LYNNWOOD, Wash., November 21, 2023—The Lynnwood City Council is considering a 22.23% increase on the property tax levy and held a public hearing on it during a special business meeting on November 20 before their normal business meeting.

None who spoke during public comments were in favor of the increase, most citing the rise in inflation as their primary concern. Most speakers also agreed that the city should cut costs rather than increase taxes.

“To say that we’re going to increase property tax by 22.2% is really a stunner,” Councilmember George Hurst said. “I understand that we have inflation and it impacts not only residents, but it impacts the city. Inflation impacts us. I can foresee some increase, but a 22% increase is a lot and I really have to look at this hard before agreeing to something like that.”

The first public commenter questioned whether the city was adequately utilizing the funds they take in.

“This year you lost $1.75 million because you weren’t doing safety checks on inmates and one died,” Glen Bowers said. “Now the EPA has fined you half a million dollars because our wastewater facility isn’t operating to standards. And these are fines for your mistakes, but we’re the ones that have to pay.”

During public comments, former Councilmember Ted Hikel questioned the pay that city directors and employees receive. In comparing the current budget with the previous 2021-2022 budget just two years ago, he identified $23.9 million in increases; yet the City has not identified any opportunities for cost avoidance or savings.

“The Development and Business Services up $5 million, the Executive Department (Mayor Christine Frizzell) up $1.2 million, Human Resources up $400,000, IT up $900,000, Legislative only up $200,000, Courts up a million, Parks up $4 million, Police up $10,000,000, Public Works – one of the bigger departments – only up $500,000, Fire Marshals up $700,000, Non-Department, again another million dollars,” Hikel said.

He then shared that City directors make between $168,000 to $217,000 per year, more than twice their subordinates and that of the average Lynnwood resident.

“There is something wrong with the pay when you compare it to all the people in the community who are working in other businesses — they [Lynnwood residents] don’t make that kind of money,” Hikel said. “People are wonderful, they’re great, who work for the city, but the remuneration and the added benefits they get for retirement, for health and insurance — this is way out of proportion to what the community earns as a whole. You’ve got to think about that.”

Prior to the public comments, Finance Director Michelle Meyer gave an overview, relaying much of the information The Lynnwood Times previously reported on.

Based on the 2023 average home price in Lynnwood of $643,000, the city’s portion of the property tax is roughly $280 a year. If passed, this would increase the property tax by $59 to $338 a year or “right under $5 a month to the average homeowner,” according to Meyer.

After hearing these figures, Council Vice President Julieta Altamirano-Crosby asked Meyer what the percentage increase is.

“It sounds big: it’s 22.22%,” Meyer said. “The ordinance is rounded to 22.23% so the county can round to that $5.5 million.”

This $5.5 million is the projected amount for 2024 if the levy is increased and would be a $1,000,000 increase from 2023. The general fund forecast continues this $500,000 increase every year: 2025 at $6 million and 2026 at $6.5 million for a total of $12.5 million, for example.

To meet this forecast 2024, the levy would increase from the current $0.43 per $1000 of assessed valuation to $0.53 per $1000.

After a question from Councilmember Jim Smith, Meyer stated the city saw an increase in sales tax revenue, bringing in a $3 million surplus in that area. However, according to Meyer, these funds have already been allocated.

“We only collect only a small amount from property taxes because we happen to be a large retail center, so we collect most of our revenues from sales tax, which is unique,” Meyer said. “In the mid-biennium amendment process, we are highlighting that that money is actually already spent on a few amendments that needed to happen for this biennium.”

After hearing public comments, Smith agreed with one of the speakers and suggested the city conduct internal or external audits to find areas to cut costs.

One suggestion to make up for not passing the levy made by Smith was increasing fees at the Lynnwood Recreation Center for non-city residents, as they don’t pay the property tax that benefits it.

This is the third time the proposed property tax increase has been brought before the council. Meyer also mentioned that this is not new information to the council, as it was part of the 2023-2024 budget passed in December 2022.

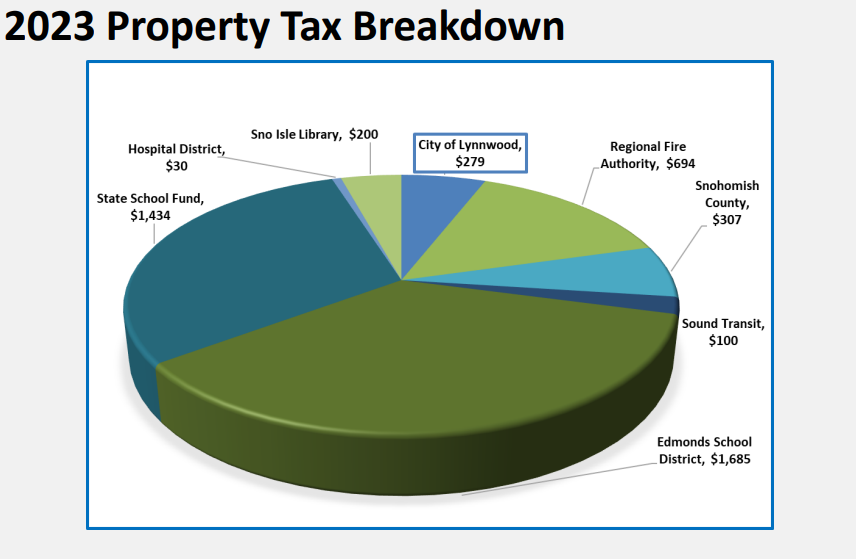

According to the tax distribution from the Snohomish County Assessor’s Office, cities and towns account for 8.92% of the property tax. The school districts and state schools have the highest percentages at 34.33% and 28.98% respectively.

This was something one public speaker commented on. The Edmonds School District is considering a proposed increase in their levy and bonds of $714 million over 4 years, so while the proposed amount for Lynnwood might be small comparatively, multiple increases in various levies would become overwhelming.

The council will take action on the proposed property tax levy next week, as the state requires the city to certify their levy with the county by the end of November.

Last year, the council did not vote on an increase to the property tax levy, something Council President Shannon Sessions pointed out.

“Everybody always forgets when we don’t do it,” Sessions said. “If we keep not doing it, we’re going to be in trouble. I don’t know how I’m going to vote on it yet, but it’s important to note that it’s lovely how everybody always forgets when we don’t do it.”

4 Responses

We need to take the extra money from the police budget and then raise taxes 50% to fund needle exchange. There aren’t enough bums getting what they need on the streets. We need to fund needle exchange and safe injection sites. I thought that is what everyone wanted in 2020?