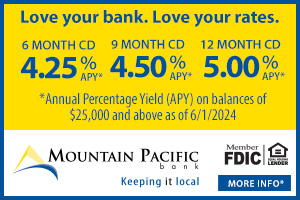

On July 31, the Federal Reserve Rate was lowered from its benchmark rate by a quarter point. Amid intense pressure from President Trump and Wall Street, the feds dropped the lending rate from 2.25% to 2%. This is the first reduction in the Federal Reserve Rate since the 2008 recession.

According to Heritage Bank Executive Vice President and Chief Operating Officer Bryan McDonald, the immediate impact will be a 0.25-point decrease on credit facilities where the interest rate is directly tied to the Prime Rate or similar short-term interest rate indexes.

Common consumer credit facilities typically tied to the Prime Rate include credit cards, home equity lines of credit and personal lines of credit. On the commercial side, operating lines of credit, short-term construction loans and credit cards would likely see a similar reduction.

Ultimately, credit facilities tied to the Prime Rate or similar short-term indexes just became less expensive, resulting in interest savings for consumers and businesses.

Longer term loans such as mortgages and auto loans are typically less impacted by a change in the Federal Funds Rate. These loans typically have much longer terms and amortizations, as much as 30 years in the case of residential mortgages. Their interest rates are tied to longer term indexes that have less correlation to the Federal Funds Rate.

If you are looking to finance a home, interested in a home equity line of credit or any other loan product mentioned above, please contact the Lynnwood branch of Heritage Bank directly at 425-775-5480 or visit them in person at 19510 58th Avenue W.

Contributed by: Bryan McDonald, Heritage Bank Executive Vice President & Chief Operating Officer