OLYMPIA—Secretary of State Steve Hobbs delivered official notification to the Washington State Legislature on January 16 that signature verification has been completed and certified for Initiative 2117 (I-2117) concerning carbon tax credit trading. If enacted into law, the I-2117 will prohibit carbon tax credit trading, also known as “cap-and-invest,” and repeal provisions of the Washington Climate Commitment Act passed by the legislature on April 24, 2021, and signed into law by Governor Jay Inslee on May 17 of that same year.

Last week, Secretary Hobbs notified the Legislature on January 11 that signature verification had been completed for Initiative 2113, which if passed, would restore local police oversight of crime response and pursuit.

The signatures on the remaining four pending initiative petitions are being verified by the Office of the Secretary of State Elections Division team using a state-mandated process of examining a 3% random sample of submitted signatures.

If sufficient signatures are verified, the Legislature may approve an initiative or send it to voters. If an initiative is rejected by the Legislature or the Legislature takes no action by the end of the Legislative session on March 7, the Secretary of State will certify the initiative for the General Election on November 5. The Legislature may also pass an alternative proposal to accompany an initiative on the ballot.

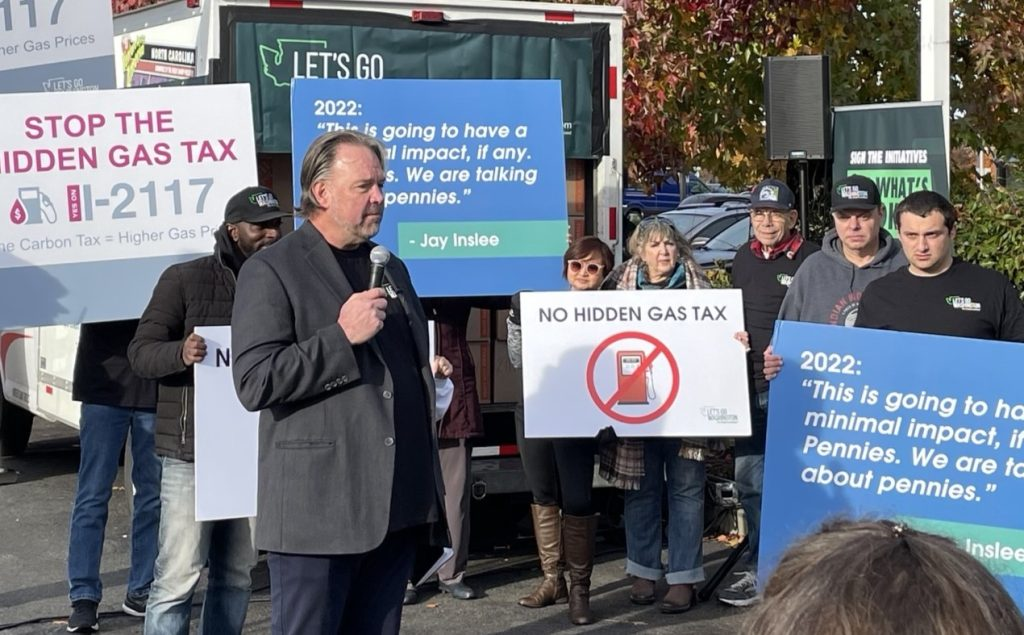

Let’s Go Washington turned in a total of 2,662,310 signatures between late November through December 28 last year to qualify six landmark initiatives—from establishing Parental Rights to repealing the state’s Carbon Tax scheme.

At a legislative preview hosted by the Washington State Association of Broadcasters and Allied Daily Newspapers of Washington earlier in January, House Speaker Laurie Jenkins shared her disdain for Let’s Go Washington and specifically its founder, Heywood, comparing their efforts to the “Robber Barons” of the 19th century.

“I am very sadden when I think about why the initiative process was established in this state… It was really like the big railroad barons that folks didn’t want taking over this state,” Jenkins said. “Now what we have is an ultrawealthy, multi-millionaire trying to buy his way onto the ballot.”

“People are just mad…. not because they don’t like it; it’s because they are making a choice between groceries and gas,” Brian Heywood, founder of Let’s Go Washington, shared with host Brandi Kruse on her Tuesday podcast of unDivided on November 21, 2023.

He explained to Kruse that the “cap-and-invest” scheme is a money grab by the legislature and a triple hidden tax on Washingtonians.

“First of all you see it in the gas prices [at the pump]… Then if you go and buy groceries, every single thing in a grocery store came on a truck that had to pay this hidden gas tax. Now your eggs, your milk and your cheese prices are up. And then we have the hidden increase in your home heating costs with PSE,” said Heywood.

In 2021, the Washington State Legislature passed the Climate Commitment Act (CCA), which creates a market-based program (called the “cap-and-invest” program) to cap and reduce greenhouse gas emissions, according to the Department of Ecology. To achieve this, the scheme puts a price on greenhouse gas emissions emitted in Washington state increasing the cost to deliver electricity, natural gas, and carbon-based fuels that is forwarded to end-users.

Using a 1990 baseline, CCA seeks to reduce state greenhouse gas emissions 45 percent by 2030, 70 percent by 2040, and 95 percent and achieve net-zero emissions by 2050.

Starting on January 1, 2023, businesses and organizations that emit more than 25,000 metric tons of greenhouse gases a year such as carbon dioxide, were charged a carbon offset fee which is then used to invest in climate projects throughout the state and with the goal to transition Washington to a lower-carbon economy. Affected businesses include fuel suppliers, natural gas and electric utilities, waste-to-energy facilities (starting in 2027), and railroads (starting in 2031).

The cap-and-invest program sets a limit on overall carbon emissions in the state. Businesses emitting more than 25,000 metric tons of greenhouse gases a year are required to obtain carbon allowances equal to their covered greenhouse gas emissions which are purchased through quarterly auctions hosted by the Department of Ecology, or bought and sold on a secondary market. Businesses not complying with the CCA program will be fined up to $50,000 per violation, per day by the Department of Ecology.

The state estimates approximately 75% of statewide greenhouse gas emissions will be covered under this cap-and-invest scheme. As of August, Washington state has received $1.213 billion in revenues from the three greenhouse gas allowance auctions with a fourth auction scheduled for December 6, 2023. An additional $184 million in revenue was collected on behalf of eligible electric and gas utilities to provide credits to customers for increased costs.

Currently thirteen states have adopted carbon pricing policies: California, Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Virginia, and Washington.

Historically, Washingtonians have overwhelmingly rejected carbon pricing policies—in 2016 with I-732 at 59.25%, and in 2018 with I-1631 at 56.56%. According to the Washington State Public Disclosure Commission, a total of $2.7 million was spent by committees for and against I-732; whereas in 2018, that amount jumped to $47.9 million — $16.42 million in support and $31.58 million against.

If I-1631 would have passed, and assuming emissions would remain at 2019 levels of 102 million metric tons (the latest state reported data according to KING5), from 2020 to the end of 2023, the state would have received $7.344 billion in revenues to fund various environmental projects such as clean energy infrastructure and to increase the resiliency of water and forest resources.

Author: Mario Lotmore

6 Responses

When droughts/floods increase in frequency and extent (as they have due to climate change) the cost of groceries and wood increase (supply and demand). Climate change is inflationary.

Why not return fees from a carbon tax to citizens to offset higher energy costs. The shift in the market would favor clean energy and new careers, as it has in, for example, the UK. A monthly check will do the talking….