OLYMPIA—The Senate Ways and Means Committee and the House Finance Committee held a joint public hearing to discuss a citizen initiative, I-2111, concerning personal income tax, in the John L. O’Brien building in Olympia Tuesday, February 27. The joint meeting was chaired by Representative April Berg (D-Mill Creek).

There was a total of 181 testifiers in favor of the initiative with 6,008 in favor but had not signed up to testify at Tuesday’s hearing. On the other hand, there were 24 opposed to the initiative who had signed up to testify with 649 not testifying in opposition.

Jeff Mitchell, Revenue Coordinator at the Senate Ways and Means Committee, and Tracey Taylor, staff member with House Finance, began the meeting with a brief on Initiative 2111 which relates to a prohibition on state and local taxes from imposing or collecting income taxes, defined as having the same meaning as “gross income” in the Internal Revenue code.

The Department of Revenue noted that the state of Washington does not tax an individuals’ personal income. The initiative is “perspective only,” it would not repeal any existing taxes imposed by the state or any municipality. Additionally, a fiscal note found that there would be no impact to state or local revenues.

Steve Ewing, with the Department of Revenue, explained that the initiative would not repeal or otherwise impact any existing taxes or charges it would only limit future taxes on broad-based income such as those imposed by the federal government and by other states.

The Washington State Attorney General’s Office and the Department of Revenue were the only agencies who received the fiscal note, both of whom determined there would be no expenditures related to the implementation of the initiative.

“Under our state constitution legislative authority is vested in the legislature and it has been held unconstitutional for the legislature to hand off its legislative function to other entities,” said Jeff Mitchell. “More specifically the state Supreme Court has ruled that an attempt to incorporate future changes in federal laws or regulations is an invalid delegation of legislative power…The State statute would be based on the future judgement on the federal government without state government approval.”

This definition of gross income includes, but is not limited to compensation for services, business income, gains from dealing with property interest – rents, royalties, dividends, annuities. If passed the initiative would go into effect 90 days after passing.

In July of 2019, the Court of Appeals Division 1 of Washington State invalidated a statute, RCW 36.65.030, that prohibited cities and counties from levying a tax on net income. The court ruled that the enacting legislation containing the tax prohibition violated the Single Subject rule under the state constitution. The Washington State Supreme Court did not accept review.

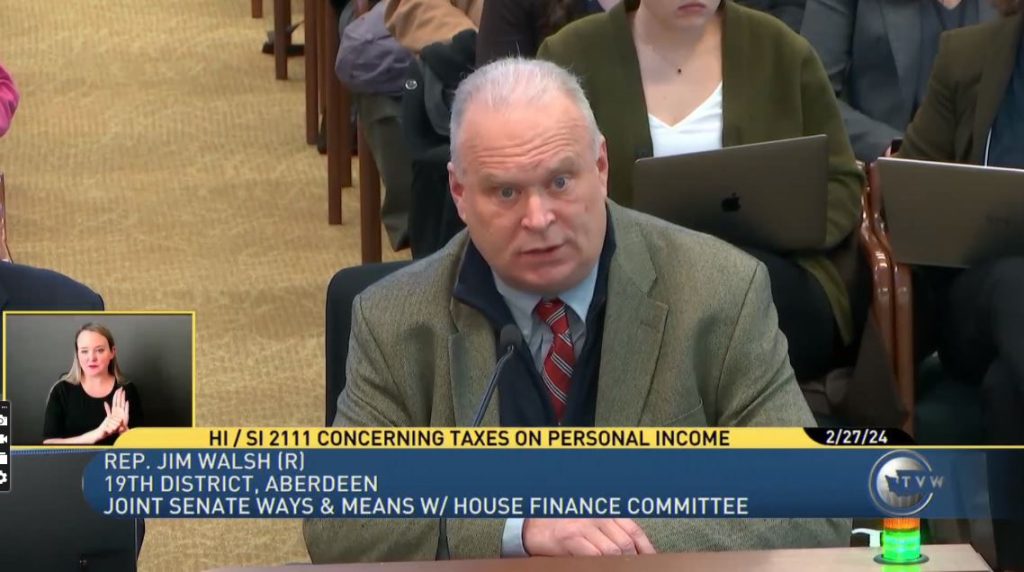

First to testify on Initiative 2111 was Representative Jim Walsh (R-Aberdeen), who filed the initiative with the Secretary of State’s Office.

“Initiative 2111 is designed to do one thing and that is to codify law, the state’s longstanding tradition of not having an income tax based on personal income,” said Rep. Walsh. “It’s been drafted narrowly so that it only applies to personal income, it does not apply to any other sort of tax and also it is designed really to support the good fiscal traditions of this state.”

