WASHINGTON, D.C, August 7, 2022 – Today, Vice President Kamala Harris cast the tie-breaking vote to pass the Inflation Reduction Act (IRA) in the U.S. Senate. The U.S. House of Representatives is now expected to take up the legislation later this week before sending it to President Biden’s desk for signature. The Senate used the Budget Reconciliation Process for passage of the IRA along party lines (51-50) with no Republican support.

Despite its name Inflation Reduction Act, according to the New York Times, the Congressional Budget Office found that the legislation would have little to no impact on inflation this year.

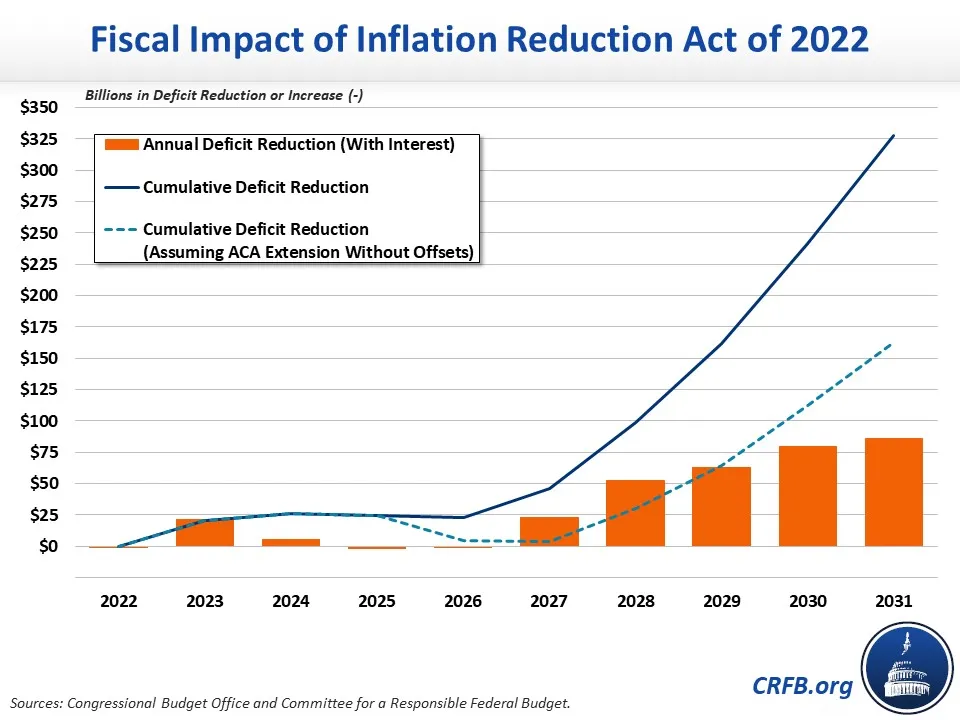

According to the Congressional Budget Office (CBO) the IRA would reduce the federal budget deficit by $305 billion over the next ten years through $790 billion in increase revenues and cost savings for the Federal Government. It would also be the largest deficit reduction bill since the Budget Control Act of 2011.

Below is a breakdown of the $790 billion in the revenue and budget saving policies adopted:

- Health Savings – $322 billion

- Repeal Trump-Era Drug Rebate Rule, $122 billion

- Drug Price Inflation Cap, $101 billion

- Negotiation of Certain Drug Prices, $99 billion

- Revenues – $468 billion

- A new 15 Percent Corporate Minimum Tax, $313 billion

- IRS Tax Enforcement Funding, $124 billion

- Closure of Carried Interest Loophole, $13 billion

- Methane Fee, Superfund Fee, Other Revenue, $18 billion

A controversial policy in the legislation is the increase funding to the IRS. According to CBO, the $80 billion increase in IRS funding (with roughly $60 billion for tax enforcement) would yield approximately $200 billion of additional revenue over a decade, or $120 billion of net savings.

The $790 billion in cost savings and increased revenue will be used to fund $485 billion in Health Care and Climate policies.

- Energy and Climate – $386 billion

- Clean Electricity Tax Credits, $161 billion

- Air Pollution, Hazardous Materials, Transportation and Infrastructure, $40 billion

- Individual Clean Energy Incentives, $37 billion

- Clean Manufacturing Tax Credits, $37 billion

- Clean Fuel and Vehicle Tax Credits, $36 billion

- Conservation, Rural Development, Forestry, $35 billion

- Building Efficiency, Electrification, Transmission, Industrial, DOE Grants and Loans, $27 billion

- Other Energy and Climate Spending, $14 billion

- Health Care – $98 billion

- Extension of Expanded ACA Subsidies (three years), $64 billion

- Part D Re-Design, LIS Subsidies, Vaccine Coverage, $34 billion

The legislation invests $386 billion over 10 years in tax credits aimed at swaying consumers to electric vehicles and incentivizing utilities toward renewable energy sources like wind or solar power.

“No one should have to worry about whether they can afford the health care or medicine they need. This bill will finally give Medicare power to force drug companies to the bargaining table and negotiate lower drug prices for patients across the country. And for seniors who are often on fixed incomes: we are going to cap the price of insulin at just $35 per month, cap out-of-pocket costs, and we are stopping big pharma from jacking up the cost of their drugs—forcing them to limit price increases to inflation,” said Senator Murray of the Inflation Reduction Act’s prescription drug provisions.

She continued, “Lifesaving medicine doesn’t do any good if people can’t afford it—and this legislation makes meaningful progress toward making sure people don’t have to empty their savings account just so they can fill their prescription.”

In a tweet released today, Congressman Rick Larsen (WA-02) calls on his fellow House members to pass the IRA this week.

Like I say: there are 19 “darkest before the dawn” moments before Congress acts. The House and the Senate burned through most of them to get the #InflationReductionAct over the last 18 months. Now it comes to the House for passage this week, hopefully with a spare dawn or two

— Rep. Rick Larsen (@RepRickLarsen) August 7, 2022

Congresswoman Suzan DelBene (WA-01) echoed a similar sentiment and praised the Senate for passing the legislation.

The Senate just passed historic legislation to help lower your prescription drug, health coverage, & energy costs.

The House will come back this week to quickly take up the Inflation Reduction Act.

— Rep. Suzan DelBene (@RepDelBene) August 7, 2022