A pair of new reports outline financial consequences if voters approve ballot measures this fall repealing Washington’s capital gains tax and scrapping its cap-and-trade program.

Passing the initiatives will dry up significant streams of revenue the state government is counting on for programs ranging from child care and early learning to electric vehicles and clean energy research.

But the amounts at risk with Initiative 2109 dealing with the capital gains tax, and Initiative 2117 concerning the Climate Commitment Act, differ from forecasts presented to lawmakers in February.

And, in the case of the capital gains tax, it’s billions of dollars less.

That’s according to analyses for each measure prepared by the Office of Financial Management, which is required by state law to write statements of fiscal impacts for initiatives. The statements are posted online and will appear in the voter’s guide for the Nov. 5 election.

OFM’s analysis for Initiative 2124 to make Washington’s long-term care benefit voluntary came out in early July.

Each statement is written in as plain and neutral language as possible. OFM’s examination of Initiative 2109 is just over three pages while Initiative 2117’s spans 15 pages, an indication of how interwoven it is to the state’s operating, capital and transportation budgets.

Initiative 2109

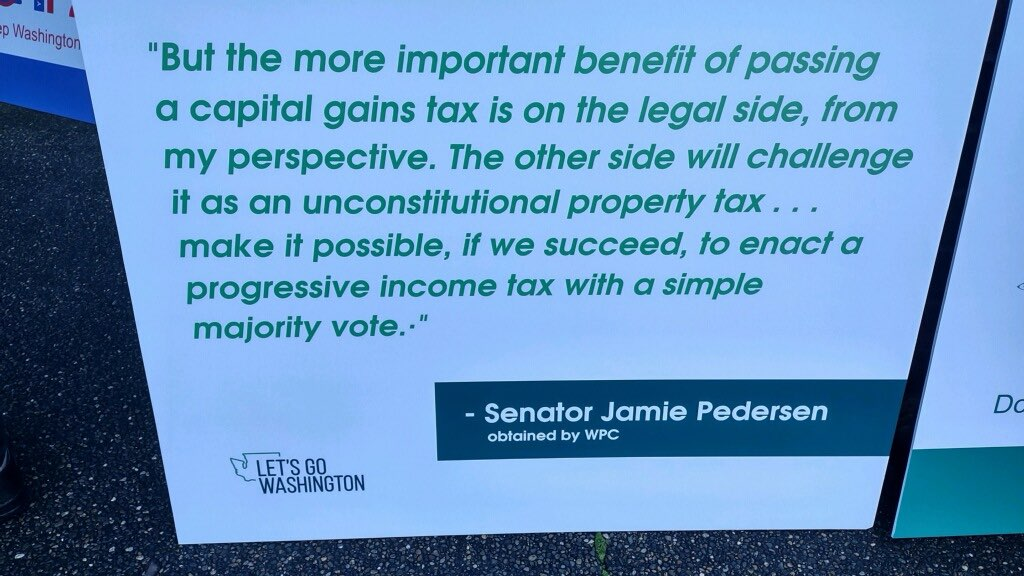

This measure takes aim at the capital gains tax,which lawmakers approved in 2021 and the state Supreme Court upheld in 2022.

It generated about $786 million in 2023, its first year of collections. As of May 15, collections in 2024 totaled $433 million. To put those numbers into perspective, the state’s current two-year operating budget is nearly $72 billion.

Each year, up to $500 million from the tax is deposited into a state account for K-12 schools, colleges, early learning and child care programs. Any tax collections beyond that amount go to an account that helps pay for school construction and renovations.

In its fiscal impact statement, OFM estimates passing the measure will result in a loss of $2.2 billion for the Education Legacy Trust Account over five fiscal years: $424 million in the current year that ends June 30, 2025 and $1.78 billion over the ensuing four years. It will net less than $500 million in each year.

It is a stark contrast from February when a fiscal note provided to lawmakers estimated a loss of $5.6 billion in the same five-year period.

Money in the Education Legacy Trust Account supports K-12 education, expands access to higher education and provides funding for early learning and child care programs, according to the report. The fiscal analysis does not cite any specific program at risk of losing revenue if the measure passes.

Initiative opponents say if the tax goes away it will worsen child care and education funding crises, and put pressure on lawmakers to make up the lost revenue with new taxes.

Backers of the measure, however, say the state collects enough revenue to pay for education and child care without a capital gains tax. And they note it’s a volatile form of revenue, prone to up and down swings, especially during recessions.

In the meantime, the fiscal impact statement projects state agencies will save an estimated $10.1 million over five years as a result of the initiative.

The Department of Revenue, which administers the tax, would save money as it winds down the program. The attorney general’s office anticipates some savings due to less litigation and less time spent advising the Department of Revenue.

Initiative 2117

OFM’s analysis for Initiative 2117 – which repeals the Climate Commitment Act and ends the auction of carbon emission allowances – is lengthy.

That’s because auctions, which began in February 2023, have generated $2.15 billion in revenue to date and lawmakers have spent some in all three of the state government’s budgets, according to the report. For example, $150 million will cover the cost of providing a $200 credit on electricity bills of hundreds of thousands of households by mid-September.

The next scheduled auction is Sept. 4 and would be the last if the initiative passes. Three remaining auctions scheduled in the current fiscal year would be canceled resulting in a projected revenue loss of $758 million through June 30, 2025.

Overall, the state would lose out on $3.8 billion in proceeds from auctions between December, when the measure would take effect, and June 30, 2029.

Initiative 2117 eliminates five accounts created under the Climate Commitment Act and directs the remaining funds to be transferred to two new accounts.

Thirty-seven state agencies have spending authority from Climate Commitment Act funds in the current biennium for programs, projects, and as grants for local governments, community groups, school districts and tribes. The initiative would eliminate the revenue source that pays for these programs.

State lawmakers prepared for this possibility in this year’s legislative session by delaying spending for certain programs until Jan. 1 when the fate of the ballot measure is known.

For each of the various accounts, the fiscal impact statement itemizes “significant activities” that would be eliminated in the current fiscal year and “future impacts” as a result of losing out on money counted on from auctions.

Examples of projects and programs that would see funding reduced or eliminated in the current budget include $42 million for construction of hybrid-electric ferries and electrification of ferry terminals; $29.9 million for public bus and transit facility projects; $5 million in grants for electric boats for federally recognized tribes, tribal enterprises and tribal members, and $1 million for transportation planning for the the 2026 World Cup matches to be played in Seattle.

Looking to the future, the state Department of Transportation would not get money it counted on to cover the cost of allowing those 18 and under to ride for free on state ferries and Amtrak. And funding penciled in for building new hybrid-electric ferries would not be realized.

Slimming or eliminating programs also means jobs will be cut. Overall, 318 full-time positions spread through more than a dozen agencies face elimination, per the report.

SOURCE: This article was authored by Jerry Cornfield of the Washington State Standard part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Images were added by the Lynnwood Times.

FEATURED IMAGE: These boxes contain signed petitions for Initiative 2109, a measure to repeal Washington state’s capital gains tax. It will be on ballots in November 2024. (Jerry Cornfield/Washington State Standard)

Author: Lynnwood Times Contributor

One Response

Good.

Get rid of the slush funds used to support friends and family.

Quit taking money from us to redistribute to others.

The hybrid ferry is plain ridiculous.