SNOHOMISH COUNTY, Wash., December 13, 2021 – Just weeks after the Snohomish County Council approved its $1.25 billion 2022 budget on November 9, County Executive Dave Somers along with County Council Chair Stephanie Wright and County Council Vice Chair Megan Dunn propose a county-wide 0.1% sales tax for affordable housing programs. If adopted, some Snohomish County cities would have the highest sales tax not only in Washington state but in the entire West Coast at 10.6 percent. The maximum sales tax in any California city is currently 10.5 percent; Oregon has a zero percent sales tax.

According to a county press release, if adopted on December 15, just 14 days after the initial announcement of the ordinance, this would raise approximately $116.5 million over five years (by 2026) staring April 1, 2022, for investments in 300 affordable housing units – this equates to approximately $388,333 per unit. According to realtor.com as of date of this article, the median listing home price for Snohomish County is $650,000 with a median sold home price at $655,000. However, the average assessed value for 2021 by the Snohomish County Assessor’s Office is $485,300.

The eroding buying power of the Snohomish County resident

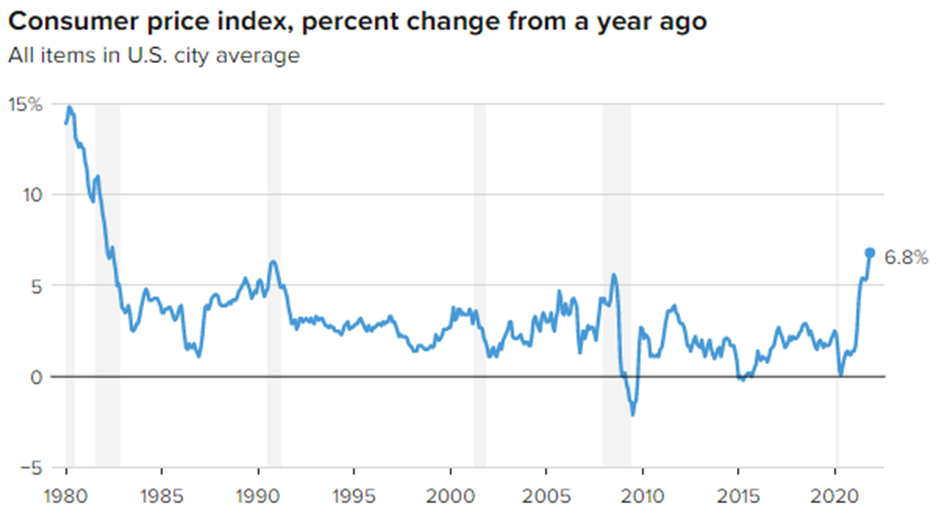

The proposed 0.1% sales tax would equate to a $72 per year per household cost to Snohomish County residents who are currently experiencing a 40-year high inflation rate of 6.8%. In last Friday’s U.S. Bureau of Labor Statistics 12-month Consumer Price Index Summary, American’s saw a 0.8 percent increase in consumer goods in November after a 0.9 percent increase the month earlier, marking it the fastest increase since June 1982.

