LYNNWOOD—Questions surrounding deficits, property tax increases, and senior city leadership salaries led the $156 million preliminary 2025-26 biennium general fund budget discussion presented to council members during Monday’s Public Hearing.

“So, our two-year revenue is estimated to be $152 million, our two-year expenditure is estimated to be $156 million; so, if I am reading that correctly, we are forecasting a deficit of [roughly] $4 million between revenues and our expenditures over that two-year period,” Councilman Patrick Decker said.

“We are a long way behind, and we are going to have to figure out how we make this work without driving the citizens and residents of Lynnwood into the poorhouse with taxes,” Decker replied to Finance Director Michelle Meyer, who confirmed that the biennium budget has approximately an additional $3.3 million of “requests” not factored into it yet.

If approved without additional revenues the biennium general fund budget deficit would increase to an estimated $7.3 million making an actual expenditure budget of just over $159 million, not $156 million as proposed. When comparing with approved biennium 2023-24 general fund budget of $129.8 million, the proposed budget is a 20.3% increase or 22.8% with the additional unfactored “requests.”

In addition to the unfunded “requests” of $3.3 million are additional monies for two maintenance workers for graffiti remediation and one human service coordinator—estimated at $1 million—for other funds, Meyer told the Lynnwood Times. She expects to present the final numbers to the council on October 14.

The Mayor is proposing that the current deficit be covered by the estimated $19 million end of year fund balance.

Meyer explained to the Lynnwood Times that the 2023-24 budget as proposed was balanced with General Fund revenues and expenditures equaling; however, the budget that was adopted in 2022 and then amended in 2023 reflected a lower property tax and additional expenditure levies approved by the council which created the “deficit” spending to start, subsequently reducing the fund balance.

In November of 2023, after heated debate from residents, the City Council approved a 5% increase ($225,000) to the 2024 property tax levy, down from the mayor’s proposed 22% figure, or $1 million.

In Monday’s proposed budget, the property tax is back; this time at an increase of 26.7% from its current rate of $0.45 per $1,000 to $0.57 per $1,000 of assessed property value. This would equate to an expected property tax revenue of $12.9 million over two-years or an additional tax burden on homeowners of $3.7 million (or an annual average increase of $100 per household).

Currently, the City has $6.5 million in banked capacity which exceeds the proposed $3.7 million property tax increase. Therefore, the council can approve the proposed 26.7% property tax increase without going to Lynnwood residents for a vote.

“When we start talking about levy rates, it’s immaterial. What we need to look at is what we are assessing as a budget amount for the property tax levy. So, it is a dollar figure, not a levy rate that we need to look at,” Council President George Hurst said after commenting on the higher-than-expected proposed property tax increase.

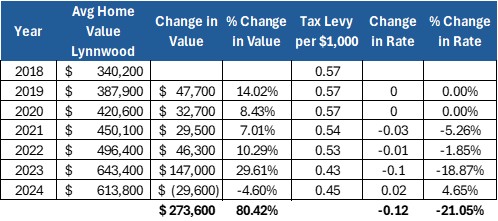

Historically, the Lynnwood property tax levy rate was $0.57 per $1,000 of assessed property value from years 2018 to 2020. The rate was lowered by 3 cents for 2021 and lowered to $0.43 for 2023, then increased to its current rate of $0.45 per $1,000 later that year to begin in 2024.

According to historical tax levy rates compiled by the Lynnwood Times from the city of Lynnwood and property values from the Snohomish County Property Assessor, since 2018, the average home value within the city limits of Lynnwood has increased 80 percent, whereas the property tax levy rate by the City has decreased 21 percent over the same period.

To understand how this impacts the average homeowner’s bottom line, consider if the rate stayed the same at $0.57 per $1,000 of assessed property value until present day. The equivalent revenue (actual dollar amount) collected by the City from the levy for a homeowner would be 80 percent more than it was in 2018. In other words, because the value of the home increased with time over the last seven years, even if the rate stayed the same at $0.57 per $1,000 of assessed property value, the total out-of-pocket expense to the taxpayer would be 80 percent more today than in 2018.

