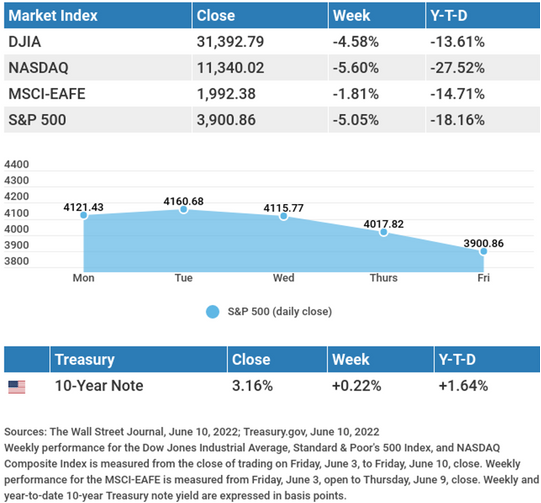

A higher-than-expected inflation report triggered a sell-off on Friday, leaving stocks in the red for the week. The Dow Jones Industrial Average lost 4.58%, while the Standard & Poor’s 500 dropped 5.05%. The Nasdaq Composite index slid 5.60% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 1.81%.1,2,3

Inflation Upends Stocks

Stocks gyrated between gains and losses last week until sliding lower on Friday’s hot inflation report, which heightened worries over a more aggressive Fed and a further economic slowdown. Stocks moved higher to begin the week, despite rising bond yields, a profit warning from a major retailer, and Senate testimony by Secretary of Treasury Janet Yellen, who said that inflation was likely to remain elevated.

Stocks turned lower later in the week on renewed concerns of an economic slowdown, sparked by a downward revision in The Federal Reserve-Atlanta’s real-time estimate of second-quarter GDP growth and a drop in new mortgage applications. Investors lightening up on stocks ahead of Friday’s inflation report may have also contributed to Thursday’s selling.

Inside Inflation

Consumer prices rose 8.6% year-over-year in May, marking the highest rate since December 1981. Price increases over the last 12 months were driven by a 34.6% jump in energy prices and by food costs, which climbed 10.1%. Used car and truck prices, which had seen three straight months of declines, rose 1.8% from April, while airfares soared 12.6% in May.4

May’s inflation exceeded economists’ forecasts and dashed the hopes that inflation had plateaued. In a separate economic report on Friday, real wages (net of inflation) fell 0.6% in April and were lower by 3% from 12 months ago.5

This Week: Key Economic Data

- Tuesday: Producer Price Index.

- Wednesday: Retail Sales. FOMC Announcement.

- Thursday: Jobless Claims. Housing Starts.

- Friday: Industrial Production. Index of Leading Economic Indicators.

This Week: Companies Reporting Earnings

- Thursday: Adobe, Inc. (ADBE), The Kroger Co. (KR).

Footnotes and Sources

- The Wall Street Journal, June 10, 2022

- The Wall Street Journal, June 10, 2022

- The Wall Street Journal, June 10, 2022

- CNBC, June 10, 2022

- CNBC, June 10, 2022

Paul Ellis, CIMA® may be reached at 425.405.7720 or paul.ellis@elliswealthmanagement.net.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Registered Representative, Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Cambridge and Ellis Wealth Management, LLC are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (425) 405-7720. This email service may not be monitored every day, or after normal business hours. This material distributed via the MarketingPro system.