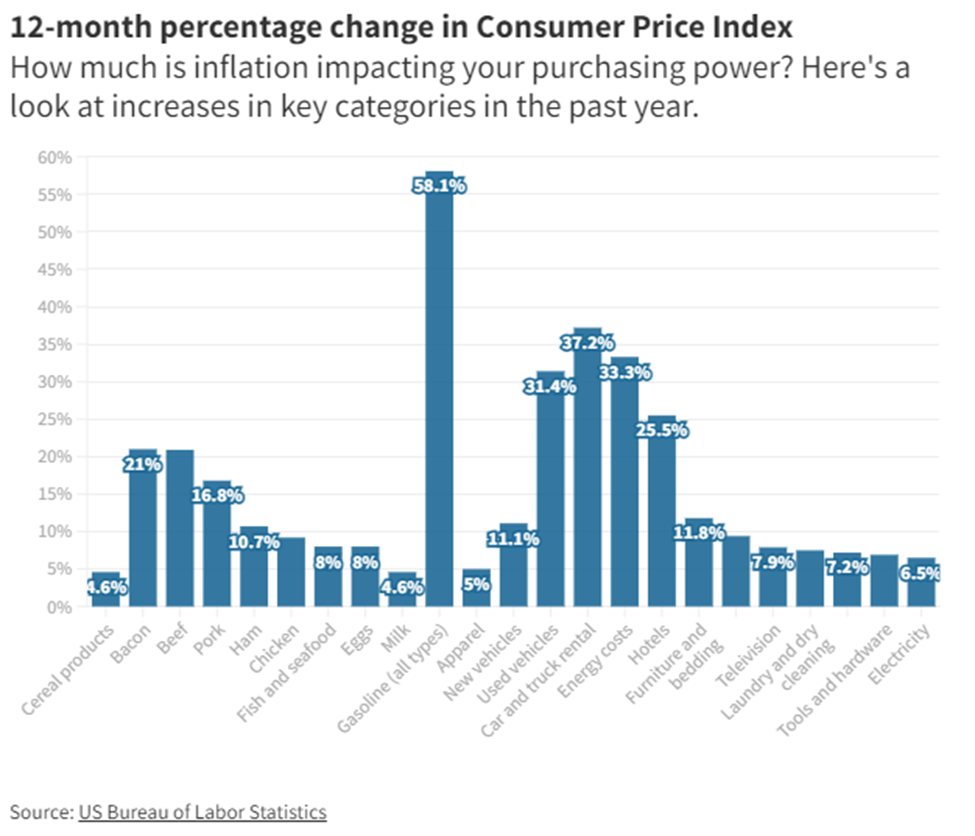

“The indexes for gasoline, shelter, food, used cars and trucks, and new vehicles were among the larger contributors,” according to the report.

“The

index for all items less food and energy rose 4.9 percent over the last 12

months, while the energy index rose 33.3 percent over the last year, and the

food index increased 6.1 percent. These changes are the largest 12-month

increases in at least 13 years in the respective series.”

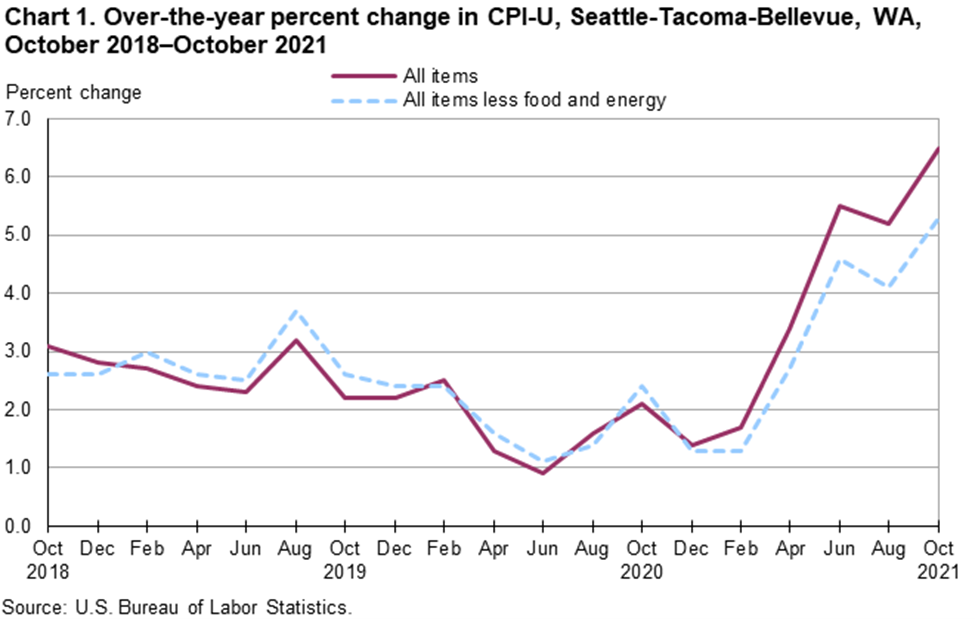

For October, the Seattle-Bellevue area over the last 12 months saw CPI-U rise by 6.5 percent. Food prices rose 7.9 percent. Energy prices rose 25.8 percent, largely the result of an increase in the price of gasoline. The index for all items less food and energy increased 5.3 percent over the year.

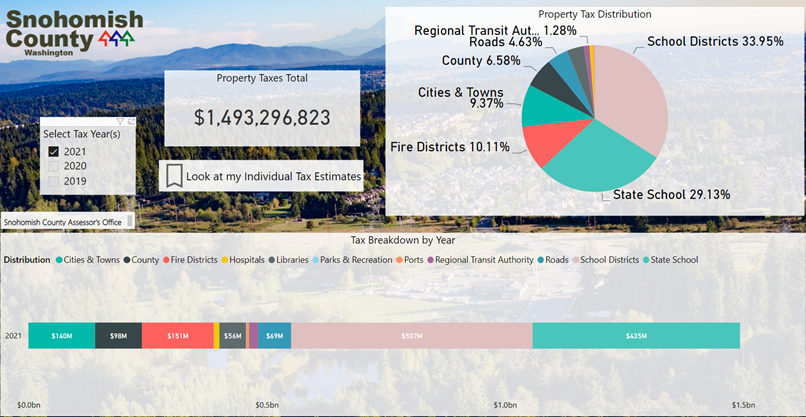

According to the property

assessment values for 2021 by the Snohomish County Assessor Office, residential

assessed values were increased 11.13% to approximately $139 billion and in 2020

the increase was 6.45 % to $125 billion – an 18.3% increase since 2019. School

Districts such as Northshore, Granite Falls, Sultan, Marysville, Lake Stevens, and

