SEATTLE—The Washington Education Association along with advocacy groups Invest In WA Now and Children’s Alliance warn that two anti-tax ballot initiatives turned in by citizen action group Let’s Go Washington last week, will not only defund paid family leave and long-term care, but will also defund the state’s Education Legacy Trust Account by $900 million.

“These initiatives would allow one mega-millionaire to rig the state’s tax system for himself,” Treasure Mackley, Executive Director of Invest In WA Now wrote in a press release by Percussion Strategic. “Washington voters strongly support making the rich pay what they owe, especially when it comes to taking care of our kids and families. We are confident voters will see these poorly written initiatives for what they are: greedy money grabs with serious consequences.”

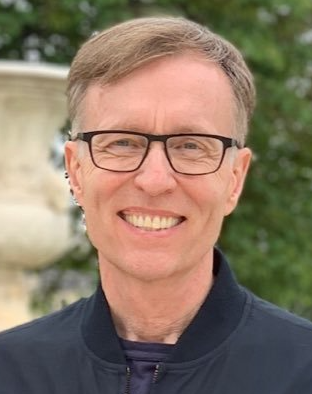

The “one mega-millionaire” whom Mackley is referring is new political powerbroker Brian Heywood—CEO of Kirkland-based investment firm Taiyo Pacific Partners and founder of the political action committee Let’s Go Washington.

The Let’s Go Washington PAC have steadily been collecting signatures since May of 2023 for six initiatives to present to the Washington State Legislature in 2024 to become law. If the legislature proposes a different measure or rejects or refuses to act on the original initiative, the initiative is placed on the 2024 General Election ballot.

As of December 23, the Let’s Go Washington website shows 2,635,700 signatures have been collected, a gain of 47,180 from an update just two days earlier. Currently five of the six initiatives have been submitted to the Secretary of State’s Office for signature verification.

More than 400,000 signatures for I-2113 were turned in on December 14, to restore authority to police officers to reasonably pursue suspicious persons who have violated the law. On December 12, 423,399 signatures were turned in to the Secretary of State’s Office for Initiative 2081, that if enacted into law, will establish Washington state’s first Parental Bill of Rights. This was preceded by the submission of I-2117 with 418,399 signatures to repeal provisions of the Washington Climate Commitment Act, also known as Cap-and-Invest, passed by the legislature in 2021.

Within hours of Heywood personally turning in over 850,000 signatures for Initiative 2111, No State Income Tax, (439,000 signatures) and I-2109, Repeal the Capital Gains Tax (420,000 signatures) on December 21, President of the Washington Education Association, Larry Delaney, released the following statement:

“At a time when school districts across the state are facing budget shortfalls, this initiative would take $900 million from our schools. Washington’s kids and families cannot afford to pay for a tax cut for a few thousand extremely wealthy individuals.”

Dr. Stephan Blanford, Executive Director of Children’s Alliance, added that by removing the capital gains tax one supports “a tax code built on institutional racism.”

“With passage of the capital gains tax, our state went from being one of the most regressive tax systems in the country to one that promises to be more balanced,” Blanford stated. “The tax was a critical first step in rectifying a tax code built on institutional racism that places a disproportionate burden on Black, brown, and Indigenous people. Once again, a small number of ultra-millionaires and billionaires are now trying to roll back progress to avoid paying what they owe.”

According to Percussion Strategic, I-2111, which prohibits the state and any local government from imposing an income tax, “has a long list of potential consequences and serious legal issues, including gutting funding for paid family and medical leave, and long-term care benefits. These are programs that Washingtonians are already using and depending on.”

The political consulting group makes the argument that repealing the capital gains tax passed by the Legislature in 2021 and upheld by the Washington State Supreme Court in March of 2023, only impacts the wealthiest 0.02% of Washingtonians. The Freedom Foundation filed a petition for certiorari in August to the U.S. Supreme Court to overturn the state’s ruling.

“The initiative would take an estimated $900 million a year from the Education Legacy Trust Account, which funds: safety and other repairs to Washington’s aging schools, creating more preschools and childcare centers so parents can get back to work, and providing much needed assistance and equipment for students with disabilities,” Percussion Strategic’s press release states.

According to an October poll by Change Research paid for by SEIU 775 and Washington Conservation Action of 1,206 likely General Election voters in Washington state, 31% of respondents support repealing the capital gains tax.

“That’s consistent with poll after poll, where voters nationwide say they want the super-rich to pay their fair share of taxes (Impact Research),” according to Percussion Strategic. “Washingtonians have long said they support the capital gains tax of 7% on extraordinary stock market profits greater than $250,000 (King 5/Survey USA, GBAO, PPP, GBAO).”

To bankroll one statewide signature gathering effort for an initiative requires at least $1,000,000. According to the Washington State Public Disclosure Commission (PDC), Let’s Go Washington has expensed $6.9 million of which approximately $5 million is directly linked to signature gathering and printing expenses.

