MUKILTEO, Wash., January 22, 2022—Mukilteo City Council will host a Work Session at 6 p.m., Monday, January 23, to discuss a proposed EMS tax increase, parking fine increases, and digital permits. The Mukilteo City Council Work Session will be held in-person and virtually by Zoom or the City’s Facebook page.

The City will be honoring former Councilmember and longtime engaged citizen Charlie Pancerzewski at its February 6 meeting.

Business Meeting Agenda (full agenda)

2023 EMS Levy Lid Lift (AB23-008)

Councilmembers will discuss a proposed 85% increase ($1,747,915) to the City’s Emergency Medical Services (EMS) property tax levy through a “Lid Lift” vote to the voters. The “lid lift” returns the EMS levy to its previously authorized rate in 2011 of $0.50 per $1,000 of assessed property value. Because the EMS levy rate falls as property values rise, over the years, the 2023 rate has fallen to $0.26806871 per $1,000 of assessed property value.

According to the Snohomish County Property Assessor’s 2022 Annual Report, for 2022, the EMS Levy rate is $0.33155306 per $1,000 of assessed property value. The total City of Mukilteo imposed property taxes for 2022 was $1.29058802572 per $1,000 of assessed property value (Property Tax Levy of $0.95903496745 + EMS Tax Levy of $0.33155305827).

In its November 21 meeting last year, the council approved a 1% property tax increase. According to City documents, the proposed property tax levy rate per $1,000 of assessed value will decrease from $0.95903497 for 2022 to $0.77542143 for 2023. Therefore, the proposed City of Mukilteo imposed property taxes for 2023, if the EMS Levy Lift is approved by voters, would be $1.27542143 per $1,000 of assessed property value ($0.77542143 + $0.50). Technically, the net change in the City of Mukilteo imposed property tax would decrease 1.19% for 2023.

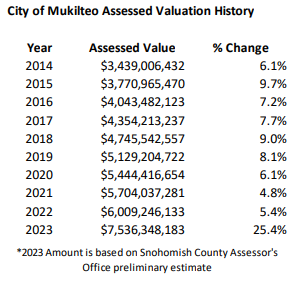

However, this reduction in the City of Mukilteo imposed property tax is slightly misleading. According to the Assessor, assessed property values for 2023 are expected to soar to 25.4% from slightly over $6 billion in 2022 to $7.54 billion in 2023.

This would equate to an overall out-of-pocket increase for a homeowner. If the Council shelves the proposed EMS Levy lift lid, the City of Mukilteo imposed property tax would be $1.04349014 per $1,000 of assessed property value instead of $1.27542143 (the do-nothing option).

In 2022, the average residential assessed value for Mukilteo was $646,300 with a 2022 City of Mukilteo imposed property tax of $834.11. Assuming a 24.5% increase in residential assessed values for 2023 (which is skewed as this percentage includes commercial properties as the residential rate is not available at the time of this article), that same home will now be assessed at $804,643 with a City of Mukilteo imposed property tax of $839.64 if there is no EMS Levy Lid Lift. With the proposed $0.50 rate to the EMS Levy, the tax burden would be $1,026.26 — a 22.2% cost burden increase to the taxpayer.

Mukilteo Mayor Joe Marine shared with the Lynnwood Times that currently $1.151 million is being transferred from the City’s General Fund to backfill the deficit for Emergency Medical Services, which in turn is depleting the General Fund. Currently, 90% of all emergency call volumes are for EMS, according to Marine.

“The fire department needs more bodies,” Marine said when asked how the revenue will be used.

Mukilteo Councilman Steve Schmalz informed the Lynnwood Times that the 2023 Adopted Budget fully funds Fire and EMS. He is concerned of the burden this would have on homeowners and if the tax is truly needed.

“According to the 2023 Budget, EMS expenditures are estimated to reduce from $4.59 million in 2022 to $4.3 million in 2023,” Schmalz said. “With record inflation and a projected ending fund balance of $6.5 million for 2023 that includes paying EMS from the General Fund, why a proposed tax increase now?”

The proposed Levy Lift would generate an estimated $1.747 million for EMS to the needed $1.151 million currently earmarked in the General Fund.

The council will discuss the need and opportunities to temporarily lift the statutory tax levy for the City to provide its emergency medical services to residents at its Monday Work Session.

2023 Fee Schedule (AB23-007)

Parking Fines Increase (AB23-012 & ORD 1471)

Digital Parking Permits (AB23-011)

Author: Mario Lotmore