Snohomish saw the highest increase in assessed property value this year ranging

from 10.62% to 12.2%. The county is now collecting a record $1.493 billion in

property taxes for 2021.

The adopted $1.25 billion 2022 county budget, was $200 million more than the previous budget of which $143 million of the increase was attributed to federal and state revenue related to pandemic relief. In the adopted budget, was a 2.5 percent property tax increase for 2022. The rise in assessed property value with the recent 2.5 percent property tax increase for 2022 passed by the council will most likely continue to erode the purchasing power for all Snohomish County residents who are experiencing a 40-year high inflation.

New legislation usurps the voice of the people

In a press release, County Executive Somers called for “bold action” to address affordable housing.

“Too many of Snohomish County’s residents are worried about being forced onto the street because they have been on the losing end of the affordable housing crisis,” said Somers.

County Council members Wright and Dunn shared similar sentiments in the same press release.

“We have the opportunity to make significant, long-term impacts on homelessness, and to provide wholistic services that address the root causes,” said Wright. “During the pandemic, these problems increased even as federal and local dollars were used to maintain stability. It is a moral imperative that we take action, and this is another important step in protecting our residents and ensuring that we create healthy communities where all can thrive.”

“In order to address the underlying causes of homelessness, we need sufficient access to supportive housing and services to address mental health challenges and substance abuse,” said Dunn.

However, County Councilman Nate Nehring questions the need and intentions for a rushed timeline.

“Typically, proposals to increase the sales tax rate are placed on the ballot for a vote of the people” said Councilmember Nehring in a released statement on December 1. “In this case, a loophole passed by the State Legislature is being used to avoid a public vote. That isn’t right.

“There is no reason why this tax needs to be rushed through with minimal transparency,” continued Nehring. “If there are Councilmembers who think this is a good idea, they should be willing to make that case to their constituents through a robust process of public input and deliberation.”

On March 31, 2020, Governor Jay Inslee signed House Bill 1590 authorizing County legislative authorities to impose local sales and use tax for affordable housing without sending a ballot proposition to voters.

According to the bill report, “A minimum of 60 percent of revenues collected must be used for constructing affordable housing and facilities providing housing-related services, constructing mental and behavioral health-related facilities, or funding the operations and maintenance costs of newly constructed affordable housing, facilities providing housing-related services, or evaluation and treatment centers.”

The bill passed both the Senate and House by six votes. Senators Steve Hobbs (LD-44) and Keith Wagoner (LD-39), along with House Representatives Carolyn Eslick (LD-39), Robert Southerland (LD-39), and then-Representative Jared Mead (LD-44) were the only Snohomish County legislators to vote against the bill.

The Lynnwood city council sent a letter to the county council opposing the ordinance to impose a 0.1% sales tax stating this would push the city’s sales tax rate (state and local) to 10.6 percent.

“We oppose any increase in the sales tax rate in our county. We appeal to you and to our state legislature to find other forms of revenue to address the pressing issues of housing and mental health.”

The following counties and cities in Washington have already authorized 0.1% sales tax for affordable housing, including Jefferson, King, Skagit, Spokane, Whatcom Counties, and the Cities of Anacortes, Ellensburg, Olympia, Port Angeles, Poulsbo, Tacoma, Snohomish and East Wenatchee/Wenatchee.

Inflation is top concern for voters

In a recent December 7 released poll by the Wall Street Journal, 56% of those surveyed said inflation was causing them “major or minor financial strain” of which 28% said they are feeling major financial pressure. The Wall Street Journal poll interviewed 1,500 registered voters around the county between November 16 through 22. To read the full poll results, click here.

When asked if the country is going in the right direction or headed in the wrong direction, an overwhelming 63% said wrong direction. Respondents stated immigration, economy, and inflation as there top three most important issue they would like the President and Congress to address. Zero percent of those surveyed stated Affordable Housing should be a priority.

When asked if inflation, the economy, and crime would be better or worse a year from now, 52%, 46% and 47% respectively said worse. Only 23%, 30%, and 14% respectively responded that these issues would be better a year from now.

