Now that the general election voting period is open, watch for opponents of the money-saving initiatives on the ballot to crank their attacks up another level.

You may have already seen ads opposing Initiative 2124, which would make our state’s long-term care payroll tax optional.

Those ads are funded largely by the labor union that labels itself as the “caregivers union” in our state.

The same union had successfully influenced the Legislature’s Democratic majority to impose the payroll tax, and the long-term care fund known as WA Cares, in the first place.

But then there are the ads that promote the WA Cares fund itself. Without mentioning I-2124, the campaign tries very hard to mislead workers into thinking their long-term care would be entirely and unconditionally covered by this wrong-headed, government-run scheme.

Unbelievably, Washington taxpayers are stuck funding this disinformation. Legislative Democrats and Gov. Jay Inslee made that decision.

It’s wrong. Unfortunately, it also is not the only example of state government using its power, and your tax dollars, in an unethical effort to influence the outcome of a ballot measure.

The most blatant attempt is Inslee’s dictate to protect his cap-and-tax scheme.

Officially known as the Climate Commitment Act, or CCA, it has enriched state government by more than $2 billion while dramatically driving the cost of gas and home heating up in our state since it took full effect in 2023.

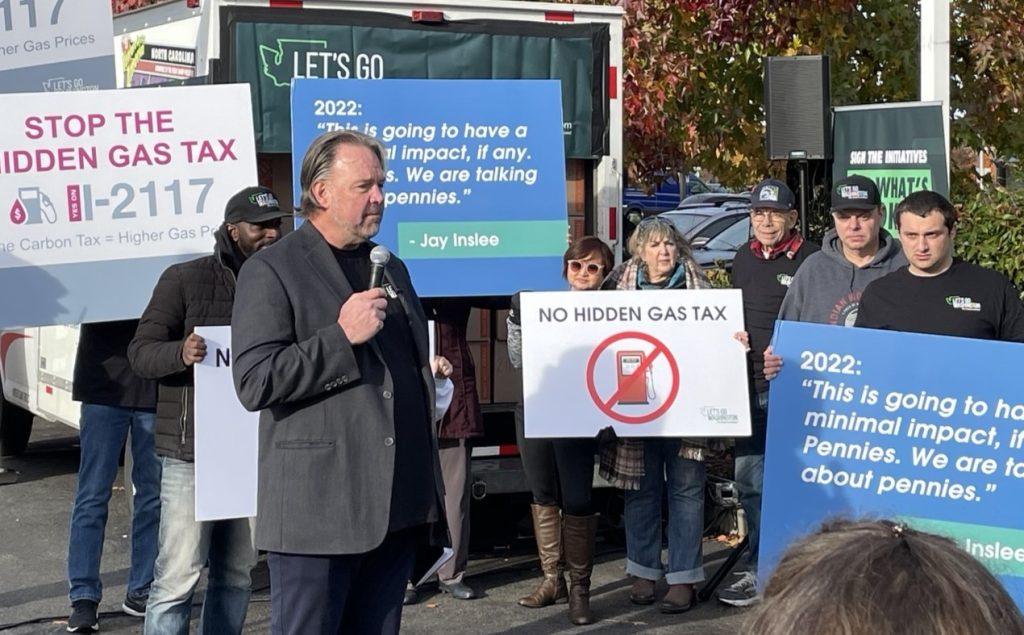

At the end of 2023, petitions containing more than 469,000 voter signatures were submitted to qualify Initiative 2117 and repeal the CCA. Within two weeks, Inslee shamelessly issued an unprecedented directive to the many state agencies under his control.

Basically, it orders any agency that receives money generated by the CCA — which critics accurately call the “hidden gas tax” — to acknowledge the CCA funding and display a special CCA logo at every opportunity. The same goes for a local agency or organization receiving a grant tied to the CCA.

There is no good way to quantify the value of the taxpayer resources that have gone toward promoting the cap-and-tax law because of Inslee’s dictate. It would be too difficult to calculate the cost of the time spent by agency staff on all the actions the governor requires.

It is indisputable, however, that the supporters of I-2117 can’t siphon taxpayer dollars to promote their point of view, the way Inslee has.

