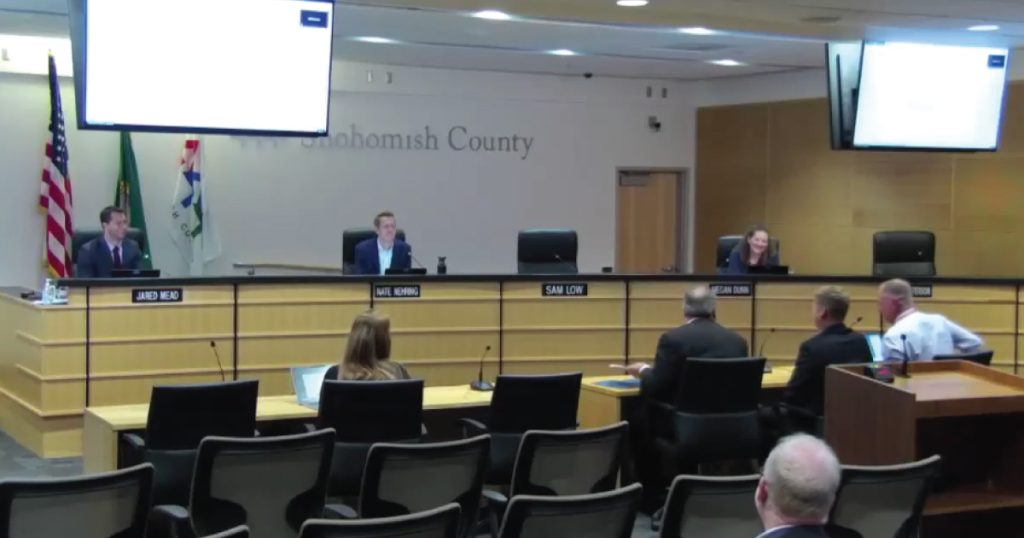

EVERETT—The Snohomish County Council voted unanimously to place a ballot measure implementing a Public Safety, Health, and Criminal Justice Sales and Use Tax of 0.2%—making it the highest Sales and Use Tax in the Washington state at up to 10.8%—before the voters of Snohomish County for the General Election in November 2024.

If approved, the cities of Bothell, Brier, Edmonds, Mountlake Terrace, Woodway, and the unincorporated Public Transportation Benefit Area of Snohomish County would have a sales tax rate of 10.7%; whereas Lynnwood, Mill Creek, and Mukilteo will be at 10.8% making these the highest sales tax municipalities in the state and the highest in the United States.

Among cities with populations of 200,000 or more, the following 10 have the highest sales taxes, according to the Tax Foundation:

- Tacoma, Washington (10.3%)

- Chicago, Illinois (10.25%)

- Fremont, California (10.25%)

- Long Beach, California (10.25%

- Oakland, California (10.25%)

- Seattle, Washington (10.25%)

- Birmingham, Alabama (10%)

- Baton Rouge, Louisiana (9.95%)

- Memphis, Tennessee (9.75%)

- St. Louis, Missouri (9.679%+)

The Snohomish County Council has the responsibility of appointing members to two committees, one will write a statement supporting “yes” (pro) and one will write a statement supporting “no” (con).

Committees are allowed to have up to three (3) members each.

The Snohomish County Council is seeking volunteers to serve on either the pro or con committee for this ballot measure. If you are interested in serving on a committee, please submit a completed application to the Snohomish County Council no later than 5 PM on Thursday, July 18, 2024.

The November ballot measure would ask the following question:

The Snohomish County Council passed Ordinance No. 24-047 concerning a public safety, health, criminal justice sales and use tax. This proposition would authorize the imposition of a county-wide sales and use tax, in addition to any other taxes authorized by law, of two tenths of one percent (0.2% — 2 cents for every $10) to be used for public safety, health, and criminal justice purposes, as authorized by RCW 7 82.14.450. Should this proposition be: Approved or Rejected.

This latest potential sales increase comes just over two years after 0.1% (estimated $23 million) was added to the local sales and use tax that was approved in December of 2021, and took effect on April 1, 2022, for affordable housing programs, specifically 300 affordable housing units over five years. Since 2022, the Snohomish County Council-approved budget has increased 33.6% (or $420 million) in two years from $1.25 billion to $1.67 billion.

Author: Mario Lotmore