According to the Congressional Budget Office, the nearly $2 trillion Build Back Better Act will add an additional $367 billion in unfunded spending coupled with the $1.2 trillion infrastructure bill that is expected to include another $256 billion in unfunded spending. Economists state that the “burst” of Federal spending during the pandemic will most likely not reduce inflation in the upcoming months.

The Giant Elephant in the Room

Despite rising inflation, between the second quarter of 2019 to the second quarter of 2021, the median hourly wage of high-wage workers increased from $50.59 to $52.68 and the median for low-wage workers increased from $10.79 to $11.70, according to the Pew Research Center. However, this 4.13 percent increase for high-wage earners when adjusted for November’s inflation of 6.8% equates to a 2.67 percent reduction in buying power. For low-wage earners, this equates to a 1.63 percent increase in purchase power.

However, the Bureau of Labor Statistics reported last Friday that “[r]eal average hourly earnings for all employees decreased 0.4 percent from October to November, seasonally adjusted … This result stems from an increase of 0.3 percent in average hourly earnings combined with an increase of 0.8 percent in the Consumer Price Index.”

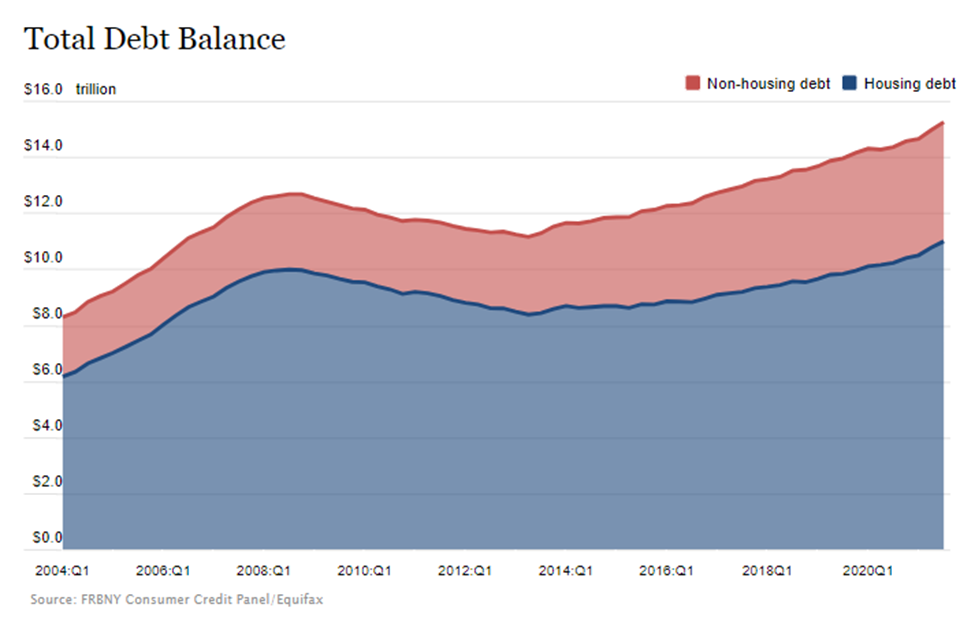

According to the Federal Reserve Bank of New York’s Center for Microeconomic Data press release, household debt climbed to a record $15.24 trillion in the third quarter of 2021. Mortgage balances rose by $230 billion, followed by auto loan balances at $28 billion, credit card balances by $17 billion, and student loan balances by $14 billion. Despite the total debt balance being $1.1 trillion more than at the end of 2019 and $2.57 trillion more than the financial collapse in 2008, delinquency rates across all debt products have remained low and continued to decline, according to the report.

In a Snohomish County seniors survey conducted by the county’s Human Services Department and published on June 15, 2021, Snohomish County is home to approximately 212,020 residents age 55 or older. A total of 3,480 respondents participated either online or returned physical survey results. Over 90 percent of the respondents were age 60 or older and 70 percent of the respondents were women. The goal of the survey was to better understand the challenges seniors face during the pandemic.

Among seniors who responded to the survey, one in four have been financially impacted by the pandemic.

One respondent wrote, “Finances are tight. Hard to afford anything other than the most necessary living expenses. Costs keep going up squeezing more money, that I don’t have. Financial assistance would help.”

Eight percent of respondents said they were struggling to meet their housing payments. Those living with a spouse/partner were 38.7% of the respondents with 38.6% living alone and another 18.9% living with their family. Only 4 percent stated they live with a roommate or have an alternative living arrangement.

About a third of the seniors stated that the pandemic has them worried about their retirement savings.