As with the WA Cares ads, the idea of the CCA “branding” is to put a happy face on an unpopular state-run policy that has yet to offer any real benefit to people but is already raising their cost of living.

Sometimes the state-manufactured PR has taken a less obvious form. The state Department of Social and Health Services recently went on a popular neighborhood-oriented social-media app to solicit viewers for an hour-long webcast titled “WA Cares Basics: What Workers Need to Know.”

You have to ask what workers “need” to know about a payroll tax that will remain mandatory unless I-2124 is passed.

The willingness of Democrats, especially Inslee, to assist political campaigns with public resources is nothing new.

Anyone who remembers his embarrassingly brief campaign for his party’s 2020 presidential nomination may also remember how Inslee bilked our state’s taxpayers for the added cost of hauling his Washington State Patrol security detail to campaign stops around the country.

The Inslee campaign lasted less than six months total. Even so, it racked up nearly $1 million in executive-protection costs for the second and third months alone.

Inslee’s campaign should have stepped in and paid for the added security. Other candidates in similar circumstances did exactly that. Instead, the governor insisted he was entitled to make taxpayers pick up the tab.

If asked, the governor would no doubt come up with a defense for making taxpayers foot the bill for the WA Cares ad campaign and his CCA “branding and funding acknowledgement” dictate. But there is no good excuse, and here’s why.

Washington workers also pay for two other state programs through mandatory payroll deductions. One is unemployment insurance (UI), the other is industrial insurance — better known as workers’ compensation.

You won’t find any ads on television or online praising UI or workers’ comp.

WA Cares should be no different, yet the state Department of Social and Health Services went ahead and tapped taxpayers for the multimillion-dollar cost of what it calls a “large-scale marketing and outreach campaign to inform the public about the purpose of the WA Cares Fund program and how it meets their needs.”

Similarly, every year legislators adopt or update a capital budget to support a wide range of state-agency and community projects.

Even so, recipients of capital-budget dollars aren’t required to acknowledge the source of the funding, or post specific signage, or use a certain logo when communicating about the funding.

The same is true about the funding in the transportation budgets we adopt or update yearly.

In that light, there is zero justification for forcing recipients of Climate Commitment Act money into becoming CCA cheerleaders — except Inslee wants it that way.

The governor knows how unpopular the CCA has become, especially since he knowingly made the false claim that it would only add “pennies” to the cost of gasoline.

The initial bump was close to 50 cents per gallon. It’s fallen some since, but gas continues to average more than $4 per gallon across the board in our state. That’s still higher than our neighboring states, and remains third-highest in the nation.

The payroll tax, meanwhile, takes $290 out of the annual wages of a worker who earns $50,000 annually, and puts it into a state-run fund. The most a worker can take out of the fund to help pay for long-term care, over a lifetime, stands at $36,500.

Considering workers have to pay into the fund for at least 10 years before they can draw anything out, think of what an assisted-living facility might cost then – and how inadequate the WA Cares money would be.

There are already ample reasons to pass I-2117, I-2124 and the other two measures on the ballot: Initiative 2109, to repeal the capital-gains income tax, and Initiative 2066, to protect energy choice and block a natural-gas ban.

The thought that Democrats and Inslee would use taxpayer dollars in an attempt to sway the initiative results is yet another reason.

The time has come to vote. Get your ballot marked and turned in no later than Nov. 5. And to pay less, vote yes!

John Braun, Republican Senate Minority Leader

Senator John Braun was first elected to the Washington State Senate in 2012 to represent Southwest Washington’s 20th Legislative District, which includes most of Cowlitz and Lewis counties along with parts of Clark and Thurston.

John is leader of the Senate Republican Caucus and a member of the Senate Ways & Means Committee, the Labor & Commerce Committee, and the Housing Committee.

Prior to his business career, John served on active duty in the U.S. Navy. He holds a bachelor’s degree in electrical engineering from the University of Washington and master’s degrees in business administration and manufacturing engineering from the University of Michigan.

He and his family reside on a small farm in rural Lewis County, outside Centralia.

COMMENTARY DISCLAIMER: The views and comments expressed are those of the writer and not necessarily those of the Lynnwood Times nor any of its affiliates.

Author: Lynnwood Times Contributor