Heywood has loaned his Let’s Go Washington PAC $4.15 million of the $6.7 million receipts and contributed an additional $1.7 million in both in-kind and cash contributions of a total of $2.55 million in contributions. The PDC shows that the PAC is almost $240,000 in debt.

Attorney Abby Lawlor of Seattle-based union-side labor and employment law firm Barnard Iglitzin & Lavitt, representing Heather Weiner, Campaign Strategist with Percussion Strategic, filed a complaint with the PDC against Let’s Go Washington PAC in July alleging campaign violations ranging from failure to report expenditures accurately to unlawfully concealing the identity of an in-kind expenditure.

Then PAC Treasurer Conner Edwards, in his response to the PDC wrote, “I will note that many of the allegations in this complaint consist of pure conjecture and are asserted without evidence… I take full responsibility for my work and I am happy to work with the PDC to amend any filings if the agency determines that amendments are necessary.”

A supplemental complaint was filed on October 17, 2023, against Let’s Go Washington again by attorney Abby Lawlor, this time on behalf of SEIU 775, Civic Ventures, Washington Conservation Action, and Planned Parenthood Alliance Advocates. This complaint alleges inaccurate reporting of the $4 million related to paid signature gathering stating that a portion of it, $3.6 million, should have been classified as a “pledge” on a prior report.

The complaint further alleges that the PAC failed to disclose an in-kind contribution related to discounted gas for a “a stunt signature gathering event” and video interviews Heywood had with Glenn Morgan of We the Governed.

“We take PDC filing requirements very seriously and are working with the PDC to ensure we are in compliance,” Heywood wrote in a statement to the Lynnwood Times addressing the PDC complaints.

According to a search by the Lynnwood Times on the Security and Exchange Commission’s Enforcement database, Heywood nor his $2.4 billion investment company have any enforcement, litigation, nor administrative proceedings and have routinely filed required SEC filings with no delinquencies.

Public IRS documents obtained by the Lynnwood Times of Invest in WA Now, one of the political advocacy groups against the capital gains tax initiative, shows that Campaign Strategist Heather Weiner, who is one of PDC complainants against the Let’s Go Washington PAC, received $244,898 in 2021, from Invest in WA Now as an independent contractor. Another IRS filing by Invest in WA Now for 2020 shows Weiner receiving $113,779 for contracted services and an IRS filing in 2022 shows Percussion Strategic was paid $225,556 for “Communication/Social Media/Advertising” services.

Invest in WA Now is a progressive tax code reform advocacy group based in Seattle.

A 2019 filing of IRS form 990 by the Washington Education Association (WEA), shows that the organization provided a $250,000 grant to Invest in WA Now and again in 2021 for $250,000.

In December, Let’s Go Washington sent a “cease and desist” letter from former Washington State Attorney General Rob McKenna, to SEIU 775, Fuse Washington, and Fieldworks alleging a “coordinated intimidation campaign” by the three organizations to illegally interfere with signature collection efforts.

SEIU 775, involved in the second PDC complaint against Let’s Go Washington, is a 50,000-member long-term care workers union. Fuse Washington is a progressive political advocacy group and FieldWorks is a K-Street Washington, D.C.-based political firm specializing in Get Out the Vote efforts.

The letter alleged members of the three organizations “harassed Let’s Go Washington signature collectors,” and that Fuse Washington established a snitch hotline “encouraging the public to call to report the locations and other details concerning signature gathering.”

Just a week before the “cease and desist” letter, the Washington State Democrat Party came under fire for impeding the initiative process by actively campaigning to dissuade voters from signing any of the six the Let’s Go Washington statewide initiatives.

“The extreme Washington GOP is teaming up with the mega-rich to pass a set of ballot initiatives that would hurt working Washingtonians,” a post reads by the Washington State Democratic Party on X.

🚨The extreme Washington GOP is teaming up with the mega-rich to pass a set of ballot initiatives that would hurt working Washingtonians. Three ways you can help:

1) Decline to sign

2) Spread the word

2) Call the hotline, (425) 553-2175, to report signature gatherersRead on: pic.twitter.com/sWDcRvksfa

— Washington Democrats (@washdems) December 5, 2023

The post went on to encourage members to report locations of signature gatherers, who, have shared with media are being harassed and now concerned for their safety.

The remaining initiative yet to be turned in is I-2124: Opt Out Of State-Run Long Term Care Coverage Act. Residents can sign any or all petitions at one of over 150 locations across the state. In Snohomish County, those locations are the following:

- Family Policy Institute, 16108 Ash Way #107, Lynnwood, WA, 425-608-0242

- Pulse for Health, North Kelsey Street, Monroe, WA

- Sound Loan, Wetmore Ave, Everett, WA

The team at Let’s Go Washington are confident they will get all six statewide initiatives on the November ballot saying that these issues are popular with Washingtonians. The group’s goal to turn in signatures to the Secretary of State’s Office for the last remaining initiative is December 28, and is asking the public to turn in all petitions a day earlier by December 27, 2023.

Author: Mario Lotmore

5 Responses