DETROIT—The Mayor’s Office of Detroit, nonprofits, and the city’s Fortune 500 companies have all banded together to revitalize a city that was once left in the ashes of urban decay and bankruptcy.

Detroit has made significant strides in the last decade to put it back on the map as a thriving city without using its ARPA monies to supplement operational expenditures. The drastic infrastructure transformation, with its gleaming lights, can even be viewed from space.

Moody’s Investors Service recently upgraded Detroit’s bond rating in March by two notches from Ba1 to Baa2. The city was at a junk bond rating status in just slightly over a decade ago. The credit upgrade by Moody will now allow Detroit to borrow at much lower interest rates, saving millions of dollars on capital projects and municipal services. The city now boosts robust reserves, a strong tax base and a “pipeline of development projects,” according to Detroit Free Press.

The former downtown site of J. L. Hudson Department Store—once the country’s largest department store—is redeveloping into a mixed-use shopping, hotel, and office skyscraper. Retailers, IT companies, cyber security, and health care businesses are opening up shop in Detroit. Tech companies (including Microsoft and LinkedIn) have expressed interest in opening offices in the city, and even autonomous vehicle makers are looking at Detroit real estate to potentially reignite an industry that led the city into prominence decades ago.

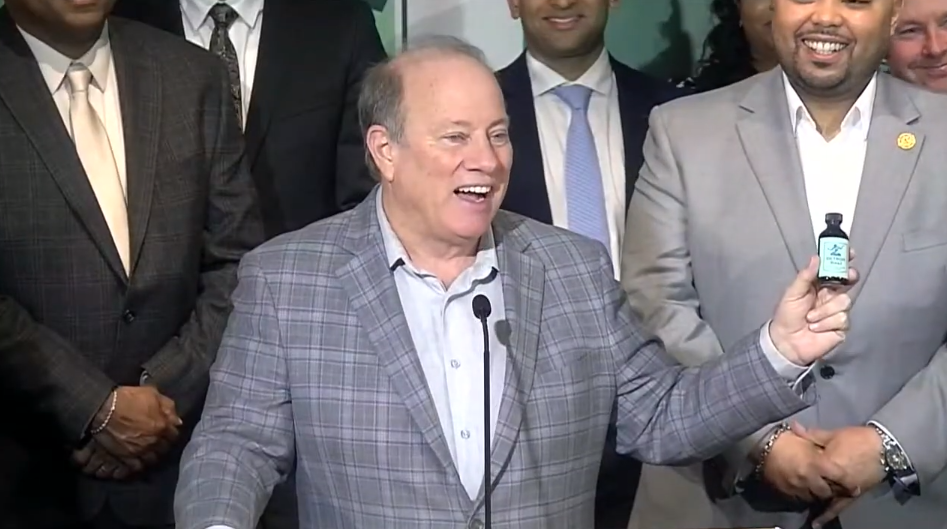

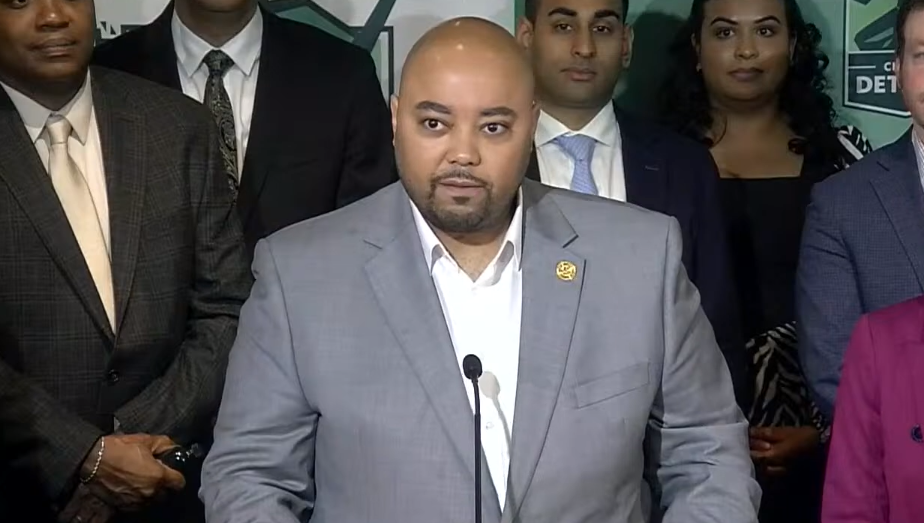

Mayor Mike Duggan credited the City’s Chief Financial Officers over the last decade and the sound budget decisions by Detroit City Council as major contributors to Detroit’s success.

“In 2014, all the analysts were predicting a financial crisis in 2023 when Detroit hit the ‘pension cliff’ and had to start making $150 million a year in payments to the pension fund,” said Mayor Duggen in a presser. “City Council’s strong support to establish a $479 million Retiree Protection Fund over the last decade was key to our current success.”

Billionaire Dan Gilbert, co-founder of Quicken Loans and owner of the NBA’s Cleveland Cavaliers, is also a main player in the Midwest city’s revitalization efforts. Gilbert has become one of the largest owners of commercial landowners in Detroit, purchasing and updating more than 60 properties downtown costing around $1.3 billion. Gilbert has moved approximately 12,000 of his employees into these buildings while convincing Chrysler, Microsoft, and Twitter to follow. Another 140 tenants are startup companies and entrepreneurs his venture firm helped finance.