When looking at the actual figures from the City and the County, and factoring in the 21 percent reduction in the levy rate against the 80 percent increase in home valuation over the last seven years, would equate to a net increase in tax dollars paid to the City from a homeowner of just over 59 percent. The city council agreed to property tax relief due to COVID impacts from 2021 to present day for Lynnwood homeowners.

Washington state law requires cities that impose a property tax to certify their levy for the subsequent year by November 30. A Public Hearing is scheduled for November 12 and the council is scheduled to vote on the property tax levy rate on Monday, November 25, 2024., and if approved, will take effect on January 1, 2025.

The General Fund’s largest revenue source, Sales Tax at 46%, is budgeted with a growth of 5.6% for 2025 and 4% for 2026 in accordance with the Puget Sound Economic Forecaster, a report published by the Center for Economic and Business Research at Western Washington University. The anticipated growth is due to the recent opening of the Lynnwood Light Rail station and the anticipated impact on development in the area, the City says.

In a bit of irony, Lynnwood, prides itself as a welcoming city, however the city is known for its redlight cameras. In anticipation for increase vehicular traffic due to the Light rail station and surrounding developments, the proposed budget has a 66.7% increase in “Fines & Forfeitures” to $17 million from its current $10.2 million.

During public comments, former Councilmember Ted Hikel questioned the $25 million increase in operating budgets for departments.

“Executive Department (Mayor Christine Frizzell’s direct staff) is up almost a million, HR Department up half a million, IT budget up $1 million, Legal up half a million, Courts up a million…Park and Recreation a million, Police Department…$16 million,” Hikel said.

He requested that the council demand cost reduction opportunities from department heads and criticized their salaries stating it was substantially more than a typical person living in Lynnwood.

“We love the department directors, not the $200,000 a year much love,” Hikel added. “You have department directors, virtually every one of them is making over $200,000 a year, when a person who lives in this city is feeling lucky to be making $65,000 a year.”

According to records obtained by the Lynnwood Times, 14 city employees made over $160,000 in 2023, of which four clocked in at over $200,000—three at $208,769 and one at $248,244—all of whom were senior staff each with decades of experience.

Below are the supporting documents from Monday’s 2025-26 Lynnwood Budget Public Hearing:

- 9.23.24 Public Hearing PPT.pdf

- 9.9.24 Memo Preliminary Report 25-26 GF Revenue Expenditure Estimates.pdf

- 9.9.24 General Fund Departmental Detail

- 9.9.24 2025-2030 Financial Forecast.pdf

- Res 2024-02 Calendar for 2025-2026 Lynnwood Budget.pdf

Other Lynnwood City Business

- A motion brought forward by Council President Hurst for the Planning Commission to conduct a review of the current zoning limitations and restrictions pertaining to retail cannabis within city limits to amend the zoning code to allow for pot shops in Lynnwood passed with a 4-3 vote. Councilmembers Josh Binda, Nick Coelho, and Derica Escamilla joined Hurst in the affirmative with David Parshall, Vice President Julieta Altamirano-Crosby, and Patrick Decker voting against the motion.

- The council unanimously confirmed Kelly Betts to fill Planning Commission Position #6.

- The council unanimously approved the Mayor to enter into and execute on behalf of the City, property transfer documents, authorizing the transfer of parcels 11, 12, 13, and 14 from the City to the Lynnwood Public Facilities District.

- The council unanimously approved the Lynnwood Police Department’s request for the council to create a Jail Manager position that will oversee operations and compliance with state, federal and local laws and regulations. This action does not require the addition of an fulltime employee. The police department intends to repurpose the Records Manager position, converting it into the Jail Manager position

- The council unanimously approved a Memorandum of Understanding between Seattle Municipal Court and Lynnwood Municipal Court to temporarily fill the position of Assistant Court Administrator. The Municipal Court budget for 2023-2024 includes salary and benefits for a full time Assistant Court Administrator position. The Seattle Municipal Court will invoice Lynnwood Municipal Court monthly for the costs of salary and benefits.

Author: Mario Lotmore