Ballots for the November 5 General Election have already hit mailboxes throughout Snohomish County and the polls are now open for early voting in Washington. Those who have started the early voting process may have noticed a set of ballot initiatives in their Voters’ Pamphlet. The Lynnwood Times broke down the pro and con arguments for each initiative to help you understand what each side is saying.

Initiative 2066: Protecting energy choice

I-2066 concerns regulating energy services, including natural gas and electrification.

As stated on the ballot, this measure would repeal or prohibit certain laws and regulations that discourage natural gas use and/or promote electrification and require certain utilities and local governments to provide natural gas to eligible customers.

If approved, the initiative would repeal or amend certain provisions of the Decarbonization Act. According to the Attorney General’s Office, I-2066 “would prohibit PSE rate plans that restrict access to gas service and any planning requirements that render gas service cost-prohibitive. It would allow PSE to offer rebates to purchase natural gas appliances or equipment.”

A Yes Vote: Those in favor of I-2066 argue that energy consumers should have the right to choose if they want to use natural gas or not. By forcing people to use electric energy this will impact low- and fixed-income families the most, they say, because current law requires homeowners to be responsible for all conversion costs—an average of $40,000 per home—and that the mandate would also increase energy costs.

Proponents take the stance that this would increase costs to small businesses who rely on natural gas (especially restaurants) and restrict access to heating and cooking if the power goes out due to natural disaster or overloaded electricity grids.

A No Vote: Those in opposition to I-2066 also argue that the initiative would drive up energy costs, affecting low income and fixed income families, because it would require utility companies to invest in aging and outdated infrastructure. They argue that the initiative would roll back “sensible modern standards that make homes and businesses more energy efficient.”

Arguments in opposition further make the point that electric energy can remain accessible through heat waves and storms, the initiative could potentially harm current clean air and protections against air pollution and argue that the initiative is backed by fossil fuel corporations who just want to make as much money as possible.

Initiative 2109: Repeal the capital gains excise tax

I-2109, as stated on the ballot, would repeal an excise tax imposed on the sale or exchange of certain long-term capital assets by individuals who have annual capital gains of over $250,000.

A Yes Vote: Arguments in favor of I-2109 consider the state’s capital gains tax as an income tax, which Washingtonians have voted against 11 times. They also argue the initiative would ensure our public education system remains funded, and the capital gains tax will drive family-wage jobs and job creators out of Washington to pursue states with lower tax rates.

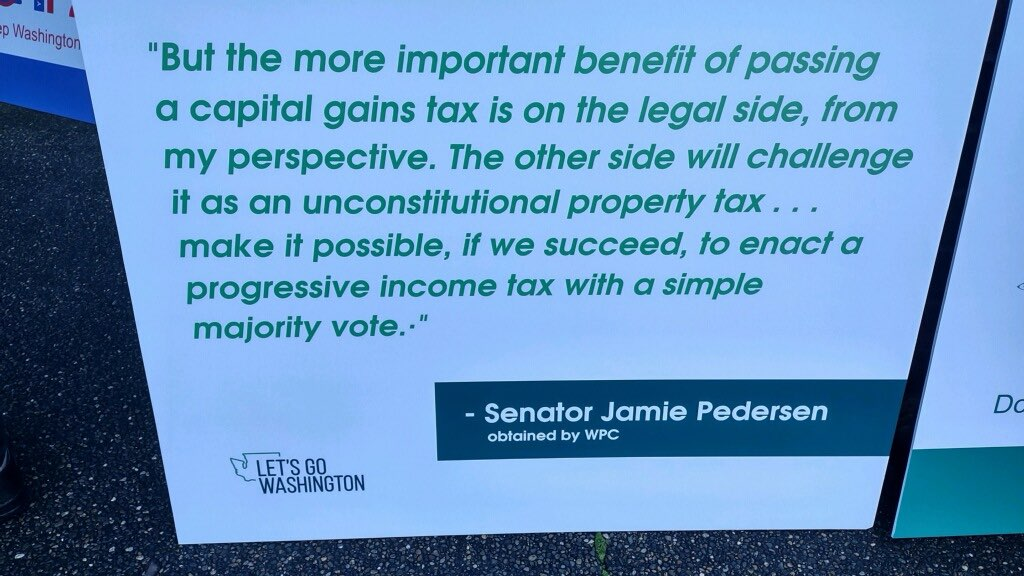

Proponents state in their argument that the IRS, every other state, and the dictionary classify capital gains as income. The state of Washington prohibits an income tax on residents. State Jamie Pedersen (D-Seattle) author of the bill allowing for a capital gains tax stated in an email to a constituent, according to proponents, “Adopting a capital gains tax is one of the best things we could do to help advance the possibility of an income tax in our state.”

In addressing education funding, proponents argue that the state has ample funding with a $3 billion surplus when the tax passed followed by $15 billion the following year.

A No Vote: Arguments against the initiative say it will eliminate billions of dedicated education dollars worsening our school funding crises, reducing access to affordable childcare and early learning, and cut investments in schools in disarray.

Those in opposition note that retirement funds, real estate, small family-owned businesses and farms are all exempt from the capital gains tax. They say that Washington has the nation’s “second most upside down tax code” with middle-class families paying a three times larger share of their income on state and local taxes than the wealthiest households.

Opponents in their voters’ pamphlet statement attacked one of the initiative’s sponsors, Brian Heywood, as a “hedge fund millionaire” who would personally benefit from the initiative while teachers, childcare providers, early learning experts, K-12 leaders, parents and small business owners would suffer the most.

