TUMWATER—All six Let’s Go Washington initiatives have been certified to the legislature after a careful review of the nearly three million signatures garnered. This marks the first instance in state history where six initiatives to the legislature have been certified in the same year.

🚨🚨🚨 800,000 voters signed at least one of these initiatives. Calling on all hard-working Washingtonians to demand that our elected leaders live up to their duty under the state Constitution. They’ve forgotten who they work for, let’s remind them. pic.twitter.com/Pg7JYpTJVo

— Brandi Kruse (@BrandiKruse) January 29, 2024

The signatures have been verified by the Office of the Secretary of State Elections Division using a state-mandated process of examining a 3% random sample of submitted signatures.

“Many significant state laws have been adopted due to the initiative process since Washington became one of the first states to enact it in 1912,” Secretary of State Steve Hobbs said. “My office’s responsibility is to ensure it runs fairly, efficiently, and smoothly.”

The legislature has until the end of the legislative session on March 7 to approve, amend, or reject the initiatives which, if approved, would appear on the November ballots for voter consideration.

Initiative 2113 deals with “reasonable” police pursuit which would remove certain restrictions on when Police officers may engage in vehicular pursuits. Such pursuits would be allowed when the officer has reasonable suspicion a person has violated the law, pursuit is necessary to identify or apprehend the person, the person poses a threat to the safety of others, those safety risks are greater than those of the pursuit, and a supervisor authorizes the pursuit.

Initiative 2117, dealing with a so-called “hidden gas tax”, would prohibit state agencies from imposing any type of carbon tax credit trading, including “cap and trade” or “cap and tax” programs, regardless of whether the resulting increased costs are imposed on fuel recipients or fuel suppliers. This would repeal sections of the 2021 Washington Climate Commitment Act as amended, including repealing the creation and modification of a “cap and invest” program to reduce greenhouse gas emissions by specific entities.

In 2021, the Washington State Legislature passed the Climate Commitment Act (CCA), which creates a market-based program (called the “cap-and-invest” program) to cap and reduce greenhouse gas emissions, according to the Department of Ecology. To achieve this, the scheme puts a price on greenhouse gas emissions emitted in Washington state increasing the cost to deliver electricity, natural gas, and carbon-based fuels that is forwarded to end-users.

Using a 1990 baseline, CCA seeks to reduce state greenhouse gas emissions 45 percent by 2030, 70 percent by 2040, and 95 percent and achieve net-zero emissions by 2050.

Starting on January 1, 2023, businesses and organizations that emit more than 25,000 metric tons of greenhouse gases a year such as carbon dioxide, were charged a carbon offset fee which is then used to invest in climate projects throughout the state and with the goal to transition Washington to a lower-carbon economy. Affected businesses include fuel suppliers, natural gas and electric utilities, waste-to-energy facilities (starting in 2027), and railroads (starting in 2031).

The cap-and-invest program sets a limit on overall carbon emissions in the state. Businesses emitting more than 25,000 metric tons of greenhouse gases a year are required to obtain carbon allowances equal to their covered greenhouse gas emissions which are purchased through quarterly auctions hosted by the Department of Ecology, or bought and sold on a secondary market. Businesses not complying with the CCA program will be fined up to $50,000 per violation, per day by the Department of Ecology.

The state estimates approximately 75% of statewide greenhouse gas emissions will be covered under this cap-and-invest scheme. As of August, Washington state has received $1.213 billion in revenues from the three greenhouse gas allowance auctions with a fourth auction scheduled for December 6, 2023. An additional $184 million in revenue was collected on behalf of eligible electric and gas utilities to provide credits to customers for increased costs.

Currently thirteen states have adopted carbon pricing policies: California, Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, and Washington.

Historically, Washingtonians have overwhelmingly rejected carbon pricing policies—in 2016 with I-732 at 59.25%, and in 2018 with I-1631 at 56.56%. According to the Washington State Public Disclosure Commission, a total of $2.7 million was spent by committees for and against I-732; whereas in 2018, that amount jumped to $47.9 million — $16.42 million in support and $31.58 million against.

If I-1631 would have passed, and assuming emissions would remain at 2019 levels of 102 million metric tons (the latest state reported data according to KING5), from 2020 to the end of 2023, the state would have received $7.344 billion in revenues to fund various environmental projects such as clean energy infrastructure and to increase the resiliency of water and forest resources.

Initiative 2124, opting out of state-run long term care coverage act, would amend state law establishing a state long term care insurance program to provide that employees and self-employed people must elect to keep coverage under RCW 50B.04, allow employees to opt-out of coverage under RCW 50B.04 at any time, and repeal a current law governing exemptions for employees who had purchased long term care insurance before November 1, 2021.