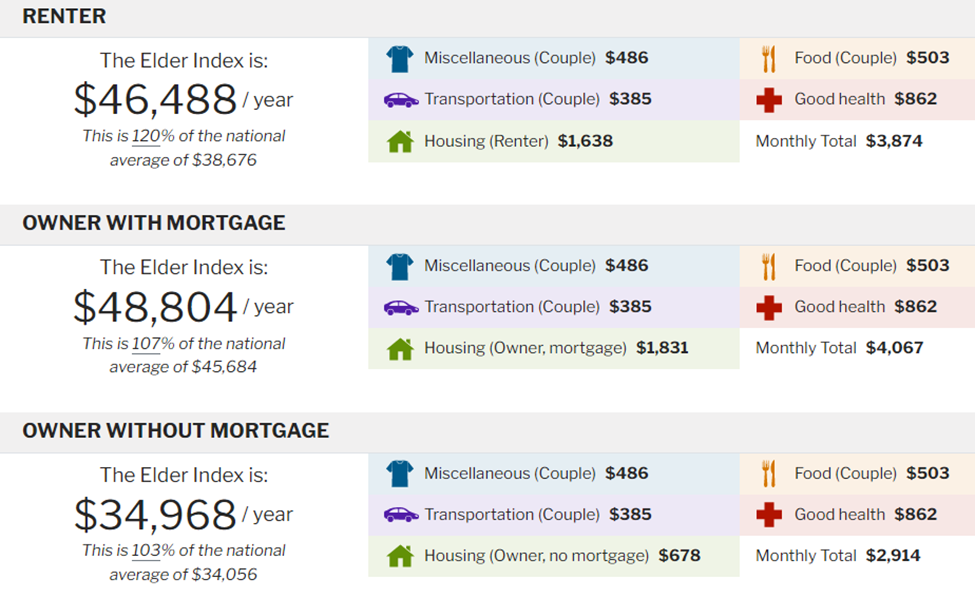

According to the Elder Index, a measure of the income required for older adults to maintain their independence in the community and meet their daily costs of living, for a couple age 65 or older and in good health, the current monthly costs are currently $153 more per month than a year ago.

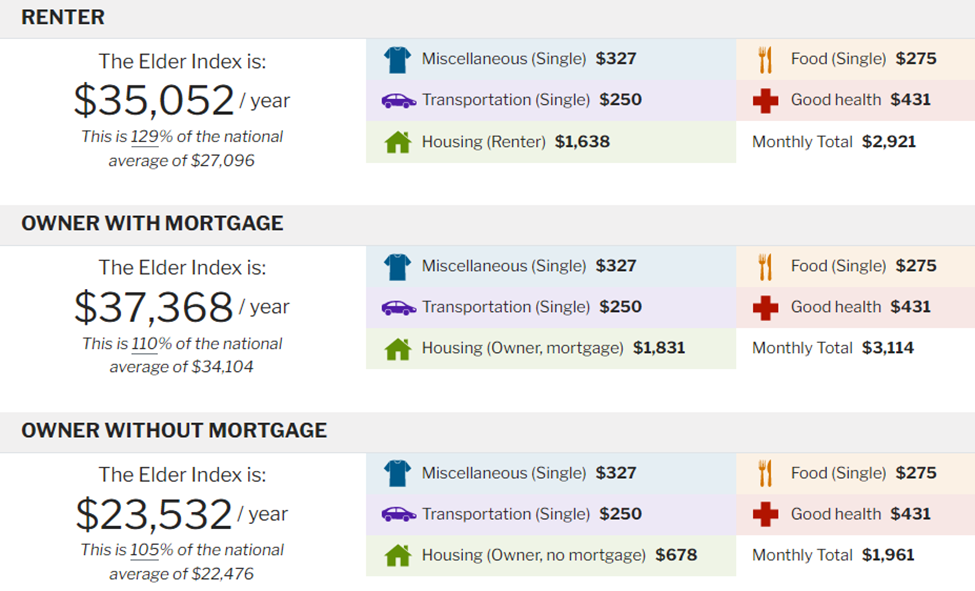

For a single person age 65 or older and in good health, the current monthly costs of living are currently $87 more per month than a year ago.

With inflation at a 40-year high, coupled with rising property taxes, an 8-cent paper bag fee, and a 7% capital gains tax that will be imposed in January 2022, those on fixed-income will undoubtedly be hit disproportionately by the well-intention 0.1% county-wide sales tax hike to address affordable housing.

A public hearing is scheduled for December 15, then the county council will vote on the ordinance immediately after the hearing.

Author: Mario Lotmore

2 Responses