Several business owners and representatives of labor groups across Washington State also testified at Tuesday’s hearing voicing their support for the initiative.

Speaking in opposition to the initiative was Marcy Bowers representing the Statewide Poverty Action Network who said they are opposing the initiative because she believes it doesn’t do anything for Washingtonians.

“Our state continues to have one of the most upside-down tax codes in the nation where those with the least pay the most,” said Bowers. “Our insufficient and upside-down revenue structure means we often lack the resources to adequately invest in strategies to lift families out of poverty while also funding our education programs to educate and grow future generations.”

In further opposition was Charles Mayer with Washington Physicians for Social Responsibility who noted that the State of Washington has the second most regressive tax code in the nation which leads to “demanding the most from those who have the least to pay”.

Many voices testifying against the initiative seemed to revolve around similar points including that the initiative would not change anything in the state’s current tax code, the state needs additional funding resources to assist in areas such as homelessness and extreme poverty, and legislative resources should be focused on assisting in the area’s the state needs most rather than considering a “vaguely worded” incident, as referred by Maggie Humphrey with Moms Rising.

Kai Smith with Pacifica Law Group echoed Humphrey’s points about the language of the initiative being “poorly written, confusing, and broad in its definition of personal income,” which he said is measure for concern.

Anthony Mixer with Washington State Young Republicans argued that with the passing of the Capital Gains Tax, which he considers an income tax, that the state’s current tax code requires better language in statue.

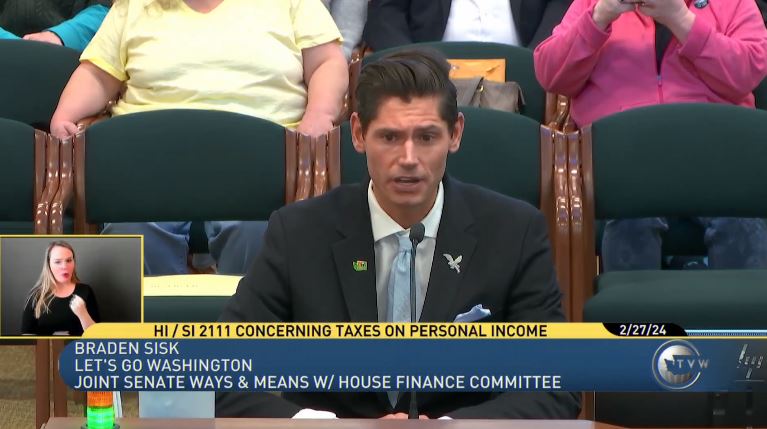

Initiative 2111 is just one of six Let’s Go Washington initiatives being considered in Olympia. It received over 450,000 signatures before being verified by the Office of the Secretary of State Elections Division using a state-mandated process of examining a 3% random sample of submitted signatures.

The State Constitution authorizes the initiative process allowing the public to place a proposition directly on the ballot or submit a law to legislation for consideration. The legislature has until the end of the legislative session on March 7 to approve, amend, or reject the initiatives which, if approved, would appear on the November ballots for voter consideration.

Braden Sisk, one of the key signature gatherers for the six Let’s Go Washington initiatives, attended Tuesday’s hearing who explained that while Washington may not have a state income tax there is no measure to prevent law makers from implementing one in the future. He continued that one of the big draws to Washington state is that it does not have an income tax in lieu of sales tax.

“Washington State does not want an income tax,” said Steve Gordon with Concerned Taxpayers of Washington State. “People don’t necessarily feel that they’re getting value for their tax dollars. Crime is up, education is down, homelessness and addiction deaths have skyrocketed while affordability for the basic family has moved out of reach…Taxpayers are waking up to the fact that the problem isn’t more money for government it’s a lack of policy.”

Below are the dates, times, and locations of the in-person public hearings to each of the landmark Washington state initiatives to the legislature which will also be broadcast live on the TVW website. Instructions to participate either remotely or in person, click on “SIGN UP TO TESTIFY” link—please note that there are separate instructions for remote versus in person testimony.

I-2081 public hearing to support parental rights in public education

- Background (Republican). No Democrat background has been posted.

- 8 to 9 a.m., Wednesday, Feb. 28

- House Hearing room A, John L. O’Brien Bldg., Capitol Campus, Olympia

- SIGN UP TO TESTIFY ON I-2081

I-2113 public hearing to restore “reasonable suspicion” standard for police pursuit

- Background (Republican). No Democrat background has been posted.

- 9 to 10 a.m., Wednesday, Feb. 28

- Senate Hearing Room 4, John A. Cherberg Bldg., Capitol Campus, Olympia

- SIGN UP TO TESTIFY ON I-2113

One Response