Washington lawmakers were the first in the country to implement a long-term care payroll tax for those who don’t own private long-term care insurance that caps off at a lifetime disbursement of $35,500 which adjusts for inflation. Eligible long-term care expenses include nursing care, home modifications for wheelchair ramps, home-delivered meals, and reimbursement to family caregivers.

Initiative 2109 would repeal the Capital Gains Tax, imposed on the sale or exchange of certain long-term capital assets by individuals who have annual capital gains of over $250,000.

“Not only does the income tax on capital gains not support of the law or voters, but in their own words, it’s a foot in the door for a statewide income tax,” said Heywood. “They’re already planning to expand the tax and target more small business owners, family farms, entrepreneurs and restaurant owners. It’s time to shut the door on this for good.”

On January 16, the U.S. Supreme Court decided not to hear an appeal to overturn Washington state’s capital gains tax.

“The U.S. Supreme Court’s decision today was a huge victory for Washington kids and families. It preserved $900 million a year to support Washington’s childcare and education programs, far more than was initially projected to be collected from this tax,” Invest in Washington Now, a non-profit opposing I-2109 released in a statement. “This decision could not have come at a more critical time as school districts across the state are facing funding shortfalls.

After spending years falsely claiming that the capital gains tax is an income tax, and losing that argument again and again, they made another desperate attempt based on a dubious legal theory which forced them to admit that it’s an excise tax.”

Initiative 2111 would prohibit the state, counties, cities, and other local jurisdictions from imposing or collecting income taxes, defined as having the same meaning as “gross income” in the Internal Revenue code.

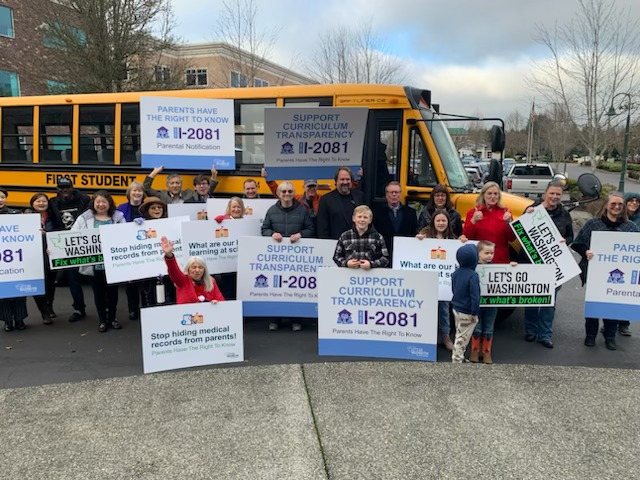

And lastly, Initiative 2081 would allow parents and guardians of public-school children to review instructional materials and inspect student records, including health and disciplinary records, upon request. It would require public schools to provide parents and guardians with certain notifications, including about medical services given and when students are taken off campus; access to calendars and certain policies, and written notice and opportunities to opt students out of comprehensive sexual health education and answering certain surveys or assignments.

“The fact that six initiatives have been introduced in a single year point to the urgency the people of Washington feel toward fixing what’s broken in our state. The people are demanding change from Olympia,” said Rep. Jim Walsh, R-Aberdeen, sponsor and author of all six initiatives.

Let’s Go Washington, a conservative group founded by Redmond businessman Brian Heywood, turned in a total of 2,662,310 signatures between late November through December 28 last year to qualify the six landmark initiatives.

At a legislative preview hosted by the Washington State Association of Broadcasters and Allied Daily Newspapers of Washington earlier in January, House Speaker Laurie Jenkins shared her disdain for Let’s Go Washington and specifically its founder, Heywood, comparing their efforts to the “Robber Barons” of the 19th century.

“I am very sadden when I think about why the initiative process was established in this state… It was really like the big railroad barons that folks didn’t want taking over this state,” Jenkins said. “Now what we have is an ultrawealthy, multi-millionaire trying to buy his way onto the ballot.”

“People are just mad…. not because they don’t like it; it’s because they are making a choice between groceries and gas,” Brian Heywood, founder of Let’s Go Washington, shared with host Brandi Kruse on her Tuesday podcast of unDivided on November 21, 2023.

According to the Washington State Public Disclosure Commission (PDC), Let’s Go Washington has expensed $6.933 million ($2.61 per signature submitted) of which approximately $5 million is directly linked to signature gathering and printing expenses. Heywood has loaned his Let’s Go Washington PAC $4.15 million and contributed an additional $1.7 million in both in-kind and cash contributions.

Author: Kienan Briscoe

5 Responses