TUMWATER—The Let’s Go Washington citizen action group turned in 424,890 signatures on Thursday to provide Washington residents the choice to opt of the state-operated Washington Cares Fund assessment – aka Long-term Care Tax (LTC).

“The huge lies that are being told that this somehow takes away long-term care health…this is a complete and total falsehood; all this does is give people a choice,” Brian Heywood said at a press conference in front of the Secretary of State’s Office on Thursday as he delivered the signatures for Initiative 2124.

Nearly 63% of Washington voters said the long-term care payroll tax should be repealed with an Advisory Vote in 2019.

Washington lawmakers were the first in the country to implement a long-term care payroll tax for those who don’t own private long-term care insurance that caps off at a lifetime disbursement of $35,500 which adjusts for inflation. Eligible long-term care expenses include nursing care, home modifications for wheelchair ramps, home-delivered meals, and reimbursement to family caregivers.

Signed into Law by Governor Jay Inslee in 2019 and originally set to begin on January 1, 2022, the LTC payroll tax deduction was delayed 18 months by the Washington State Legislature after public outcry and was rescheduled to begin on July 1, 2023. The deadline to apply for an exemption to be taxed was December 31, 2022, and benefits become available in 2026 to those who qualify.

The program is funded with a 0.58 percent payroll tax on all employee wages (or an annual average of $471.22 per worker based on 2021 salary data from Office of Financial Management) and unlike other state insurance programs, there is no cap on wages. All wages and other compensation, including stock-based compensation, bonuses, paid time off, and severance pay, are subject to the long-term care payroll tax.

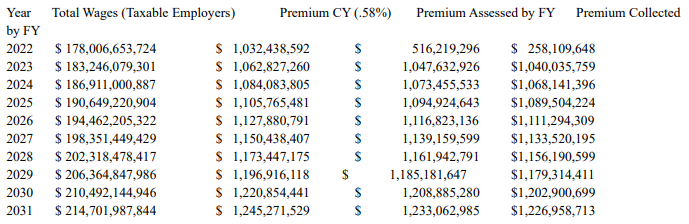

According to the fiscal report associated with the HB 1087, the bill that enacted the LTC payroll tax that was sponsored by House Speaker Laurie Jinkins, the Washington Cares Fund for the program is expected to collect at least $500 million by the end of 2023 and another $1.07 billion by the end of 2024. Below is the protected revenue schedule that is to be deposited in the long-term services and support trust account:

Critics of LTC argue that besides the funding being inadequate for Washington’s aging population with an average annual per person in-home care cost of $42,000 according to AARP and $144,000 for a private nursing home, the benefits are not portable. In other words, people who pay into the program but later move out of state will not be able to access their LTC benefits unless they reestablish another ten years of uninterrupted contributions to the program. Also, the WA Cares Fund only covers the taxpayer, and not a spouse nor dependent.

“A mega-millionaire’s self-funded campaign just filed an initiative to the Legislature (I-2124) that would in effect repeal WA Cares, a long-term care benefit for more than 3 million working Washingtonians,” Percussion Strategic released in a statement opposing Let’s Go Washington’s effort. “WA Cares is widely supported by health and services organizations like AARP Washington, MS Society, Lupus Foundation, Alzheimer’s Association, Washington Health Care Association, and other members of the We Care For WA Cares coalition.”

Percussion Strategic is currently representing several organizations opposing this and other initiatives of Let’s Go Washington.

“Millions of working Washingtonians are counting on the WA Cares Fund to help pay for their care in case of injury, illness, or age. By effectively repealing WA Cares, this initiative would force workers to choose between depleting their savings to qualify for Medicaid, or betting on long-term care insurance only the wealthiest can afford,” said Jessica Gomez, campaign manager of We Care For WA Cares.

Washington state may be the first in the nation to have passed a long-term care tax, but California, New York, Pennsylvania, and Minnesota may soon follow.

Let’s Go Washington, led by the new political powerbroker Brian Heywood, has turned in more than 434,112 signatures for I-2113 to restore authority to police officers to reasonably pursue suspicious person who have violated the law. For Initiative 2081, 454,372 signatures were turned in to the Secretary of State’s Office, that if enacted into law, will establish Washington state’s first Parental Bill of Rights. This was preceded by the submission of I-2117 with 469,011 to repeal provisions of the Washington Climate Commitment Act, also known as Cap-and-Invest, passed by the legislature in 2021.

Last week the citizen action group turned Initiative 2111, No State Income Tax with 446,372 signatures, and 433,553 signatures were collected for I-2109, Repeal the Capital Gains Tax.

Upon successfully completing the verification of 2,662,310 signatures for the six initiatives, the Secretary of State’s Office will certify the initiatives for the Legislature in its 2024 session to take one of the following actions:

- Adopt the initiative as proposed resulting in it becoming law without a vote of the people;

- Reject or refuse to act on the proposed initiative resulting in it being placed on the November 5, 2023, General Election ballot; or

- Propose a different measure dealing with the same subject where both measures will be placed on the November 5, 2023, General Election ballot.

According to the Washington State Public Disclosure Commission (PDC), Let’s Go Washington has expensed $6.933 million ($2.61 per signature submitted) of which approximately $5 million is directly linked to signature gathering and printing expenses. Heywood has loaned his Let’s Go Washington PAC $4.15 million and contributed an additional $1.7 million in both in-kind and cash contributions.

7 Responses