,” Council President Schmalz said. “I think if we can bank it, and use it later, that’s fine.”

Similarly, council decided to move the Public Hearing for a separate Property Tax Levy, an EMS Property Tax Levy, until Council’s next meeting on November 21, initiated by Councilman Emery and seconded by three other council members. The motion passed unanimously.

In 2010, voters approved the City’s Proposition 1 to “authorize the City of Mukilteo to levy additional regular property taxes at a rate of up to fifty cents per one thousand dollars of assessed valuation, for collection in 2011 and each and every year thereafter” for Emergency Medical Services (EMS).

The proposed Resolution 2022-20, Exhibit 1, establishes the Emergency Medical Services tax levy assessment for the 2023 budget. The Resolution sets the EMS levy at $2,020,259.12 (compared to $1,992,383.93 in 2022) including allowable amounts for new construction, state utility values and refunds.

Preliminary Budget Presentations

Matt Niehaus, Public Works Director for the City of Mukilteo, commenced the discussed on the 2023 Preliminary Budget in relation to the Public Works Department. Following his presentation council had the opportunity to follow up with questions before moving to continue the Public Hearing to November 21.

Mayor Marine presented the 2023 Preliminary Budget to the City Council on October 24, 2022.

The City Council discussed the information presented, asked questions of staff, and took public testimony. They also continued the public hearing to November 7th in order to provide an additional opportunity for their discussion and to take public testimony.

Council will continue the Preliminary Budget discussion at their November 14 Work Session where they will accept feedback, close the Preliminary Public Hearing on November 21 and open the final Public Hearing that same day, hold its final budget meeting on November 28, and then adopt the budget December 5 based on the feedback gathered.

To view the Preliminary Budget in its entirety click here.

Lodging Tax Grant Recommendations

Nick Nehring, Executive Assistant, then gave his first presentation to council on Lodging Tax Grant Recommendations.

The City Council may accept the Lodging Tax Advisory Committee (LTAC) recommendations in full; or make awards in the recommended amounts to all, some or none of the grants; or, lastly, change the grant dollar amounts. If that third option is chosen, it triggers a 45-day review period by the Committee before final action could be taken by the Council.

The LTAC has made the following grant recommendations:

Recommendation 1

Fund Four Ongoing Grant Awards:

- Major Event Support for the Mukilteo Lighthouse Festival Association $60,000.00

- Chamber of Commerce Tourism Center Staffing $58,000.00

- Rosehill Community Center Staffing $38,500.00

- City of Mukilteo City Staff Support for the Lighthouse Festival $33,000.00

Recommendation 2

Fund Annual Tourism Grants $33,000.00

The total 2022 Lodging Tax Grant Recommendations is $222,500.00.

The hotel/motel tax fund receives the 2% hotel/motel tax assessed on hotels/motels within the City. RCW 67.28.1816 restricts use of the tax to fund tourism promotion, acquisitions, operations and/or maintenance of tourism facilities within the City.

The Lodging Tax Advisory Committee was established by Ordinance 1189 (2008) to advise the City Council on effective use of the fund’s assets. Each year, the Committee solicits grant applications to fund tourism promotional opportunities within the City. These applications are reviewed by the Committee and their recommendations sent to the City Council.

The Lodging Tax Advisory Committee consists of Councilman Harris as chair, 2 local hoteliers and 3 members representing various local non-profits. The Committee met on October 12, 2022, to review 14 grant applications and hear presentations. All grant applicants presented their applications to the Committee, with the exception of the MukFest Pirates, who withdrew their application because they mistakenly applied for the wrong grant. After the presentations, the Committee deliberated to form their recommendations for City Council consideration.

Council President Steve Schmalz motioned to change the grant amount recommendation by the LTAC committee in the amount of $12,500, triggering the 45-day review period, seconded by Vice President Crawford. The motion passed unanimously.

Ambulance Purchase Authorization

Council President Schmalz motioned to authorize the mayor to sign one replacement ambulance chassis for the Fire Department committing $53,933 of the $395,000 purchase price, seconded by Councilman Riaz Khan. The motion passed unanimously.

This agenda item, if approved, will allow the Fire Department to commit to purchasing a chassis for an ambulance that is proposed in the 2023 budget as a new budget item.

The proposed cost of the entire ambulance is $395,000, approving this item will only be

committing $53,933 of the $395,000. Funds will be expended in 2023. This approval is requested in advance of the adoption of the 2023 Budget due to timing issues associated with purchase of the ambulance.

The Fire Department has proposed the replacement of the 2010 ambulance that has exceeded its projected 10-year service life. This ambulance has experienced multiple mechanical problems and is difficult to have serviced due to age. The ambulance proposed to be replaced no longer meets current safety standards and cannot be retrofitted at a cost to effectively meet these standards. It is currently the department’s third out unit, responding as an aid unit from Station 25 when staffing allows, as well as filling in for a primary unit when one of the department’s two primary units are down for maintenance. Tentative delivery for a completed ambulance is 18-24 months from the date a contract is signed. The ambulance will be purchased through a cooperative bid and be similar in configuration to the unit purchased in 2016 for maximum operational effectiveness.

The department began design discussions with one ambulance manufacturer. That manufacturer has advised the department that the order period for an ambulance chassis is only open for a short window of time and closes the first week of November. Waiting until October 2023 will push the delivery date for a new ambulance back an additional 12 months (April 2025 at a minimum). The department now asks for authorization to contract with a manufacturer to

commit to purchasing a 2023 F-450 chassis. Purchase will be funded from the EMS Vehicle Replacement Fund.

Author: Kienan Briscoe