Initiative 2117: Prohibit carbon tax credit trading and repeal carbon tax scheme

I-2117, as stated on the ballot, would prohibit state agencies from imposing any type of carbon tax credit trading, also known as “cap-and-invest,” and repeal provisions of the Washington Climate Commitment Act passed by the legislature on April 24, 2021, and signed into law by Governor Jay Inslee on May 17 of that same year.

In 2021, the Washington State Legislature passed the Climate Commitment Act (CCA), which creates a market-based program (called the “cap-and-invest” program) to cap and reduce greenhouse gas emissions, according to the Department of Ecology. To achieve this, the scheme puts a price on greenhouse gas emissions emitted in Washington state increasing the cost to deliver electricity, natural gas, and carbon-based fuels that is forwarded to end-users.

Using a 1990 baseline, CCA seeks to reduce state greenhouse gas emissions 45 percent by 2030, 70 percent by 2040, and 95 percent and achieve net-zero emissions by 2050.

The cap-and-invest program sets a limit on overall carbon emissions in the state. Businesses emitting more than 25,000 metric tons of greenhouse gases a year are required to obtain carbon allowances equal to their covered greenhouse gas emissions which are purchased through quarterly auctions hosted by the Department of Ecology, or bought and sold on a secondary market. This carbon offset fee is then used to invest in climate projects throughout the state and with the goal to transition Washington to a lower-carbon economy.

Affected businesses include fuel suppliers, natural gas and electric utilities, waste-to-energy facilities (starting in 2027), and railroads (starting in 2031).

Currently thirteen states have adopted carbon pricing policies: California, Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, and Washington.

A Yes Vote: Those in favor of I-2117 calls Washington’s carbon tax a “hidden tax that hurts low-income people,” resulting in state gas prices skyrocketing— nearly 40 cents per gallon. They further argue that the tax kills small businesses and good jobs while giving “billions to government bureaucrats with little left for tackling pollution and climate change.”

Proponents for the initiative argue the lack of transparency in disclosing its true costs to Washingtonians. The state that the Washington State Utilities and Transportation Commissionstate made it illegal for utility companies to tell consumers that carbon tax costs were being passed along to them adding cost to their bills.

Supporters further argue that the law prohibits the funds from the carbon tax to be used to maintain roads and bridges and state, “Don’t be fooled by dishonest scare tactics.”

A No Vote: In the opposing side, over 500 organizations and Tribes oppose I-2117 and have endorsed the No on 2117 campaign, including firefighters, small businesses, Tribal Nations, doctors, nurses, and public health leaders (even Bill Nye the Science Guy), labor unions, and environmental groups.

They argue that the initiative would be detrimental to clean air efforts, would cost Washington approximately $9.1 billion in economic output over eight years, would gut at least $216 million in fish and wildlife restoration, slash funding for Tribal-led projects and harm Tribal leadership, devastate the state’s ferry system, cut one third (or $5.4 billion) of the state’s transportation funding, threaten water quality and drinking water sources, among other things.

The No on 2117 campaign has compiled a list of projects that would be cut by the initiative in a Clean & Prosperous Institute’s Risk of Repeal map.

Initiative 2124: Opt-Out of Long-Term Services Insurance Program Initiative

I-2124 concerns making state long-term care insurance a voluntary choice.

As stated on the ballot, this measure would provide that employees and self-employed people must elect to keep coverage under RCW 50B.04 and could opt-out any time. It would also repeal a law governing an exemption for employees.

Washington lawmakers were the first in the country to implement a long-term care payroll tax for those who don’t own private long-term care insurance that caps off at a lifetime disbursement of $36,500 which adjusts for inflation.

The program is funded with a 0.58 percent payroll tax on all employee wages (or an annual average of $471.22 per worker based on 2021 salary data from Office of Financial Management) and unlike other state insurance programs, there is no cap on wages. All wages and other compensation, including stock-based compensation, bonuses, paid time off, and severance pay, are subject to the long-term care payroll tax.

The benefits of the long-term care program are portable however, out-of-state participants would need to continue contributing to the fund during their working years. Also, the WA Cares Fund only covers the taxpayer, and not a spouse nor dependent.

A Yes Vote: Arguments in favor of I-2124 state that Washington voters should have a choice whether they pay a long-term care payroll tax—a decision in which over 500,000 Washington workers have already opted out of. They argue that, for many families, the long-term care program will only cover a few months of care and those working less than 500 hours a year could be taxed and never receive benefits, and benefits cannot be transferred to spouses within married couples.

Proponents further argue that anyone with a preexisting condition can stay in the long-term care program.

A No Vote: On the opposing side, those not in favor argue that crucial benefits to protect against injuries, illnesses, disabilities or age would be cut thus taking away the state’s “only affordable and guaranteed coverage available.” Medicare and private health insurance, they argue, do not cover long-term care which 70% of the population need at some point.

Those in opposition further argue that the initiative would take away long-term care benefit payments and leave 3.9 million working people with the broken private long-term care insurance market as their only option. They argue that private insurance companies often deny claims and increase premiums for women discriminately.

Lastly, the opposing end argues that the initiative would impact those with pre-existing conditions because private insurance companies regularly reject them.

Editor’s Note: Mario Lotmore contributed to this article. Article updated 5:04 p.m., Oct 27, 2024, to correct I-2124 coverage.

Author: Kienan Briscoe

One Response

Thank you for posting your article giving explanations as well as YES and NO vote clarifications.