Gilbert has also purchased the historic Madison Theater Building, Chase Tower, Two Detroit Center, Dime Building, the First National Building, the David Stott Building, and the former Federal Reserve Bank of Chicago Detroit Branch Building, and several other buildings on the city’s Woodward Avenue.

Other companies that have opened up shop in Detroit as of late include Levi’s, Lego, Rihanna’s Savage X Fenty, The Lip Bar, Free People, and a new downtown sports bar called Gilly’s Sports Bar.

In 2017 Politico even listed Gilbert as one of “Detroit’s Most Interesting Mayors” even though he has never served as the Mayor of Detroit but for his role in the city’s development. The actual Mayor of Detroit, Mike Duggen, appointed Gilbert to a committee that same year to lead a bid to attract Amazon to open its second North America headquarters to Detroit but Amazon removed Detroit from its list of contender cities in 2018.

Last year Gilbert attended a Detroit Free Press Breakfast Forum, one of the few public speaking events he has attended since suffering a stroke in 2019, where he spoke about the future of Detroit and where he envisions it heading in the coming years. That vision encompassed a much-needed expanded regional transit system in metro Detroit and hopes of bringing Apple to the city.

Why is Gilbert trying to save Detroit? For one, he has said he simply loves the city and wants to see it flourish again (Gilbert was born and raised in Detroit) but there’s also a financial benefit to him having relocated the headquarters of his company to Detroit in 2010.

What was once the richest city in America—home to General Motors,Ford Motor Company, and Stellantis (formerly Fiat Chrysler Automobiles)—Detroit was a leader in the automotive industry during its peak in the 1950’s,with a population rising from under 500,000 in 1910 to nearly 2 million by 1950 making it the fourth largest city in the United States at the time. But by 2009, when General Motors filed bankruptcy, the city was quick to follow suit declaring a record-breaking $18 billion Chapter 9 bankruptcy in July of 2013.

When the automotive industry began to dwindle, both General Motors and Chrysler received bailouts of $20 million but the recession was still too hard to bounce back from. Detroit’s long-term debt was estimated to be between $18 billion and $20 billion, far exceeding the United States record of Jefferson County, Alabama’s $4 billion filing back in 2011.

Although Detroit officially filed for bankruptcy in 2013, the city’s decline first began in the 1960’s when a building boom displaced residents into the suburbs, plummeting the population to just 700,000 and leaving the highest unemployment rate (over 16%) of any American city. Municipal workers were left without pensions, and an emergency manager took over mayoral duties.

Those fleeing the city were primarily White while many Blacks stayed behind who were restricted from buying houses altogether until at least 1968. By 1970, about 50% of Detroit’s population was Black and by the 1980’s Detroit became the first major city in America to have a predominately Black (63%) population.

Racial tensions stirred in the city, exacerbated by the poor living and working conditions Black Americans were forced to deal with when the automotive industry attracted a surge of workers without offering housing. The competition for available housing pushed Blacks into high density public house projects often with extremely poor conditions. The majority of those working for car manufacturers were, in fact, men (95.5%) and were also, in fact, mostly White (60.8%) according to Gitnux, a website which tracks market statistics.

Detroit became the most segregated city in America between 1950 and 1970. Its racial tensions date even further back to when Black Americans rapidly fled the South seeking refuge from Jim Crow laws and job opportunities in the, then, booming auto industry. In 1942 the city attempted to correct the poor high-density conditions that most of its Black residents were living in by building public housing complexes nearby White neighborhoods which sparked a series of riots that weren’t quelled until the U.S. Army dispatched 6,000 troops. Still, nine White residents and 25 Black Detroiters were killed during a riot in 1943 with 17 of the 25 Black Detroiters killed by police.

These racial uprisings continued in Detroit with incumbent Edward Jeffries even using it as his campaign platform, and the largest of which – the 1967 Twelfth Street Riot – prompting an investigation by President Lyndon B. Johnson concluding that “pervasive inequality and racism” were the leading causes.

These inequalities, and racial divides, directly influenced Detroit’s economy because it fostered an environment where nearly half of its residents were below the poverty line by 2011, high school education was below the National average, four-year college graduation rate was just 13%, and child poverty was close to 60%. So, when auto manufacturers left the city—due to high gas prices and the stock market crash of 2008—Detroit had a dwindling tax base and a lack of city revenues to keep it afloat.

By the time auto manufacturers left the city for more affordable suburban factories, the city was already suffering from an unstable economy with subprime lending accelerating mortgage foreclosures in the early 2000’s. To add to this, the city failed to properly assess property value during and after the housing market crash extracting more than $600 million more from property taxes from owners than constitutionally permitted. By 2011, approximately a quarter of all of Detroit’s homes were foreclosed due to unpaid property tax.

More than 24,000 abandoned homes and facilities were demolished using federal money. Thousands more were renovated and put back on the market to prevent families from moving out of the city.

Detroit exited bankruptcy in 2014 with about $7 billion of its debt restructured or wiped out. Businesses, foundations, and the state of Michigan helped soften the blow slightly with more than $800 million to assist with pensions cuts and prevented the sale of city-owned art. The city is now paying back the $470 million it owes to workers using a city created fund.